Explain the importance of economies of scale in terms of its contribution to Ryanairs cost leadership strategy [25]

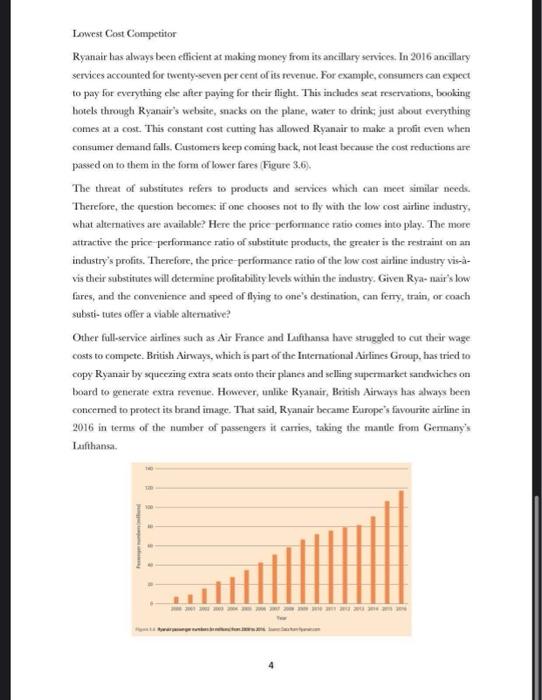

Ryanair: How to Compete in the Airline Industry Background It may surprise many people to know that Ryanair is Exarope's favourite airline. The low-cost airline carries 120 million passengers every year on more than 1,800 daily flights. It flies from Eighty-six bases, connecting over 200 destinations, in thirty-four countries. It has more than 12,000 employees and an industry-leading thirty-two-year safety record. Ryanair was founded in Ireland in 1985, initially operating daily from Waterford in the southeast of Ireland to London Gatwick. By 1990 the airline had accumulated 20 million in losses and went through a process of restructuring. As part of this restructuring, a new CEO, Michael O'Leary, was hired and dispatched to the US to understand what makes low-cost Southwest Airlines so successful. The intention was to copy Southwest Airlines US business model and adapt it for se in Europe. In 1991, despite the Gulf War, Ryanair made a profit for the first time. Southwest Airlines Southwest Airlines is the world's first successful low-cost airline. It pioneered a model for reducing operating costs which is now used all over the world. To reduce costs Southwest fills its planes with more scats, makes sure each flight is packed, and flies its aircraft more often than fill-service airlines. In addition, it only purchases one type of aircraft, Boeing 737-800s. The advantage of this is that they only need to train mechanics to service one type of airplane, Supply parts and inventory for aircraft maintenance are streamlined. If they must take a plane out of service at the last minute for maintenance, the fleet is totally interchangeable; both on-board crews and ground crews are already familiar with it. And it faces few challenges in how and where it can park its planes on the ground, since they're all the same shape and size. Moreover, Southwest does not assign scat numbers. This means that if one plane is substituted for another, and the new plane has a different seat configuration, there's no need to adjust the entire seating arrangement and iste new boarding passes. Passengers simply board and sit where they like. To lure customers from other airlines, Southwest Airlines does not charge for the first and second checked baggage. It also recognizes that consumers have different travel needs; some are content to book wecks in advance, while others have a need for more immediate flights. The use of yield-management systems allows Southwest to raise ticket prices when demand is high and reduce them during quiet periods, which also increases efficiency. Its flights are usually point-to-point that is, the plane lands, is turned around, and often heads back to where it came from. 1 How Ryanair Competes Michael O'Leary was to take careful note of Southwest Airline's low cost structure and how it competes in the airline industry. However, Mr O'Leary is a pragmatist and understood that Southwest's business model would not work in the regulated European airline industry. In 1997, the so-called 'Open Skics' policy of the European Union was implemented, which effectively deregulated the scheduled airline business in Europe. This enables airlines to compete freely throughout Europe. At the same time, Ryanair became a public limited company, offering its shares on the Dublin and New York (NASDAQ Stock Exchange. This provided further capital for the purchase of aircraft Since deregulation, Mr O'Leary has taken the co-frills concept pencered by Southwest Airlines and substantially extended it. The airline is not known for its glamorous waiting-rooms, nor for having an empathetic customer service. Uncler Mr O'Leary's leadership, Ryanair has led punitive fees to manage passenger behaviour more than other airlines. For example, to reduce ground-staff numbers, it is now prohibitively expensive to check in at the airport or to store luggage in the hold when travelling with Ryanair. When it flies to a city, it utilizes that city's secondary and even tertiary airports, where the costs of operating are cheaper than flying to the main airport. As a result, there's less delay in turning around the aircraft to get it back in the sky. The airline has often made provocative announcements, for example, it made headlines with a suggestion that it might charge passengers to use aircraft toilets. No doubt, it believes that till publicity is good publicity', since such outbursts keep its advertising budget to a minimum. In common with Southwest Airlines, Ryanair flies only Boeing 737-800. In 2006, it flew 425 million passengers in the year and took delivery of its hundredth Boeing 737-800. It also launched its Web check-in service, giving passengers the opportunity to