Answered step by step

Verified Expert Solution

Question

1 Approved Answer

explain q.no.6 please with answers. 130 531 2050 Question 5 Caria has an engineering business and buys an item of equipment on 1 February 2018

explain q.no.6 please with answers.

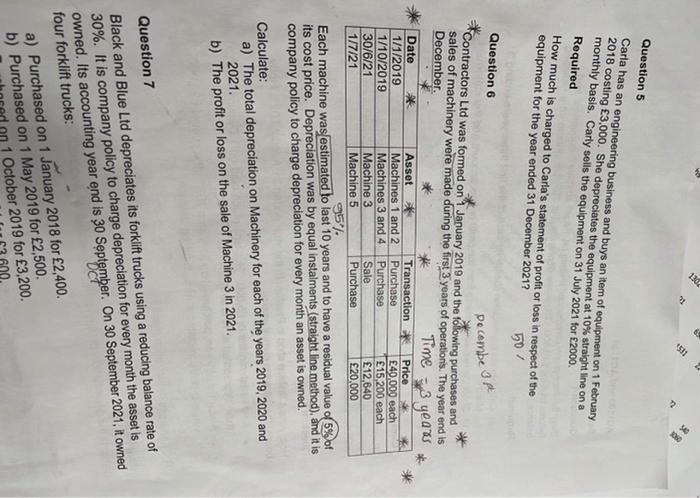

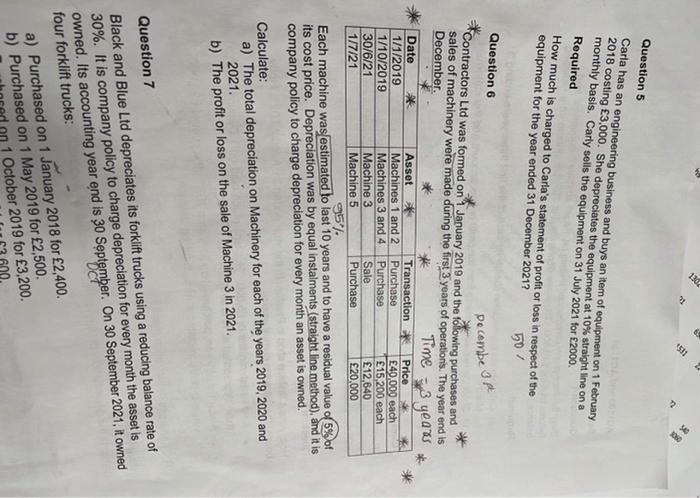

130 531 2050 Question 5 Caria has an engineering business and buys an item of equipment on 1 February 2018 costing 3,000. She depreciates the equipment at 10% straight line on a monthly basis. Carly sells the equipment on 31 July 2021 for 2000. Required How much is charged to Carla's statement of profit or loss in respect of the equipment for the year ended 31 December 2021? 507 Decembe Up Question 6 Contractors Ltd was formed on 1 January 2010 and the following purchases and sales of machinery were made during the first 3 years of operations. The year end is December * Time 3 years Date Asset Transaction Price 1/1/2019 Machines 1 and 2 Purchase 40,000 each 1/10/2019 Machines 3 and 4 Purchase 15,200 each 30/6/21 Machine 3 Sale 12,640 1/7/21 Machine 5 Purchase 20,000 957; Each machine was estimated to last 10 years and to have a residual value of 5% of its cost price. Depreciation was by equal instalments (straight line method), and it is company policy to charge depreciation for every month an asset is owned. Calculate: a) The total depreciation on Machinery for each of the years 2019, 2020 and 2021 b) The profit or loss on the sale of Machine 3 in 2021. Question 7 Black and Blue Ltd depreciates its forklift trucks using a reducing balance rate of 30%. It is company policy to charge depreciation for every month the asset is owned. Its accounting year end is 30 September. On 30 September 2021, it owned four forklift trucks: 007 a) Purchased on 1 January 2018 for 2,400. b) Purchased on 1 May 2019 for 2,500. on 1 October 2019 for 3,200

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started