Answered step by step

Verified Expert Solution

Question

1 Approved Answer

explain in detail please, thank you :) Consider only three assets, GM stock, Toyota stock, (risk-free) Japanese national bond in a market: The total market

explain in detail please, thank you :)

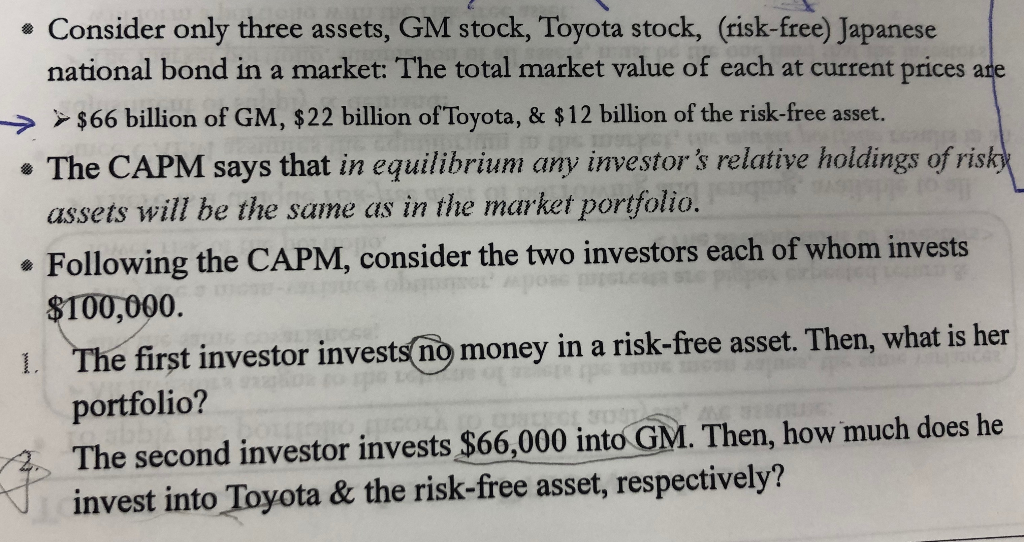

Consider only three assets, GM stock, Toyota stock, (risk-free) Japanese national bond in a market: The total market value of each at current prices are > >$66 billion of GM, $22 billion of Toyota, & $12 billion of the risk-free asset. The CAPM says that in equilibrium any investor's relative holdings of risk assets will be the same as in the market portfolio. Following the CAPM, consider the two investors each of whom invests $100,000 1. The first investor invests no money in a risk-free asset. Then, what is her portfolio? A. The second investor invests $66,000 into GM. Then, how much does he v invest into Toyota & the risk-free asset, respectivelyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started