check-in online. In order to generate further revenue, Ryanair introduced on-board mobile phone use across its entire fleet which lets customers gamble and play bingo during the flight. The year before, to celebrate its twentieth anniversary, it offered 100,000 flights at only ninety-nine pence each. Ar the same time, it reminded passengers that its competitors add a fuel surcharge to top up the price of their tickets. Growth in passenger numbers continue as it strips out not-essential services and introduces yiekl-management systems which allow it to vary ticket prices according to demand for Ryanair's CEO, pricing is not complex, it is all about what the market will bear. In 2010, traffic grew to 72.1 million passengers with an average fare of only 39 and no fuel surcharges, despite a sharp increase in fuel costs. Their business model is Toad factor-active, yaeld-passive, Ryanair N takes whatever ticket prices it can get in order to ensure the aircraft is as full as possible; in other words, it achieves a high load factor. In the past, Mr O'Leary has suggested a load factor of between eighty-two and eighty-three per cent throughout the year would be fine: Ryanair's actual losach factor is often in access of ninety per cent. What this allows it to do is to capitalize on the prevailing low-fare trend. It creates a virtuous cycle in which low fares encourage greater passenger traffic. As more passengers lly,so this continues to drive both the cost reduction it achieves from using airports, and lowers its timit cost per employee and per aircraft Crucially, high passenger numbers also drive the demand for ancillary services. It actively supports its load factor by offering a range of lower fares and aggressive seat sales. By 2015, traffic passed the 100 million customer mark; 106.4 million customers are flow, at an average fare of 46 and a 93 per cent load factor. Customer Service In 2013, Ryanair was considered to have the worst customer service out of Britain's 100 biggest brands in a survey by a consumer magazine. In the same year, two quarterly profit warnings showed Ryanair failing to keep up with its rival, including easyJet, whose friendlier image had attracted tlyers. The usually belligerent Mr O'Leary was forced to make a conscious effort to improwe Ryanair's corporate reputation and avoid losing sales to competitors. In a bid to show how Ryanair is undergoing revolutionary customer change the boss of Europe's biggest low cost airline was presented to the world cuckelling a puppy. The chief executive, revealed his new image at an event to launch the airline's new, updated website and app. Mr O'Leary said the airline had an "Always Getting Better' plan, sta By 2014 it had relaxed its hard-line cabin baggage allowance, recluced penalties for failing to print out boarding passes, and introduced allocated seating. For example, an unpopular 70 fee for re-isuing boarding passes at the airport was lowered to 10. Mr O'Leary also promised that flyers will no longer pay disproportionate charges for small transgressions in hand-luggage size: be blamed local agents in some airports for applying his rules with excess zeal. There's no more conflict", he said. The new website drastically reduces the number of steps required to book a flight, and allows regular travelers to store information about their travel documents and paymenit card. The moves were a response to easyJet filling its planes more successfully than any other European airline and making healthy prolits. "To placate customers, Ryanair also followed its arch-rival into primary hubs such as Rome Fiumicino and Brussels, and began moving away from secondary airports The effect of this "nicer guy approach was a leap in profits to 867m.cting with "fixing the things our customers don't like a 3 Lowest Cost Competitor Ryanair has always been efficient at making money from its ancillary services. In 2016 ancillary services accounted for twenty-seven per cent of its revenue. For example, consumers can expect to pay for everything else after paying for their flight. This includes seat reservations, booking hotels through Ryanair's website, snacks on the plane, water to drink, just about everything comes at a cost. This constant cost cutting has allowed Ryanair to make a profit even when consumer demand falls. Customers keep coming back, not least because the cost reductions are passed on to them in the form of lower fares Figure 3.6). The threat of substitutes refers to products and services which can meet similar needs. Therefore, the question becomes if one choose not to fly with the low cost airline industry, what alternatives are available? Here the price performance ratio comes into play. The more attractive the price performance ratio of substitute products, the greater is the restraint on an industry's profits. Therefore, the price-performance