Explore the annual report and financial statements to familiarize yourself with the company.

1. Provide a brief overview of the basic company information: history, primary products and services, primary markets, competitive situation and business strategy:

2. Who are the auditors and are there any concerns raised in the audit reports?

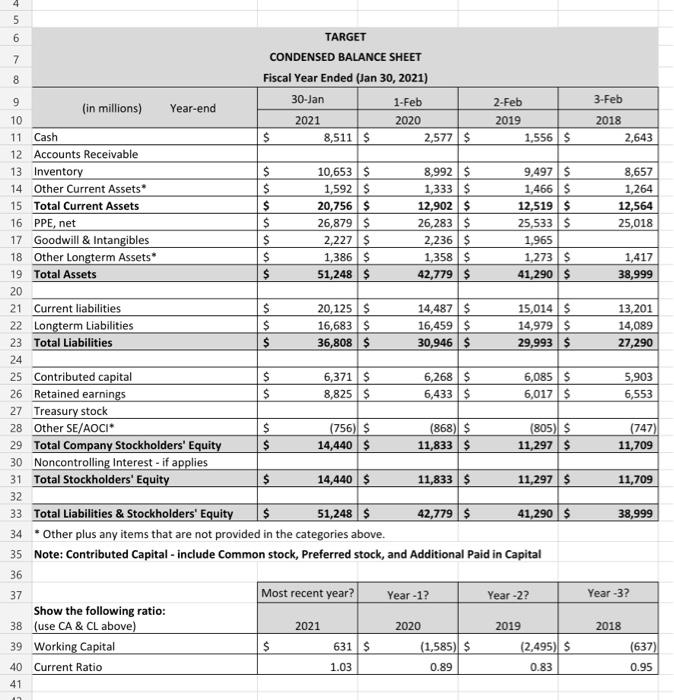

Brief Balance Sheet Analysis:

3. What is the capital structure of the company:

a) For the most recent year, what is the relative proportion of short-term assets to long-term assets?

b) For the most recent year, what proportion of total assets is financed by owners?

c) For the most recent year, what proportion of total assets is financed by non-owners?

