Question

X and Y are partners sharing profits in the ratio of 3: 2 with capitals of Rs.80, 000 and Rs.60, 000 respectively. Interest on

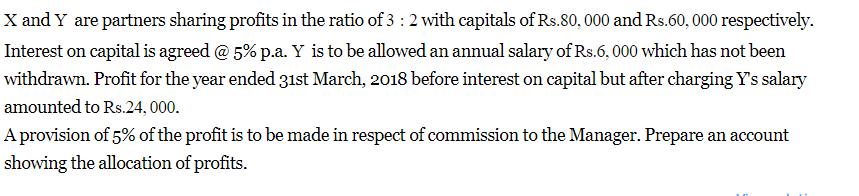

X and Y are partners sharing profits in the ratio of 3: 2 with capitals of Rs.80, 000 and Rs.60, 000 respectively. Interest on capital is agreed @ 5% p.a. Y is to be allowed an annual salary of Rs.6, 000 which has not been withdrawn. Profit for the year ended 31st March, 2018 before interest on capital but after charging Y's salary amounted to Rs.24, 000. A provision of 5% of the profit is to be made in respect of commission to the Manager. Prepare an account showing the allocation of profits.

Step by Step Solution

3.56 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

i Adjustment ac Dr Cr Profit and ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Selling Customers for Life through Service

Authors: Charles M. Futrell

13th edition

77861019, 978-0077861018

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App