Answered step by step

Verified Expert Solution

Question

1 Approved Answer

( Extension of problem 2 ) You are still an employee of University Consultants, Limited. The investor tells you she would also like to know

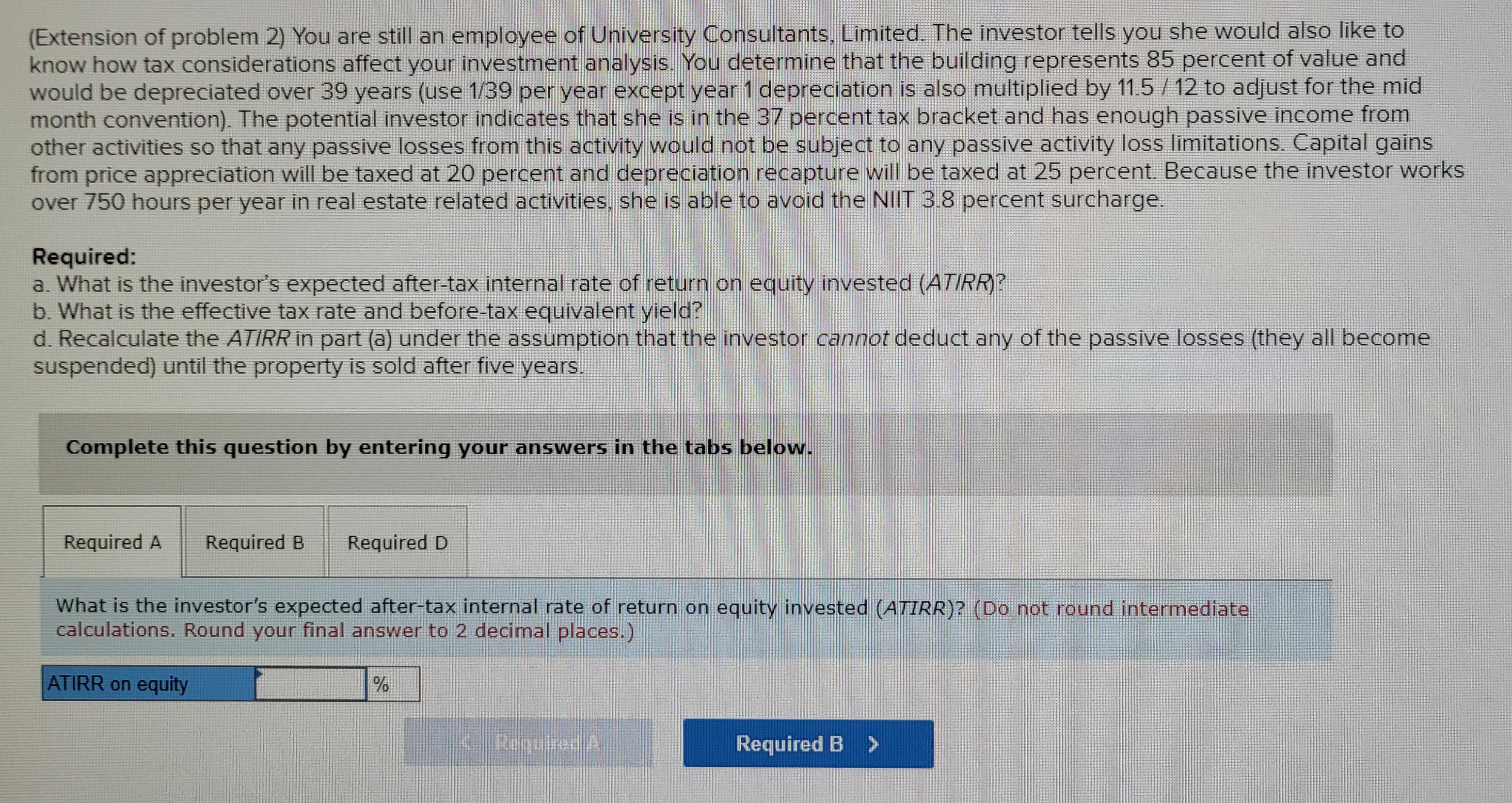

Extension of problem You are still an employee of University Consultants, Limited. The investor tells you she would also like to know how tax considerations affect your investment analysis. You determine that the building represents percent of value and would be depreciated over years use per year except year depreciation is also multiplied by to adjust for the mid month convention The potential investor indicates that she is in the percent tax bracket and has enough passive income from other activities so that any passive losses from this activity would not be subject to any passive activity loss limitations Capital gains from price appreciation will be taxed at percent and depreciation recapture will be taxed at percent. Because the investor works over hours per year in real estate related activities, she is able to avoid the NIIT percent surcharge.Required:a What is the investor's expected aftertax internal rate of return on equity invested ATIRRb What is the effective tax rate and beforetax equivalent yield?d Recalculate the ATIRR in part a under the assumption that the investor cannot deduct any of the passive losses they all become suspended until the property is sold after five years.Extension of problem You are still an employee of University Consultants, Limited. The investor tells you she would also like to

know how tax considerations affect your investment analysis. You determine that the building represents percent of value and

would be depreciated over years use per year except year depreciation is also multiplied by to adjust for the mid

month convention The potential investor indicates that she is in the percent tax bracket and has enough passive income from

other activities so that any passive losses from this activity would not be subject to any passive activity loss limitations Capital gains

from price appreciation will be taxed at percent and depreciation recapture will be taxed at percent. Because the investor works

over hours per year in real estate related activities, she is able to avoid the NIIT percent surcharge.

Required:

a What is the investor's expected aftertax internal rate of return on equity invested ATIRR

b What is the effective tax rate and beforetax equivalent yield?

d Recalculate the ATIRR in part a under the assumption that the investor cannot deduct any of the passive losses they all become

suspended until the property is sold after five years.

Complete this question by entering your answers in the tabs below.

What is the investor's expected aftertax internal rate of return on equity invested ATIRRDo not round intermediate

calculations. Round your final answer to decimal places.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started