4. For the most recent year, what are the companys largest assets and liabilities?

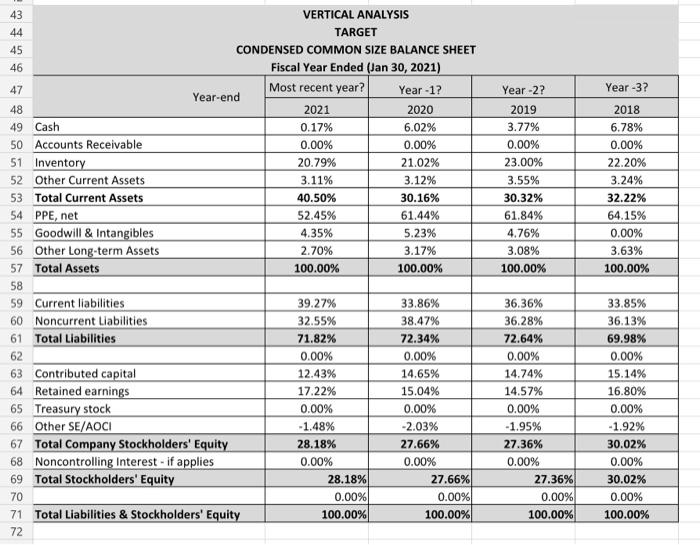

5. Examine Worksheet A common size and trend analysis, are there any major differences over time?

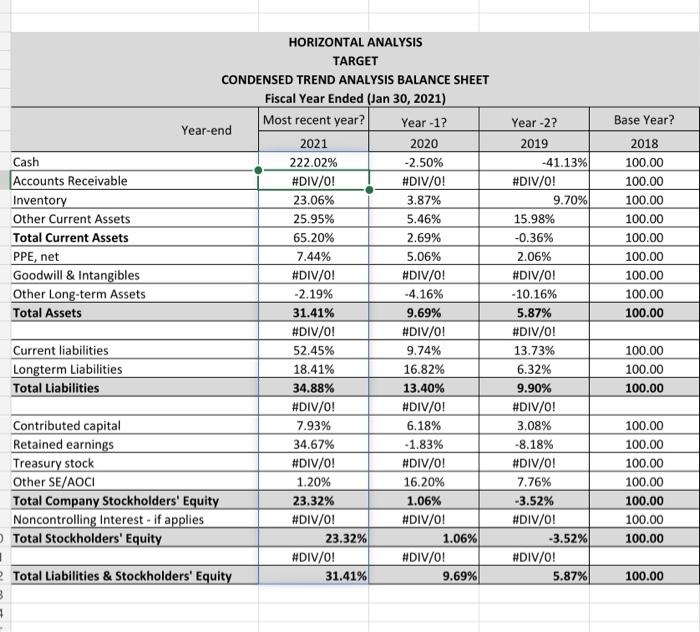

Brief Income Statement Analysis:

6. Is the company profitable?

7. What are the companys major expenses?

8. Are there any transitory items (extraordinary or discontinued operations)? If so, are they large in magnitude?

9. Examine Worksheet B common size and trend analysis, are there any major differences over time?

Statement of Cash Flows Analysis:

10. Operating Activities

a. For the most recent year, is Net Cash Flow from Operating Activities (NCFOA) positive?

b. Has there been an overall increase or decrease in NCFOA from the base year to the most recent year?

c. Is NCFOA increasing, decreasing or variable over the three year period?

d. For the most recent year, is NCFOA smaller or larger than Net Income?

e. What are the major differences between NCFOA and Net Income? What are the amounts for depreciation expense?

f. Is the trend for NCFOA consistent with the trend for Net Income over the last three years? If not, are there any significant differences between NCFOA and Net Income that explain this inconsistency (e.g. impairments, restructuring charges, stock-based compensation, deferred taxes. etc.)?

g. Briefly discuss, and interpret, the NCFOA to Current Liabilities ratio for the three years.

11. Investing Activities

a. For the most recent year, did the company purchase new property, plant, and equipment (Capital Expenditures)? If so, what is the amount for these purchases?

b. What is the horizontal trend for Capital Expenditures? Are the expenditures increasing (generally a healthy sign), stable, or decreasing (generally a company in decline)?

c. Briefly discuss, and interpret, the NCFOA to Capital Expenditures ratio for the three years.

d. BWhat is the horizontal trend for net cash flow for investments only (short-term and long-term)? Calculate, and include, the net amounts for cash flows for investments for each year.

e. Did the company acquire any businesses during the three years? If so, which year(s), and was it a significant amount?

Financing Activities

a. What is the horizontal trend for net cash flow for debt only (short-term and long-term)? Calculate, and include, the net amounts for cash flows from debt for each year.

b. During the three years, did the company issue new stock? If so, what type of stock (common and/or preferred) and what was the trend over the three years?

c. During the three years, did the company repurchase treasury stock? If so, what was the trend over the three During the three years, did the company pay any cash dividends? If so, what was the trend over the three years?

