Answered step by step

Verified Expert Solution

Question

1 Approved Answer

explain to Aroha if she is carrying on a business. Support your response with reference to legislation and applicable case law of New Zealand. Aroha

explain to Aroha if she is carrying on a business. Support your response with reference to legislation and applicable case law of New Zealand.

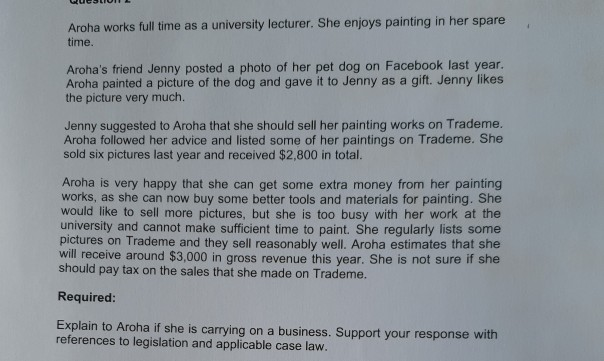

Aroha works full time as a university lecturer. She enjoys painting in her spare time. Aroha's friend Jenny posted a photo of her pet dog on Facebook last year. Aroha painted a picture of the dog and gave it to Jenny as a gift. Jenny likes the picture very much. Jenny suggested to Aroha that she should sell her painting works on Trademe. Aroha followed her advice and listed some of her paintings on Trademe. She sold six pictures last year and received $2,800 in total. Aroha is very happy that she can get some extra money from her painting works, as she can now buy some better tools and materials for painting. She would like to sell more pictures, but she is too busy with her work at the university and cannot make sufficient time to paint. She regularly lists some pictures on Trademe and they sell reasonably well. Aroha estimates that she will receive around $3,000 in gross revenue this year. She is not sure if she should pay tax on the sales that she made on Trademe. Required: Explain to Aroha if she is carrying on a business. Support your response with references to legislation and applicable case law

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started