ratio of the low cost airline industry vis-- vis their substitutes will determine profitability levels within the industry, Given Rya- nair's low fares, and the convenience and speed of flying to one's destination, can ferry, train, or coach substitutes offer a viable alternative? Other full-service airlines such as Air France and Laufthansa have struggled to cut their wage costs to compete. British Airways, which is part of the International Airlines Group, has tried to copy Ryanair by squeezing extra scats onto their planes and selling supermarket sanduiches on board to generate extra revenue. However, unlike Ryanair, British Airways has always been concemed to protect its brand image. That said, Ryanair became Europe's favourite airline in 2016 in terms of the number of passengers it carries, taking the mantle from Germany's Lufthansa mmmmm Aircraft are the single largest capital cost in any airline, so getting fleet costs right is a key objective. In 2013, Ryanair acquired 180 new Boeing 737-800s with a list price of $15 billion. This was negotiated at a time when Boeing was launching its all-new Bocing 737 MAX aircraft with extra seats. With this deal Ryanair had the capacity to grow the fleet by fifty per cent without compromising on flight cost per passenger. It since expanded that order even further to add 110 units of the 737 MAX aircraft, with options on another 100. These planes pro-vide extra seats and new, efficient engines that will cut unit costs even more and further improve the carrier's competitiveness. Ryanair is a massive customer for Bocing, which allows it to negotiate the best prices for its fleet of aircraft. Also, aircraft manufacture is dominated by two players, Boeing and Airbus, and Ryanair has said in the past that it will buy from Airbus if it doesn't receive the deal it needs from Boeing. Another major cost, the cost of fuel, is determined by the price of oil, and falling oil prices benefit all airlines. Mr O'Leary is all too aware that, given Ryanair's low cost basc, it can still make profits even when its ticket prices are cheaper than any of its rivals. He predicts that as fares continue to fall, his airline will fly over 200 million passengers a year by 2024. In 2017, the Irish airline made a profit after tax of 1.3bn (l.lbn), even though it slashed ticket prices. Michael O'Leary said fares had fallen by thirteen per cent, but profitability has doubled over three years. He added, 'Frankly I see no reason why that trend won't continue.' Ryanair: How to Compete in the Airline Industry Background It may surprise many people to know that Ryanair is Exarope's favourite airline. The low-cost airline carries 120 million passengers every year on more than 1,800 daily flights. It flies from Eighty-six bases, connecting over 200 destinations, in thirty-four countries. It has more than 12,000 employees and an industry-leading thirty-two-year safety record. Ryanair was founded in Ireland in 1985, initially operating daily from Waterford in the southeast of Ireland to London Gatwick. By 1990 the airline had accumulated 20 million in losses and went through a process of restructuring. As part of this restructuring, a new CEO, Michael O'Leary, was hired and dispatched to the US to understand what makes low-cost Southwest Airlines so successful. The intention was to copy Southwest Airlines US business model and adapt it for se in Europe. In 1991, despite the Gulf War, Ryanair made a profit for the first time. Southwest Airlines Southwest Airlines is the world's first successful low-cost airline. It pioneered a model for reducing operating costs which is now used all over the world. To reduce costs Southwest fills its planes with more scats, makes sure each flight is packed, and flies its aircraft more often than fill-service airlines. In addition, it only purchases one type of aircraft, Boeing 737-800s. The advantage of this is that they only need to train mechanics to service one type of airplane, Supply parts and inventory for aircraft maintenance are streamlined. If they must take a plane out of service at the last minute for maintenance, the fleet is totally interchangeable; both on-board crews and ground crews are already familiar with it. And it faces few challenges in how and where it can park its planes on the ground, since they're all the same shape and size. Moreover, Southwest does not assign scat numbers. This means that if one plane is substituted for another, and the new plane has a different seat configuration, there's no need to adjust the entire seating arrangement and iste new boarding passes. Passengers simply board and sit where they like. To lure customers from other airlines, Southwest Airlines does not charge for the first and second checked baggage. It also recognizes that consumers have different travel needs; some are content to book wecks