4 5 6 TARGET 7 CONDENSED BALANCE SHEET 8 Fiscal Year Ended (Jan 30, 2021) 9 3-Feb 2018 11 Cash 2,643 8,657 1,264 12,564 25,018 1,417 38,999 30-Jan (in millions) Year-end 1-Feb 2-Feb 10 2021 2020 2019 $ 8,511 $ 2,577 $ 1,556 $ 12 Accounts Receivable 13 Inventory $ 10,653 $ 8,992 $ 9,497 S 14 Other Current Assets 1,592 $ 1,333$ 1,4665 15 Total Current Assets $ 20,756 $ 12,902 $ 12,519 $ 16 PPE, net $ 26,879 $ 26,283 $ 25,533 $ 17 Goodwill & Intangibles $ 2,227$ 2,236 $ 1,965 18 Other Longterm Assets $ 1,386 $ 1,358$ 1,273 $ 19 Total Assets 51,248$ 42,779 $ 41,290 $ 20 21 Current liabilities $ 20,125$ 14,487 $ 15,014 $ 22 Longterm Liabilities $ 16,683 $ 16,459 $ 14,979 $ 23 Total Liabilities $ 36,808 $ 30,946 $ 29,993 $ 24 25 Contributed capital $ 6,371 $ 6,268$ 6,085$ 26 Retained earnings $ 8,825$ 6,433 $ 6,017$ 27 Treasury stock 28 Other SE/AOCI $ (756) $ (868) $ (805) $ 29 Total Company Stockholders' Equity $ 14,440 $ 11,833 $ 11,297 S 30 Noncontrolling Interest - if applies 31 Total Stockholders' Equity $ 14,440 $ 11,833$ 11,297 $ 32 33 Total Liabilities & Stockholders' Equity $ 51,248 S 42,779 $ 41,290 $ 34 *Other plus any items that are not provided in the categories above. 35 Note: Contributed Capital - include common stock, Preferred stock, and Additional Paid in Capital 36 13,201 14,089 27,290 5,903 6,553 (747) 11,709 11,709 38,999 Most recent year? Year-1? Year-2? Year-3? 37 Show the following ratio: 38 (use CA & CL above) 39 Working Capital 40 Current Ratio 2021 2019 2018 2020 (1,585) $ 631$ (2,495) (637) 1.03 0.89 0.83 0.95 41 43 VERTICAL ANALYSIS 44 TARGET 45 CONDENSED COMMON SIZE BALANCE SHEET 46 Fiscal Year Ended (Jan 30, 2021) Most recent year? 47 Year -17 Year-2? Year -3? Year-end 48 2021 2020 2019 2018 49 Cash 0.17% 6.02% 3.77% 6.78% 0.00% 0.00% 0.00% 0.00% 21.02% 23.00% 22.20% 20.79% 3.11% 3.12% 3.55% 3.24% 40.50% 30.16% 30.32% 32.22% 50 Accounts Receivable 51 Inventory 52 Other Current Assets 53 Total Current Assets 54 PPE, net 55 Goodwill & Intangibles 56 Other Long-term Assets 57 Total Assets 52.45% 61.44% 61.84% 64.15% 4.35% 5.23% 4.76% 0.00% 2.70% 3.17% 3.08% 3.63% 100.00% 100.00% 100.00% 100.00% 58 59 Current liabilities 60 Noncurrent Liabilities 39.27% 32.55% 71.82% 33.86% 38.47% 72.34% 36.36% 36.28% 33.85% 36.13% 61 Total Liabilities 72.64% 69.98% 62 0.00% 0.00% 0.00% 0.00% 12.43% 14.65% 14.74% 17.22% 15.04% 14.57% 15.14% 16.80% 0.00% -1.92% 0.00% 0.00% 63 Contributed capital 64 Retained earnings 65 Treasury stock 66 Other SE/AOCI 67 Total Company Stockholders' Equity 68 Noncontrolling Interest - if applies 69 Total Stockholders' Equity 0.00% -1.48% -2.03% -1.95% 28.18% 27.66% 27.36% 0.00% 0.00% 30.02% 0.00% 30.02% 0.00% 28.18% 0.00% 100.00% 70 27.66% 0.00% 100.00% 27.36% 0.00% 100.00% 71 Total Liabilities & Stockholders' Equity 0.00% 100.00% 72 HORIZONTAL ANALYSIS TARGET CONDENSED TREND ANALYSIS BALANCE SHEET Fiscal Year Ended (Jan 30, 2021) Most recent year? Year -1? Year -2? Base Year? Year-end 2021 2020 2018 -2.50% 100.00 222.02% #DIV/0! 