Question

Explain your philosophy of investment, strategy and details of the initial portfolio above. In addition to your investment philosophy and process, please include the

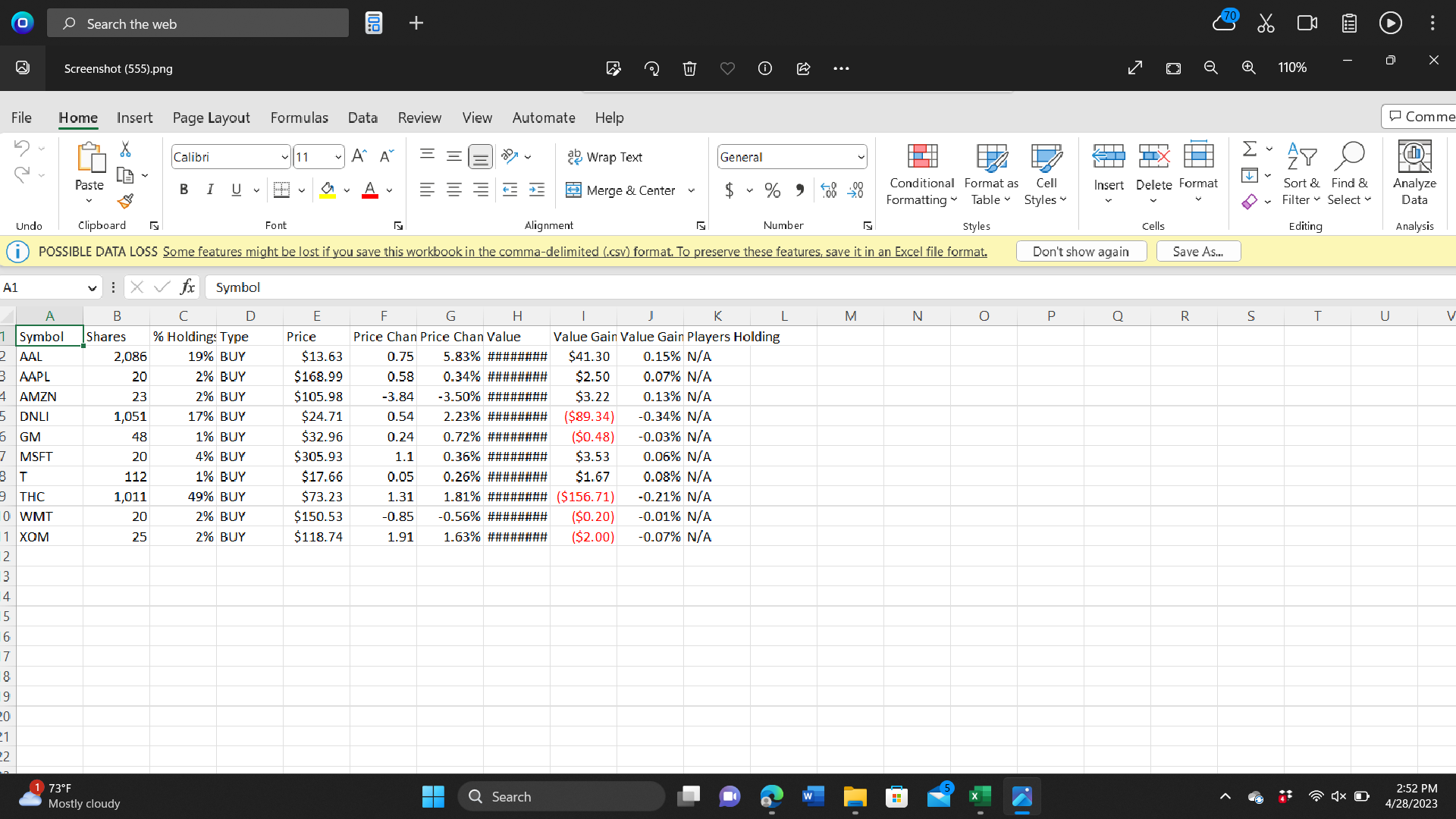

Explain your philosophy of investment, strategy and details of the initial portfolio above. In addition to your investment philosophy and process, please include the starting positions (as shown in the attachment) for your portfolio assets and your allocations to each asset.

2. Identify the investment philosophy that you decide to use as a guide to managing the portfolio. Keep the clients risk tolerance and expected return in mind and explain why it is the correct approach for them.

3. Discuss the process/strategy you are going to be using to manage the portfolio as its manager. Tie this to the client's needs and risk tolerance. How will you manage the portfolio - how often review and re-balance. What will be the criteria for making changes?

4. Last, give a summary of the assets and approximate percent of the portfolio holdings by type (stocks, mutual funds, cash, index funds, ETFs). Then, include a table that contains the assets purchased above, # of shares and starting position in above attachment.

0 File Undo A1 O Search the web 3 AAPL 4 AMZN 5 DNLI 6 GM 7 MSFT 8 T 9 THC 10 WMT 1 XOM 2 3 4 15 6 7 8 9 20 21 22 Screenshot (555).png Home Insert X LG 1 Symbol 2 AAL Paste B Shares Page Layout 2,086 20 23 1,051 48 20 112 1,011 20 25 73F Mostly cloudy Calibri B IU X fx Symbol D % Holdings Type 19% BUY 2% BUY 2% BUY 17% BUY 1% BUY 4% BUY Conditional Format as Cell Formatting Table Styles Styles Alignment G Clipboard POSSIBLE DATA LOSS Some features might be lost if you save this workbook in the comma-delimited (.csv) format. To preserve these features, save it in an Excel file format. 1% BUY 49% BUY 2% BUY 2% BUY Formulas Data Review View 11 Font a A A E Price $13.63 $168.99 $105.98 $24.71 $32.96 $305.93 $17.66 $73.23 $150.53 $118.74 + A = = Automate F G H Price Chan Price Chan Value 0.75 0.58 -3.84 0.54 0.24 1.1 0.05 1.31 -0.85 1.91 8 F Help ab Wrap Text Q Search Merge & Center 5 J K -0.34% N/A Value Gain Value Gain Players Holding 5.83% ######## $41.30 0.15% N/A 0.34% ######## $2.50 0.07% N/A -3.50% ######## $3.22 0.13% N/A 2.23% ######## ($89.34) 0.72% ######## ($0.48) 0.36% ######## $3.53 0.26% ######## $1.67 1.81% ######## ($156.71) -0.56% ######## ($0.20) 1.63% ######## -0.01% N/A ($2.00) -0.07% N/A General $ % 9 -0.03% N/A 0.06% N/A 0.08% N/A -0.21% N/A Number L M H N O KI T T TT P Insert Delete Format Don't show again Q Cells Save As... R S 110% AT O Sort & Find & Filter Select Editing T O U Comme Analyze Data Analysis 2:52 PM 4/28/2023 V

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started