in advance, while others have a need for more immediate flights. The use of yield-management systems allows Southwest to raise ticket prices when demand is high and reduce them during quiet periods, which also increases efficiency. Its flights are usually point-to-point that is, the plane lands, is turned around, and often heads back to where it came from. 1 How Ryanair Competes Michael O'Leary was to take careful note of Southwest Airline's low cost structure and how it competes in the airline industry. However, Mr O'Leary is a pragmatist and understood that Southwest's business model would not work in the regulated European airline industry. In 1997, the so-called 'Open Skics' policy of the European Union was implemented, which effectively deregulated the scheduled airline business in Europe. This enables airlines to compete freely throughout Europe. At the same time, Ryanair became a public limited company, offering its shares on the Dublin and New York (NASDAQ Stock Exchange. This provided further capital for the purchase of aircraft Since deregulation, Mr O'Leary has taken the co-frills concept pencered by Southwest Airlines and substantially extended it. The airline is not known for its glamorous waiting-rooms, nor for having an empathetic customer service. Uncler Mr O'Leary's leadership, Ryanair has led punitive fees to manage passenger behaviour more than other airlines. For example, to reduce ground-staff numbers, it is now prohibitively expensive to check in at the airport or to store luggage in the hold when travelling with Ryanair. When it flies to a city, it utilizes that city's secondary and even tertiary airports, where the costs of operating are cheaper than flying to the main airport. As a result, there's less delay in turning around the aircraft to get it back in the sky. The airline has often made provocative announcements, for example, it made headlines with a suggestion that it might charge passengers to use aircraft toilets. No doubt, it believes that till publicity is good publicity', since such outbursts keep its advertising budget to a minimum. In common with Southwest Airlines, Ryanair flies only Boeing 737-800. In 2006, it flew 425 million passengers in the year and took delivery of its hundredth Boeing 737-800. It also launched its Web check-in service, giving passengers the opportunity to check-in online. In order to generate further revenue, Ryanair introduced on-board mobile phone use across its entire fleet which lets customers gamble and play bingo during the flight. The year before, to celebrate its twentieth anniversary, it offered 100,000 flights at only ninety-nine pence each. Ar the same time, it reminded passengers that its competitors add a fuel surcharge to top up the price of their tickets. Growth in passenger numbers continue as it strips out not-essential services and introduces yiekl-management systems which allow it to vary ticket prices according to demand for Ryanair's CEO, pricing is not complex, it is all about what the market will bear. In 2010, traffic grew to 72.1 million passengers with an average fare of only 39 and no fuel surcharges, despite a sharp increase in fuel costs. Their business model is Toad factor-active, yaeld-passive, Ryanair N takes whatever ticket prices it can get in order to ensure the aircraft is as full as possible; in other words, it achieves a high load factor. In the past, Mr O'Leary has suggested a load factor of between eighty-two and eighty-three per cent throughout the year would be fine: Ryanair's actual losach factor is often in access of ninety per cent. What this allows it to do is to capitalize on the prevailing low-fare trend. It creates a virtuous cycle in which low fares encourage greater passenger traffic. As more passengers lly,so this continues to drive both the cost reduction it achieves from using airports, and lowers its timit cost per employee and per aircraft Crucially, high passenger numbers also drive the demand for ancillary services. It actively supports its load factor by offering a range of lower fares and aggressive seat sales. By 2015, traffic passed the 100 million customer mark; 106.4 million customers are flow, at an average fare of 46 and a 93 per cent load factor. Customer Service In 2013, Ryanair was considered to have the worst customer service out of Britain's 100 biggest brands in a survey by a consumer magazine. In the same year, two quarterly profit warnings showed Ryanair failing to keep up with its rival, including easyJet, whose friendlier image had attracted tlyers. The usually belligerent Mr O'Leary was forced to make a conscious effort to improwe Ryanair's corporate reputation and avoid losing sales to competitors. In a bid to show how Ryanair is undergoing revolutionary customer change the boss of Europe's biggest low cost airline was presented to the world cuckelling