2019 -41.13% #DIV/0! 9.70% 15.98% #DIV/0! 3.87% 100.00 23.06% 25.95% 5.46% Cash Accounts Receivable Inventory Other Current Assets Total Current Assets PPE, net Goodwill & Intangibles Other Long-term Assets Total Assets 65.20% 2.69% -0.36% 7.44% 5.06% 2.06% 100.00 100.00 100.00 100.00 100.00 100.00 100.00 #DIV/0! -2.19% 31.41% #DIV/0! #DIV/0! -4.16% 9.69% #DIV/0! 9.74% #DIV/0! - 10.16% 5.87% #DIV/0! 13.73% 6.32% 52.45% 100.00 Current liabilities Longterm Liabilities Total Liabilities 18.41% 16.82% 100.00 34.88% 13.40% 9.90% 100.00 #DIV/0! #DIV/0! 3.08% 7.93% 34.67% #DIV/0! 6.18% -1.83% #DIV/0! 16.20% Contributed capital Retained earnings Treasury stock Other SE/AOCI Total Company Stockholders' Equity Noncontrolling Interest - if applies Total Stockholders' Equity -8.18% #DIV/0! 1.20% #DIV/0! 7.76% 100.00 100.00 100.00 100.00 100.00 100.00 100.00 1.06% 23.32% #DIV/0! 23.32% #DIV/0! 31.41% #DIV/0! 1.06% #DIV/0! 9.69% -3.52% #DIV/0! -3.52% #DIV/0! 5.87% Total Liabilities & Stockholders' Equity 100.00 3 D 5 6 Company Name 7 CONDENSED INCOME STATEMENT 8 9 1-Feb (s in millions) 10 Fiscal Year Ended (Month/Day 30-Jan Year-end 2021 $ 93,561 $ 66.177 $ $ 273845 11 Sales revenue 2-Feb 2019 75,356 53,299 22,057 2020 78,1125 54.864 23.2485 12 Cost of good sold 13 Gross profit 14 $ Is 20.845$ 6.5395 18.5905 4.658 17.947 4.110 15 Operating expenses 16 Operating income 17 18 Nonoperating expenses and revenues 19 Income before income taxes 434 $ $ 9935 55465 4685 4. 1905 3.676 20 $ $ 1.1785 4,3685 9215 3.2695 746 2.930 21 Provision for income tax (Tax expense) 22 Income from continuing operations 23 24 Transitory/Nonrecurring items if applies 7 5 43685 125 3.2815 25 Net Income $ 2,937 $ 43685 3.281 $ 2,937 26 Net income attributable to Noncontrolling Interests 27 Net Income attributable to Company Stockholders 28 29 Earnings per share 30 Earnings per share-Diluted 31 $ 8.725 8.54 5 6425 6.365 5.55 5.51 $ 32 Note: Transitory/Nonrecurring items includes Extraordinary items and/or Discontinued Operations 33 34 35 36 37 38 39 Year-2? VERTICAL ANALYSIS Company Name CONDENSED COMMON SIZE INCOME STATEMENT Fiscal Year Ended (Month/Day Most recent year? Year-12 Year-end 2021 2020 100.00% 100.00% 70.73% 70.24% 29.27% 29.76% 0.00% 0.00% 2019 40 41 Sales revenue 42 Cost of good sold 43 Gross profit (Gross profit %) 100.00% 70.73% 29.27% 44 0.00% 23 80% 23 82% 45 Operating expenses 46 Operating income 22.28% 6.99% 5.96% 5.45% 47 0.00% 1.06% 5.93% 0.00% 0.60% 0.00% 0.58% 48 Nonoperating expenses and revenues 49 Income before income taxes 4.88 50 0.00% 5.36 0.00% 1 18% 