Answered step by step

Verified Expert Solution

Question

1 Approved Answer

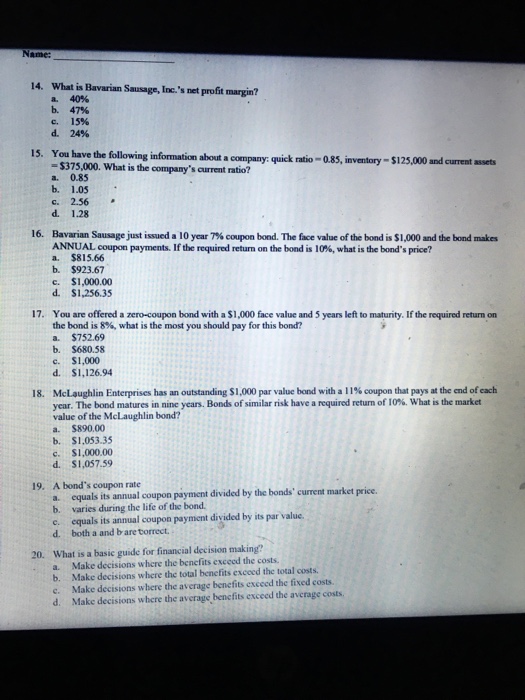

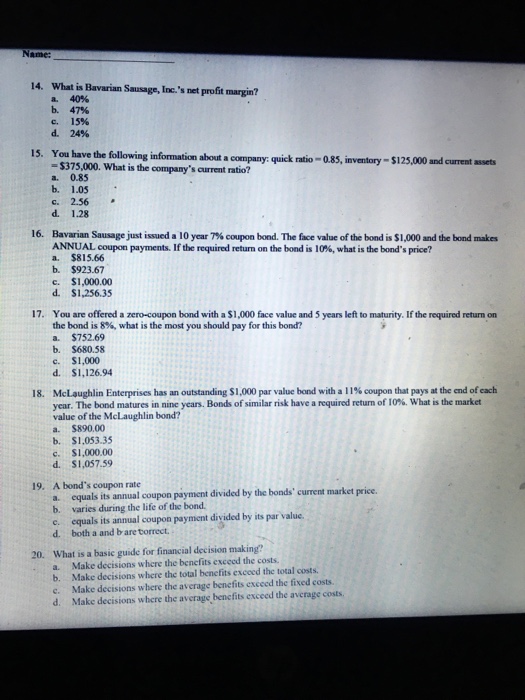

Explanation for all please 14. What is Bavarian Sausage, Inc. 's net profit margin? 40% b. 47% c. 15% d.24% 15. You have the following

Explanation for all please  14. What is Bavarian Sausage, Inc. 's net profit margin? 40% b. 47% c. 15% d.24% 15. You have the following information about a company: quick ratio-0.85, inventory-$125,000 and current assets - $375,000. What is the company's current ratio? a. 0.85 b. 1.05 c. 2.56 d. 1.28 16. Bavarian Sausage just issued a 10 year 7% coup on bond. The face value ofthe bond is $1,000 and the bond makes ANNUAL coupon payments. If the required return on the bond is 10%, what is the bond's price? a. $815.66 b. $923.67 c. $1,000.00 d. $1,256.35 17. You are offered a zero-coupon bond with a S1,000 face value and 5 years left to maturity. If the required return on the bond is 8%, what is the most you should pay for this bond? a. $752.69 b. $680.58 c. $1,000 d. $1,126.94 McLaughlin Enterprises has an outstanding $1,000 par value band with a l 1% coupon that pays at the end of each year. T e bond matures in nine years. Bonds of smalar risk have a required return of 10% What is the market value of the Mclaughlin bond? a. $890.00 b. $1,053.35 c. $1,000.00 d. S1,057.59 18. A bond's coupon rate a. equals its annual coupon payment divided by the bonds current market pr b. varies during the life of the bond e. equals its annual coupon payment divided by its par value. d. both a and b are torrect 19. price. 20. What is a basic guide for financial decision making? a. Make decisions where the benefits exceed the costs b. Make decisions where the total benefits exceed the total costs. c. Make decisions where the average benefits exceed the fixed costs d. Make decisions where the average bencfits exceed the average costs

14. What is Bavarian Sausage, Inc. 's net profit margin? 40% b. 47% c. 15% d.24% 15. You have the following information about a company: quick ratio-0.85, inventory-$125,000 and current assets - $375,000. What is the company's current ratio? a. 0.85 b. 1.05 c. 2.56 d. 1.28 16. Bavarian Sausage just issued a 10 year 7% coup on bond. The face value ofthe bond is $1,000 and the bond makes ANNUAL coupon payments. If the required return on the bond is 10%, what is the bond's price? a. $815.66 b. $923.67 c. $1,000.00 d. $1,256.35 17. You are offered a zero-coupon bond with a S1,000 face value and 5 years left to maturity. If the required return on the bond is 8%, what is the most you should pay for this bond? a. $752.69 b. $680.58 c. $1,000 d. $1,126.94 McLaughlin Enterprises has an outstanding $1,000 par value band with a l 1% coupon that pays at the end of each year. T e bond matures in nine years. Bonds of smalar risk have a required return of 10% What is the market value of the Mclaughlin bond? a. $890.00 b. $1,053.35 c. $1,000.00 d. S1,057.59 18. A bond's coupon rate a. equals its annual coupon payment divided by the bonds current market pr b. varies during the life of the bond e. equals its annual coupon payment divided by its par value. d. both a and b are torrect 19. price. 20. What is a basic guide for financial decision making? a. Make decisions where the benefits exceed the costs b. Make decisions where the total benefits exceed the total costs. c. Make decisions where the average benefits exceed the fixed costs d. Make decisions where the average bencfits exceed the average costs

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started