explain in details;

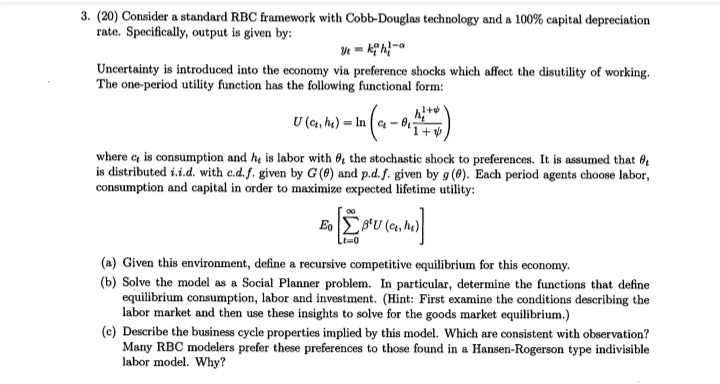

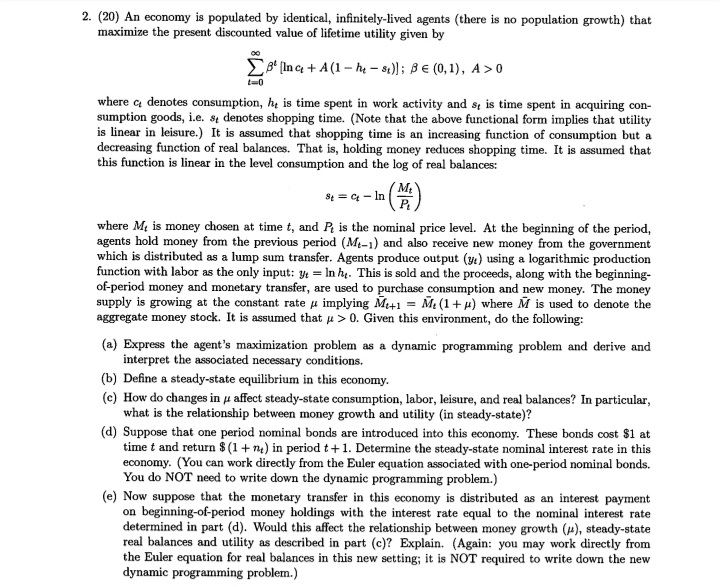

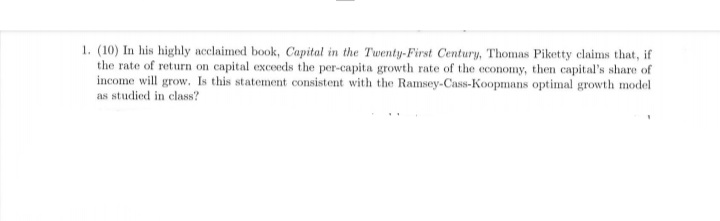

3. (20) Consider a standard RBC framework with Cobb-Douglas technology and a 100% capital depreciation rate. Specifically, output is given by: Uncertainty is introduced into the economy via preference shocks which affect the disutility of working. The one-period utility function has the following functional form: U (a, hi) = In where & is consumption and he is labor with #, the stochastic shock to preferences. It is assumed that is distributed i.i.d. with c.d. f. given by G (@) and p.d.f. given by g (#). Each period agents choose labor, consumption and capital in order to maximize expected lifetime utility: 1=0 (a) Given this environment, define a recursive competitive equilibrium for this economy. (b) Solve the model as a Social Planner problem. In particular, determine the functions that define equilibrium consumption, labor and investment. (Hint: First examine the conditions describing the labor market and then use these insights to solve for the goods market equilibrium.) (c) Describe the business cycle properties implied by this model. Which are consistent with observation? Many RBC modelers prefer these preferences to those found in a Hansen-Rogerson type indivisible labor model. Why?2. (20) An economy is populated by identical, infinitely-lived agents (there is no population growth) that maximize the present discounted value of lifetime utility given by B' na + A(1 - ht - 3)]; BE (0, 1), A>0 where c denotes consumption, he is time spent in work activity and s, is time spent in acquiring con- sumption goods, i.e. # denotes shopping time. (Note that the above functional form implies that utility is linear in leisure.) It is assumed that shopping time is an increasing function of consumption but a decreasing function of real balances. That is, holding money reduces shopping time. It is assumed that this function is linear in the level consumption and the log of real balances: #t = 4 - In Pi where M, is money chosen at time t, and A is the nominal price level. At the beginning of the period, agents hold money from the previous period (M-,) and also receive new money from the government which is distributed as a lump sum transfer. Agents produce output (y:) using a logarithmic production function with labor as the only input: y = In hy. This is sold and the proceeds, along with the beginning- of-period money and monetary transfer, are used to purchase consumption and new money. The money supply is growing at the constant rate a implying Mit1 = M: (1 + #) where M is used to denote the aggregate money stock. It is assumed that / > 0. Given this environment, do the following: (a) Express the agent's maximization problem as a dynamic programming problem and derive and interpret the associated necessary conditions. (b) Define a steady-state equilibrium in this economy. (c) How do changes in # affect steady-state consumption, labor, leisure, and real balances? In particular, what is the relationship between money growth and utility (in steady-state)? (d) Suppose that one period nominal bonds are introduced into this economy. These bonds cost $1 at time t and return $ (1 + 74) in period t + 1. Determine the steady-state nominal interest rate in this economy. (You can work directly from the Euler equation associated with one-period nominal bonds. You do NOT need to write down the dynamic programming problem.) (e) Now suppose that the monetary transfer in this economy is distributed as an interest payment on beginning-of-period money holdings with the interest rate equal to the nominal interest rate determined in part (d). Would this affect the relationship between money growth (/), steady-state real balances and utility as described in part (c)? Explain. (Again: you may work directly from the Euler equation for real balances in this new setting; it is NOT required to write down the new dynamic programming problem.)1. (10) In his highly acclaimed book, Capital in the Twenty-First Century, Thomas Piketty claims that, if the rate of return on capital exceeds the per-capita growth rate of the economy, then capital's share of income will grow, Is this statement consistent with the Ramsey-Cass-Koopmans optimal growth model as studied in class