4.19% 1.26% 51 Provision for income tax (Tax expense) 52 Income from continuing operations 0.00% 0.99% 3.89% 4.67% 53 0.00% 0.00% 0.00% 0.00% 0.01% 54 Transitory/Nonrecurring items if applies 55 Net Income 4.67% 0.009 4.67% 56 Net income attributable to Noncontrolling Interests 57 Net Income attributable to Company Stockholders 0.02% 4 20% 0.00 4.20% 3.90% 0.00% 3.90% 58 Washt A Balance Sh... Wisht BInc Stmt Wicht Cash Flow + 60 61 HORIZONTAL ANALYSIS 62 Company Name 63 CONDENSED TREND ANALYSIS INCOME STATEMENT 64 Fiscal Year Ended (Month/Day) Most recent year? 65 Year -1? Base Year? Year-end 66 2021 2020 2019 24.16% 3.66% 100.00 100.00 24.16% 2.94% 24.15% 5.40% 100.00 67 Sales revenue 68 Cost of good sold 69 Gross profit 70 71 Operating expenses 72 Operating income #DIV/0! 3.58% #DIV/0! 16.15% 59.10% #DIV/0! 128.80% 100.00 100.00 13.33% 73 #DIV/0! 7.83% 100.00 74 Nonoperating expenses and revenues 75 Income before income taxes 50.87% 100.00 76 #DIV/0! 57.91% 13.98% #DIV/0! 23.46% 100.00 77 Provision for income tax (Tax expense) 78 Income from continuing operations 49.08% 11.57% 100.00 79 #DIV/0! 71.43% 100.00 100.00 81 80 Transitory/Nonrecurring items-if applies Net Income 82 Net income attributable to Noncontrolling Interests Net Income attributable to Company Stockholders 11.71% #DIV/0! -100.00% 48.72% #DIV/0! 48.72% #DIV/0! 57.12% 56.81% 83 100.00 84 #DIV/0! 11.71% #DIV/0! 15.68% 15.43% 100.00 85 Earnings per share 86 Earnings per share-Diluted 100.00 87 88 5 6 Company Name CONDENSED STATEMENT OF CASH FLOW 7 8 Fiscal Year Ended (Month/Day) 9 ($ in millions) Year-end 30-Jan 1-Feb 2-Feb 2019 10 11 Net cash from operating activities 12 Net cash from investing activities 13 Net cash from financing activities 14 Effect of exchange rate on cash - if applies 15 Net change in cash $ $ $ 2021 10,525 $ (2,591) $ (2,000) $ 2020 7,117 $ (2,944) S (3,152) $ 5,973 (3,416) (3,644) $ 5,934 $ 1,021 S (1,087) 16 17 18 HORIZONTAL ANALYSIS 19 Company Name 20 CONDENSED TREND ANALYSIS STATEMENT OF CASH FLOWS 21 22 Fiscal Year Ended (Month/Day) 30-Jan Year-end 2021 1-Feb 2-Feb 23 2020 2019 76.21% 19.15% 100.00 -24.15% -13.82% 100.00 24 Net cash from operating activities 25 Net cash from investing activities 26 Net cash from financing activities 27 Effect of exchange rate on cash 28 Net change in cash -45.12% -13.50% #DIV/0! -645.91% #DIV/0! -193.93% 100.00 100.00 100.00 29 30 31 32 Show the following ratio: Most recent year? Year -1? Year-2? 