Answered step by step

Verified Expert Solution

Question

1 Approved Answer

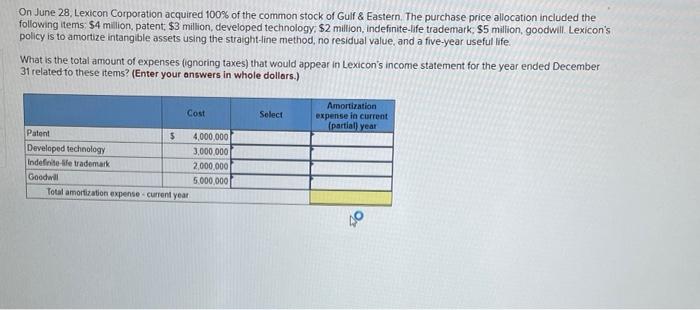

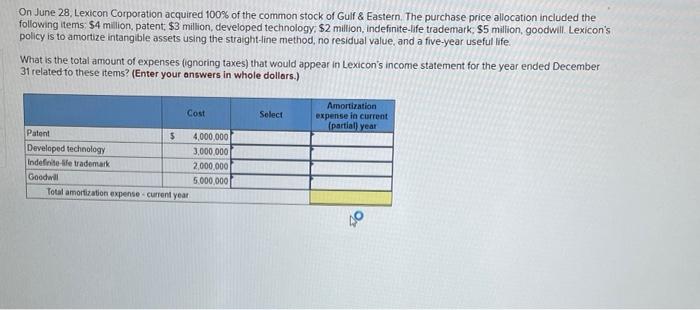

explain On June 28, Lexicon Corporation acquired 100% of the common stock of Gulf & Eastern. The purchase price allocation included the following items: $4

explain

On June 28, Lexicon Corporation acquired 100% of the common stock of Gulf & Eastern. The purchase price allocation included the following items: $4 million, patent; $3 million, developed technology; $2 million, indefinite-life trademark; $5 million, goodwill. Lexicon's policy is to amortize intangible assets using the straight-line method, no residual value, and a five-year useful life. What is the total amount of expenses (ignoring taxes) that would appear in Lexicon's income statement for the year ended December 31 related to these items? (Enter your answers in whole dollars.) Patent Developed technology Indefinite-ife trademark Goodwill $ Cost Total amortization expense-current year 4,000,000 3,000,000 2,000,000 5,000,000 Select Amortization expense in current (partial) year 9

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started