a puppy. The chief executive, revealed his new image at an event to launch the airline's new, updated website and app. Mr O'Leary said the airline had an "Always Getting Better' plan, sta By 2014 it had relaxed its hard-line cabin baggage allowance, recluced penalties for failing to print out boarding passes, and introduced allocated seating. For example, an unpopular 70 fee for re-isuing boarding passes at the airport was lowered to 10. Mr O'Leary also promised that flyers will no longer pay disproportionate charges for small transgressions in hand-luggage size: be blamed local agents in some airports for applying his rules with excess zeal. There's no more conflict", he said. The new website drastically reduces the number of steps required to book a flight, and allows regular travelers to store information about their travel documents and paymenit card. The moves were a response to easyJet filling its planes more successfully than any other European airline and making healthy prolits. "To placate customers, Ryanair also followed its arch-rival into primary hubs such as Rome Fiumicino and Brussels, and began moving away from secondary airports The effect of this "nicer guy approach was a leap in profits to 867m.cting with "fixing the things our customers don't like a 3 Lowest Cost Competitor Ryanair has always been efficient at making money from its ancillary services. In 2016 ancillary services accounted for twenty-seven per cent of its revenue. For example, consumers can expect to pay for everything else after paying for their flight. This includes seat reservations, booking hotels through Ryanair's website, snacks on the plane, water to drink, just about everything comes at a cost. This constant cost cutting has allowed Ryanair to make a profit even when consumer demand falls. Customers keep coming back, not least because the cost reductions are passed on to them in the form of lower fares Figure 3.6). The threat of substitutes refers to products and services which can meet similar needs. Therefore, the question becomes if one choose not to fly with the low cost airline industry, what alternatives are available? Here the price performance ratio comes into play. The more attractive the price performance ratio of substitute products, the greater is the restraint on an industry's profits. Therefore, the price-performance ratio of the low cost airline industry vis-- vis their substitutes will determine profitability levels within the industry, Given Rya- nair's low fares, and the convenience and speed of flying to one's destination, can ferry, train, or coach substitutes offer a viable alternative? Other full-service airlines such as Air France and Laufthansa have struggled to cut their wage costs to compete. British Airways, which is part of the International Airlines Group, has tried to copy Ryanair by squeezing extra scats onto their planes and selling supermarket sanduiches on board to generate extra revenue. However, unlike Ryanair, British Airways has always been concemed to protect its brand image. That said, Ryanair became Europe's favourite airline in 2016 in terms of the number of passengers it carries, taking the mantle from Germany's Lufthansa mmmmm Aircraft are the single largest capital cost in any airline, so getting fleet costs right is a key objective. In 2013, Ryanair acquired 180 new Boeing 737-800s with a list price of $15 billion. This was negotiated at a time when Boeing was launching its all-new Bocing 737 MAX aircraft with extra seats. With this deal Ryanair had the capacity to grow the fleet by fifty per cent without compromising on flight cost per passenger. It since expanded that order even further to add 110 units of the 737 MAX aircraft, with options on another 100. These planes pro-vide extra seats and new, efficient engines that will cut unit costs even more and further improve the carrier's competitiveness. Ryanair is a massive customer for Bocing, which allows it to negotiate the best prices for its fleet of aircraft. Also, aircraft manufacture is dominated by two players, Boeing and Airbus, and Ryanair has said in the past that it will buy from Airbus if it doesn't receive the deal it needs from Boeing. Another major cost, the cost of fuel, is determined by the price of oil, and falling oil prices benefit all airlines. Mr O'Leary is all too aware that, given Ryanair's low cost basc, it can still make profits even when its ticket prices are cheaper than any of its rivals. He predicts that as fares continue to fall, his airline will fly over 200 million passengers a year by 2024. In 2017, the Irish airline made a profit after tax of 1.3bn (l.lbn), even though it slashed ticket prices. Michael O'Leary said fares had fallen by thirteen per cent, but profitability has doubled over three years. He added, 'Frankly I see no reason why that trend won't continue