33 2021 2020 2019 0.49 0.40 0.52 -3.97 -2.35 -1.70 34 Operating Cash Flow to Current Liabilities 35 Operating Cash Flow to Capital Expenditures Net Cash from Operations to Net Income for 36 years net income is postive 2.41 2.17 2.03 37 38 Capital Expenditure -2649 -3027 -3516 39 Wksht A Balance Sh... Wisht B in Strnt Wksht C Cash Flow + 4 5 6 TARGET 7 CONDENSED BALANCE SHEET 8 Fiscal Year Ended (Jan 30, 2021) 9 3-Feb 2018 11 Cash 2,643 8,657 1,264 12,564 25,018 1,417 38,999 30-Jan (in millions) Year-end 1-Feb 2-Feb 10 2021 2020 2019 $ 8,511 $ 2,577 $ 1,556 $ 12 Accounts Receivable 13 Inventory $ 10,653 $ 8,992 $ 9,497 S 14 Other Current Assets 1,592 $ 1,333$ 1,4665 15 Total Current Assets $ 20,756 $ 12,902 $ 12,519 $ 16 PPE, net $ 26,879 $ 26,283 $ 25,533 $ 17 Goodwill & Intangibles $ 2,227$ 2,236 $ 1,965 18 Other Longterm Assets $ 1,386 $ 1,358$ 1,273 $ 19 Total Assets 51,248$ 42,779 $ 41,290 $ 20 21 Current liabilities $ 20,125$ 14,487 $ 15,014 $ 22 Longterm Liabilities $ 16,683 $ 16,459 $ 14,979 $ 23 Total Liabilities $ 36,808 $ 30,946 $ 29,993 $ 24 25 Contributed capital $ 6,371 $ 6,268$ 6,085$ 26 Retained earnings $ 8,825$ 6,433 $ 6,017$ 27 Treasury stock 28 Other SE/AOCI $ (756) $ (868) $ (805) $ 29 Total Company Stockholders' Equity $ 14,440 $ 11,833 $ 11,297 S 30 Noncontrolling Interest - if applies 31 Total Stockholders' Equity $ 14,440 $ 11,833$ 11,297 $ 32 33 Total Liabilities & Stockholders' Equity $ 51,248 S 42,779 $ 41,290 $ 34 *Other plus any items that are not provided in the categories above. 35 Note: Contributed Capital - include common stock, Preferred stock, and Additional Paid in Capital 36 13,201 14,089 27,290 5,903 6,553 (747) 11,709 11,709 38,999 Most recent year? Year-1? Year-2? Year-3? 37 Show the following ratio: 38 (use CA & CL above) 39 Working Capital 40 Current Ratio 2021 2019 2018 2020 (1,585) $ 631$ (2,495) (637) 1.03 0.89 0.83 0.95 41 43 VERTICAL ANALYSIS 44 TARGET 45 CONDENSED COMMON SIZE BALANCE SHEET 46 Fiscal Year Ended (Jan 30, 2021) Most recent year? 47 Year -17 Year-2? Year -3? Year-end 48 2021 2020 2019 2018 49 Cash 0.17% 6.02% 3.77% 6.78% 0.00% 0.00% 0.00% 0.00% 21.02% 23.00% 22.20% 20.79% 3.11% 3.12% 3.55% 3.24% 40.50% 30.16% 30.32% 32.22% 50 Accounts Receivable 51 Inventory 52 Other Current Assets 53 Total Current Assets 54 PPE, net 55 Goodwill & Intangibles 56 Other Long-term Assets 57 Total Assets 52.45% 61.44% 61.84% 64.15% 4.35% 5.23% 4.76% 0.00% 2.70% 3.17% 3.08% 3.63% 100.00% 100.00% 100.00% 100.00% 58 59 Current liabilities 60 Noncurrent Liabilities 39.27% 32.55% 71.82% 33.86% 38.47% 72.34% 36.36% 36.28% 33.85% 36.13% 61 Total Liabilities 72.64% 69.98% 62 0.00% 0.00% 0.00% 0.00% 12.43% 14.65% 14.74% 17.22% 15.04% 14.57% 15.14% 16.80% 0.00% -1.92% 0.00% 0.00% 63 Contributed capital 64 Retained earnings 65 Treasury stock 66 Other SE/AOCI 67 Total Company Stockholders' Equity 68 Noncontrolling Interest - if applies 69 Total Stockholders' Equity 0.00% -1.48% -2.03% -1.95% 28.18% 27.66% 27.36% 0.00% 0.00% 30.02% 0.00% 30.02% 0.00% 28.18% 0.00% 100.00% 70 27.66% 0.00% 100.00% 27.36% 0.00% 100.00% 71 Total Liabilities & Stockholders' Equity 0.00% 100.00% 72 HORIZONTAL ANALYSIS TARGET CONDENSED TREND ANALYSIS BALANCE SHEET Fiscal Year Ended (Jan 30, 2021) Most recent year? Year -1? Year -2? Base Year? Year-end 2021 2020 2018 -2.50% 100.00 222.02% #DIV/0! 