Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Explain this question with calculations? 23. Transaction exposure. On May 1st, Larkin Hydraulics, a wholly owned subsidiary of Caterpillar (U.S.), sold a 12 megawatt compression

Explain this question with calculations?

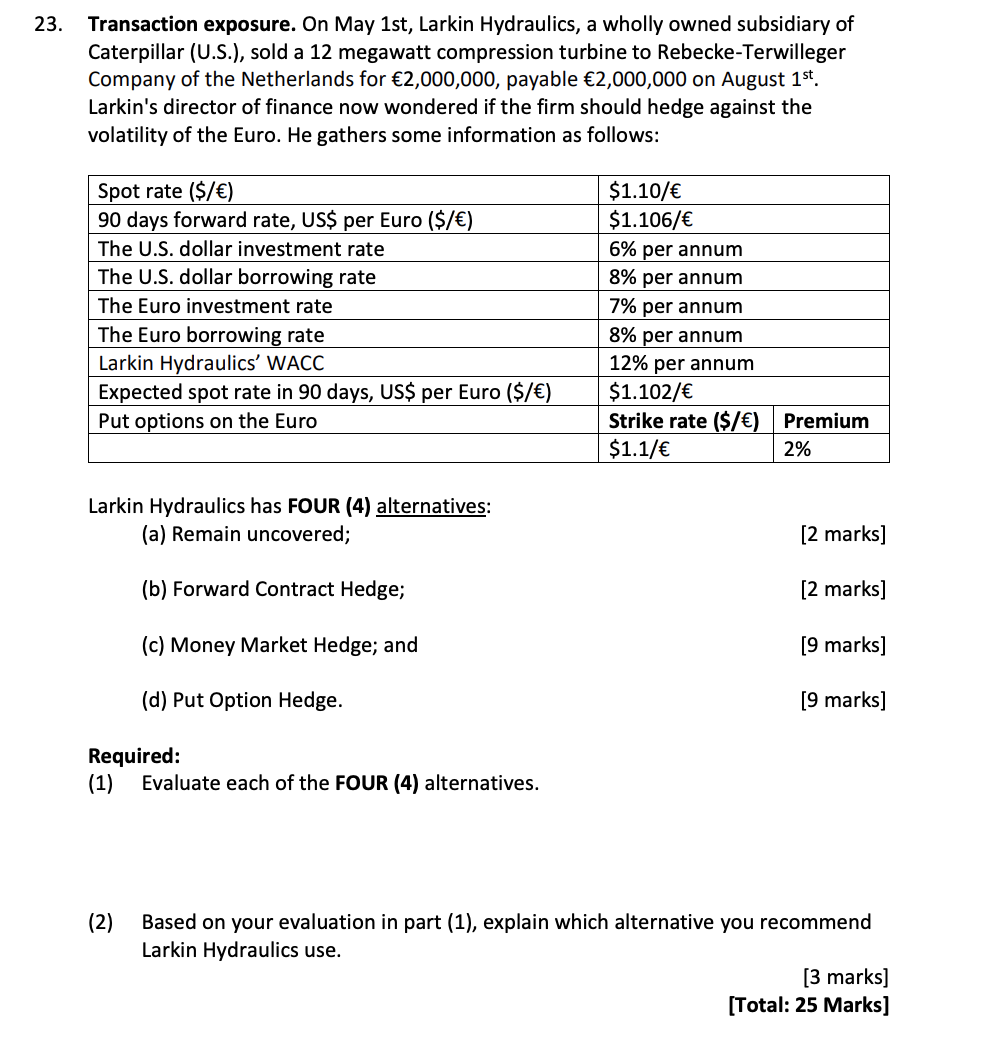

23. Transaction exposure. On May 1st, Larkin Hydraulics, a wholly owned subsidiary of Caterpillar (U.S.), sold a 12 megawatt compression turbine to Rebecke-Terwilleger Company of the Netherlands for 2,000,000, payable 2,000,000 on August 1st. Larkin's director of finance now wondered if the firm should hedge against the volatility of the Euro. He gathers some information as follows: Spot rate ($/) 90 days forward rate, US$ per Euro ($/) The U.S. dollar investment rate The U.S. dollar borrowing rate The Euro investment rate $1.10/ $1.106/ 6% per annum 8% per annum 7% per annum 8% per annum The Euro borrowing rate Larkin Hydraulics' WACC Expected spot rate in 90 days, US$ per Euro ($/) Put options on the Euro 12% per annum $1.102/ Strike rate ($/) Premium $1.1/ 2% Larkin Hydraulics has FOUR (4) alternatives: (a) Remain uncovered; (b) Forward Contract Hedge; (c) Money Market Hedge; and (d) Put Option Hedge. Required: (1) Evaluate each of the FOUR (4) alternatives. [2 marks] [2 marks] [9 marks] [9 marks] (2) Based on your evaluation in part (1), explain which alternative you recommend Larkin Hydraulics use. [3 marks] [Total: 25 Marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

answer Transaction Exposure Evaluation for Larkin Hydraulics Larkin Hydraulics faces transaction exposure due to the 2 million receivable denominated ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started