Answered step by step

Verified Expert Solution

Question

1 Approved Answer

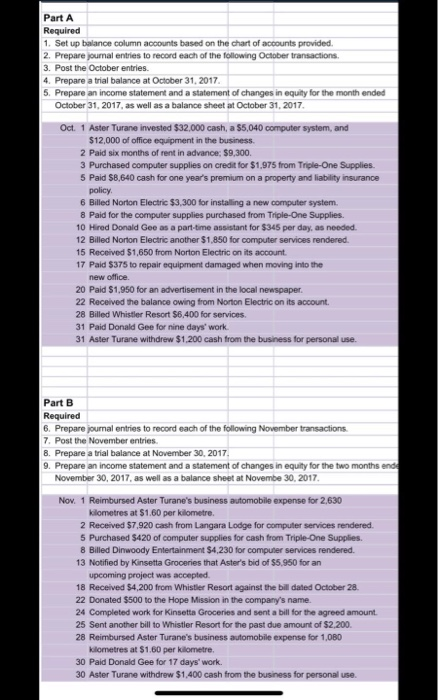

explain the journal entries? Part A Required 1. Set up balance column accounts based on the chart of accounts provided 2. Prepare journal entries to

explain the journal entries?

Part A Required 1. Set up balance column accounts based on the chart of accounts provided 2. Prepare journal entries to record each of the following October transactions. 3. Post the October entries. 4. Prepare a trial balance at October 31, 2017 5. Prepare an income statement and a statement of changes in equity for the month ended October 31, 2017, as well as a balance sheet at October 31, 2017 Oct. 1 Aster Turane invested $32,000 cash, a $5,040 computer system, and $12,000 of office equipment in the business. 2 Paid six months of rent in advance: $9,300 3 Purchased computer supplies on credit for $1,975 from Triple-One Supplies. 5 Paid $8,640 cash for one year's premium on a property and liability insurance policy 6 Billed Norton Electric $3,300 for installing a new computer system. 8 Paid for the computer supplies purchased from Triple-One Supplies. 10 Hired Donald Gee as a part-time assistant for $345 per day, as needed. 12 Billed Norton Electric another $1,850 for computer services rendered. 15 Received $1,650 from Norton Electric on its account. 17 Paid $375 to repair equipment damaged when moving into the new office 20 Paid $1,950 for an advertisement in the local newspaper. 22 Received the balance owing from Norton Electric on its account 28 Billed Whistler Resort $6,400 for services. 31 Paid Donald Gee for nine days' work. 31 Aster Turane withdrew $1.200 cash from the business for personal use. Part B Required 6. Prepare journal entries to record each of the following November transactions 7. Post the November entries. 8. Prepare a trial balance at November 30, 2017 9. Prepare an income statement and a statement of changes in equity for the two months ende November 30, 2017, as well as a balance sheet at Novembe 30. 2017. Nov. 1 Reimbursed Aster Turane's business automobile expense for 2,630 kilometres at $1.60 per kilometre. 2 Received $7,920 cash from Langara Lodge for computer services rendered. 5 Purchased $420 of computer supplies for cash from Triple-One Supplies 8 Billed Dinwoody Entertainment $4,230 for computer services rendered. 13 Notified by Kinsetta Groceries that Aster's bid of $5.950 for an upcoming project was accepted. 18 Received $4,200 from Whistler Resort against the bill dated October 28. 22 Donated $500 to the Hope Mission in the company's name. 24 Completed work for Kinsetta Groceries and sent a bill for the agreed amount. 25 Sent another bill to Whistler Resort for the past due amount of $2,200 28 Reimbursed Aster Turane's business automobile expense for 1.000 kilometres at $1.60 per kilometre. 30 Paid Donald Gee for 17 days' work. 30 Aster Turane withdrow $1,400 cash from the business for personal use Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started