2019 -41.13% #DIV/0! 9.70% 15.98% #DIV/0! 3.87% 100.00 23.06% 25.95% 5.46% Cash Accounts Receivable Inventory Other Current Assets Total Current Assets PPE, net Goodwill & Intangibles Other Long-term Assets Total Assets 65.20% 2.69% -0.36% 7.44% 5.06% 2.06% 100.00 100.00 100.00 100.00 100.00 100.00 100.00 #DIV/0! -2.19% 31.41% #DIV/0! #DIV/0! -4.16% 9.69% #DIV/0! 9.74% #DIV/0! - 10.16% 5.87% #DIV/0! 13.73% 6.32% 52.45% 100.00 Current liabilities Longterm Liabilities Total Liabilities 18.41% 16.82% 100.00 34.88% 13.40% 9.90% 100.00 #DIV/0! #DIV/0! 3.08% 7.93% 34.67% #DIV/0! 6.18% -1.83% #DIV/0! 16.20% Contributed capital Retained earnings Treasury stock Other SE/AOCI Total Company Stockholders' Equity Noncontrolling Interest - if applies Total Stockholders' Equity -8.18% #DIV/0! 1.20% #DIV/0! 7.76% 100.00 100.00 100.00 100.00 100.00 100.00 100.00 1.06% 23.32% #DIV/0! 23.32% #DIV/0! 31.41% #DIV/0! 1.06% #DIV/0! 9.69% -3.52% #DIV/0! -3.52% #DIV/0! 5.87% Total Liabilities & Stockholders' Equity 100.00 3 D 5 6 Company Name 7 CONDENSED INCOME STATEMENT 8 9 1-Feb (s in millions) 10 Fiscal Year Ended (Month/Day 30-Jan Year-end 2021 $ 93,561 $ 66.177 $ $ 273845 11 Sales revenue 2-Feb 2019 75,356 53,299 22,057 2020 78,1125 54.864 23.2485 12 Cost of good sold 13 Gross profit 14 $ Is 20.845$ 6.5395 18.5905 4.658 17.947 4.110 15 Operating expenses 16 Operating income 17 18 Nonoperating expenses and revenues 19 Income before income taxes 434 $ $ 9935 55465 4685 4. 1905 3.676 20 $ $ 1.1785 4,3685 9215 3.2695 746 2.930 21 Provision for income tax (Tax expense) 22 Income from continuing operations 23 24 Transitory/Nonrecurring items if applies 7 5 43685 125 3.2815 25 Net Income $ 2,937 $ 43685 3.281 $ 2,937 26 Net income attributable to Noncontrolling Interests 27 Net Income attributable to Company Stockholders 28 29 Earnings per share 30 Earnings per share-Diluted 31 $ 8.725 8.54 5 6425 6.365 5.55 5.51 $ 32 Note: Transitory/Nonrecurring items includes Extraordinary items and/or Discontinued Operations 33 34 35 36 37 38 39 Year-2? VERTICAL ANALYSIS Company Name CONDENSED COMMON SIZE INCOME STATEMENT Fiscal Year Ended (Month/Day Most recent year? Year-12 Year-end 2021 2020 100.00% 100.00% 70.73% 70.24% 29.27% 29.76% 0.00% 0.00% 2019 40 41 Sales revenue 42 Cost of good sold 43 Gross profit (Gross profit %) 100.00% 70.73% 29.27% 44 0.00% 23 80% 23 82% 45 Operating expenses 46 Operating income 22.28% 6.99% 5.96% 5.45% 47 0.00% 1.06% 5.93% 0.00% 0.60% 0.00% 0.58% 48 Nonoperating expenses and revenues 49 Income before income taxes 4.88 50 0.00% 5.36 0.00% 1 18% 