Answered step by step

Verified Expert Solution

Question

1 Approved Answer

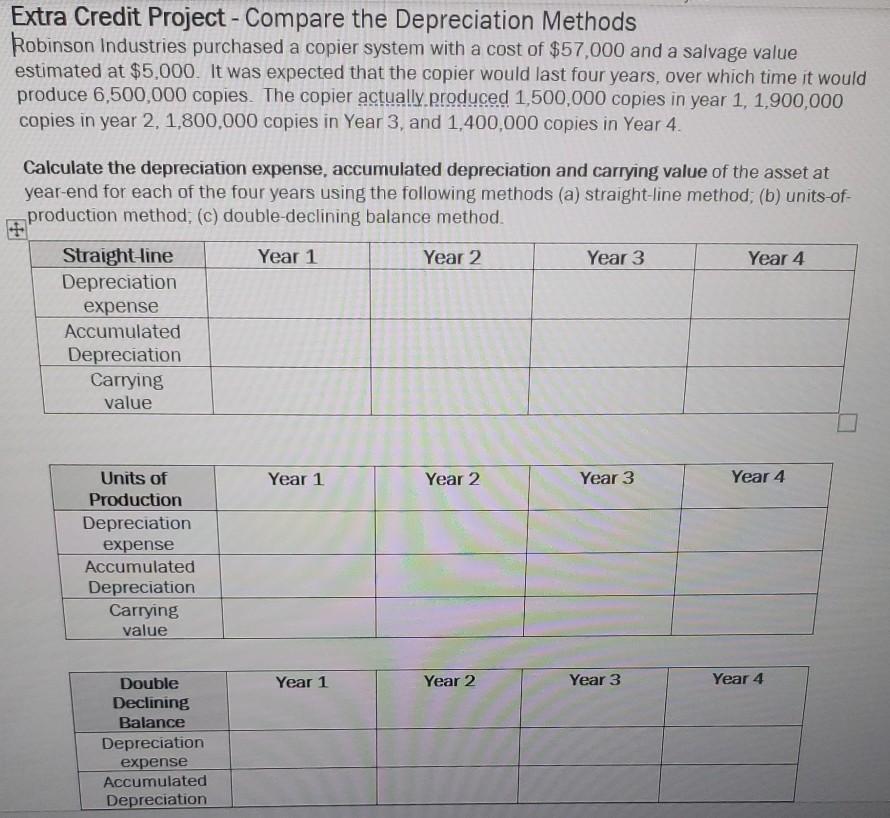

Extra Credit Project - Compare the Depreciation Methods Robinson Industries purchased a copier system with a cost of $57,000 and a salvage value estimated at

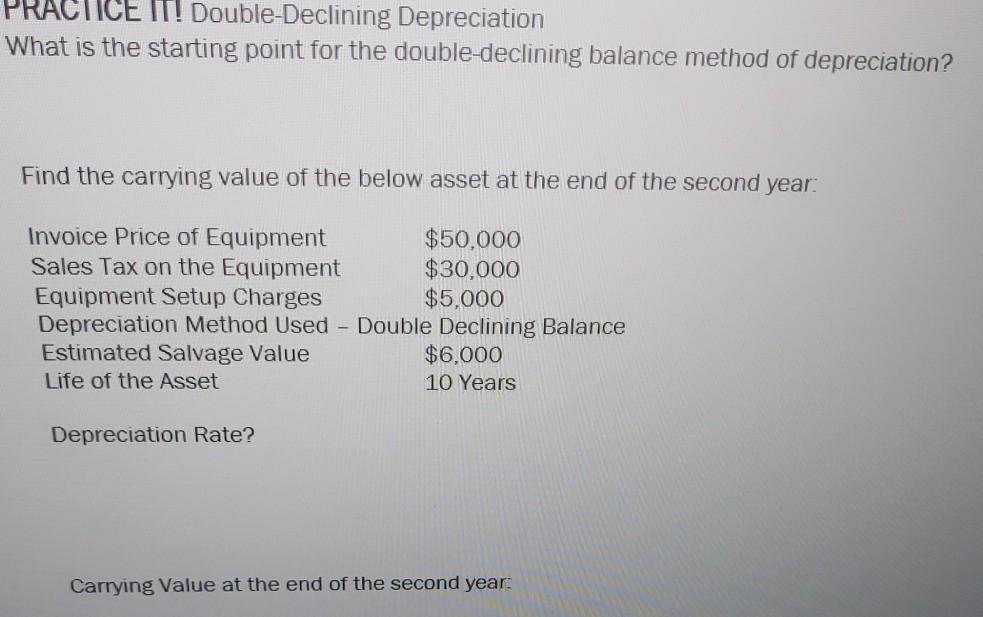

Extra Credit Project - Compare the Depreciation Methods Robinson Industries purchased a copier system with a cost of $57,000 and a salvage value estimated at $5,000. It was expected that the copier would last four years, over which time it would produce 6,500,000 copies. The copier actually produced 1,500,000 copies in year 1, 1,900,000 copies in year 2, 1,800,000 copies in Year 3, and 1,400,000 copies in Year 4. Calculate the depreciation expense, accumulated depreciation and carrying value of the asset at year-end for each of the four years using the following methods (a) straight-line method, (b) units-of- production method; (c) double-declining balance method. Year 1 Year 2 Year 3 Year 4 Straight line Depreciation expense Accumulated Depreciation Carrying value Year 1 Year 2 Year 3 Year 4 Units of Production Depreciation expense Accumulated Depreciation Carrying value Year 1 Year 2 Year 3 Year 4 Double Declining Balance Depreciation expense Accumulated Depreciation RACTICE IT! Double-Declining Depreciation What is the starting point for the double-declining balance method of depreciation? Find the carrying value of the below asset at the end of the second year. Invoice Price of Equipment $50,000 Sales Tax on the Equipment $30,000 Equipment Setup Charges $5,000 Depreciation Method Used - Double Declining Balance Estimated Salvage Value $6,000 Life of the Asset 10 Years Depreciation Rate? Carrying Value at the end of the second year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started