4.19% 1.26% 51 Provision for income tax (Tax expense) 52 Income from continuing operations 0.00% 0.99% 3.89% 4.67% 53 0.00% 0.00% 0.00% 0.00% 0.01% 54 Transitory/Nonrecurring items if applies 55 Net Income 4.67% 0.009 4.67% 56 Net income attributable to Noncontrolling Interests 57 Net Income attributable to Company Stockholders 0.02% 4 20% 0.00 4.20% 3.90% 0.00% 3.90% 58 Washt A Balance Sh... Wisht BInc Stmt Wicht Cash Flow + 60 61 HORIZONTAL ANALYSIS 62 Company Name 63 CONDENSED TREND ANALYSIS INCOME STATEMENT 64 Fiscal Year Ended (Month/Day) Most recent year? 65 Year -1? Base Year? Year-end 66 2021 2020 2019 24.16% 3.66% 100.00 100.00 24.16% 2.94% 24.15% 5.40% 100.00 67 Sales revenue 68 Cost of good sold 69 Gross profit 70 71 Operating expenses 72 Operating income #DIV/0! 3.58% #DIV/0! 16.15% 59.10% #DIV/0! 128.80% 100.00 100.00 13.33% 73 #DIV/0! 7.83% 100.00 74 Nonoperating expenses and revenues 75 Income before income taxes 50.87% 100.00 76 #DIV/0! 57.91% 13.98% #DIV/0! 23.46% 100.00 77 Provision for income tax (Tax expense) 78 Income from continuing operations 49.08% 11.57% 100.00 79 #DIV/0! 71.43% 100.00 100.00 81 80 Transitory/Nonrecurring items-if applies Net Income 82 Net income attributable to Noncontrolling Interests Net Income attributable to Company Stockholders 11.71% #DIV/0! -100.00% 48.72% #DIV/0! 48.72% #DIV/0! 57.12% 56.81% 83 100.00 84 #DIV/0! 11.71% #DIV/0! 15.68% 15.43% 100.00 85 Earnings per share 86 Earnings per share-Diluted 100.00 87 88 5 6 Company Name CONDENSED STATEMENT OF CASH FLOW 7 8 Fiscal Year Ended (Month/Day) 9 ($ in millions) Year-end 30-Jan 1-Feb 2-Feb 2019 10 11 Net cash from operating activities 12 Net cash from investing activities 13 Net cash from financing activities 14 Effect of exchange rate on cash - if applies 15 Net change in cash $ $ $ 2021 10,525 $ (2,591) $ (2,000) $ 2020 7,117 $ (2,944) S (3,152) $ 5,973 (3,416) (3,644) $ 5,934 $ 1,021 S (1,087) 16 17 18 HORIZONTAL ANALYSIS 19 Company Name 20 CONDENSED TREND ANALYSIS STATEMENT OF CASH FLOWS 21 22 Fiscal Year Ended (Month/Day) 30-Jan Year-end 2021 1-Feb 2-Feb 23 2020 2019 76.21% 19.15% 100.00 -24.15% -13.82% 100.00 24 Net cash from operating activities 25 Net cash from investing activities 26 Net cash from financing activities 27 Effect of exchange rate on cash 28 Net change in cash -45.12% -13.50% #DIV/0! -645.91% #DIV/0! -193.93% 100.00 100.00 100.00 29 30 31 32 Show the following ratio: Most recent year? Year -1? Year-2? 33 2021 2020 2019 0.49 0.40 0.52 -3.97 -2.35 -1.70 34 Operating Cash Flow to Current Liabilities 35 Operating Cash Flow to Capital Expenditures Net Cash from Operations to Net Income for 36 years net income is postive 2.41 2.17 2.03 37 38 Capital Expenditure -2649 -3027 -3516 39 Wksht A Balance Sh... Wisht B in Strnt Wksht C Cash Flow +