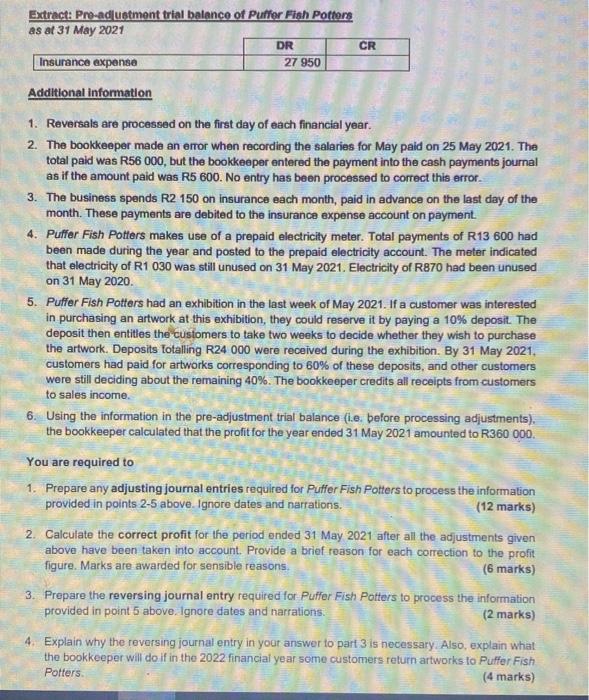

Extract: Pre-adjustment trial balance of Puffer Fish Potters as at 31 May 2021 DR CR Insurance expensa 27 950 Additional information 1. Reversals are processed on the first day of each financial year. 2. The bookkeeper made an error when recording the salaries for May paid on 25 May 2021. The total paid was R56 000, but the bookkeeper entered the payment into the cash payments journal as if the amount paid was R5 600. No entry has been processed to correct this error 3. The business spends R2 150 on insurance each month, paid in advance on the last day of the month. These payments are debited to the insurance expense account on payment 4. Puffer Fish Potters makes use of a prepaid electricity meter. Total payments of R13 600 had been made during the year and posted to the prepaid electricity account. The meter indicated that electricity of R1 030 was still unused on 31 May 2021. Electricity of R870 had been unused on 31 May 2020 5. Puffer Fish Potters had an exhibition in the last week of May 2021. If a customer was interested in purchasing an artwork at this exhibition, they could reserve it by paying a 10% deposit. The deposit then entitles the customers to take two weeks to decide whether they wish to purchase the artwork. Deposits Totalling R24 000 were received during the exhibition. By 31 May 2021. customers had paid for artworks corresponding to 60% of these deposits, and other customers were still deciding about the remaining 40%. The bookkeeper credits all receipts from customers to sales income. 6. Using the information in the pre-adjustment trial balance (i.e. before processing adjustments). the bookkeeper calculated that the profit for the year ended 31 May 2021 amounted to R360 000. You are required to 1. Prepare any adjusting journal entries required for Puffer Fish Potters to process the information provided in points 2-5 above. Ignore dates and narrations. (12 marks) 2. Calculate the correct profit for the period ended 31 May 2021 after all the adjustments given above have been taken into account. Provide a brief reason for each correction to the profit figure. Marks are awarded for sensible reasons. (6 marks) 3. Prepare the reversing journal entry required for Puffer Fish Potters to process the information provided in point 5 above. Ignore dates and narrations. (2 marks) 4. Explain why the reversing journal entry in your answer to part 3 is necessary. Also, explain what the bookkeeper will do if in the 2022 financial year some customers return artworks to Puffer Fish (4 marks) Potters Extract: Pre-adjustment trial balance of Puffer Fish Potters as at 31 May 2021 DR CR Insurance expensa 27 950 Additional information 1. Reversals are processed on the first day of each financial year. 2. The bookkeeper made an error when recording the salaries for May paid on 25 May 2021. The total paid was R56 000, but the bookkeeper entered the payment into the cash payments journal as if the amount paid was R5 600. No entry has been processed to correct this error 3. The business spends R2 150 on insurance each month, paid in advance on the last day of the month. These payments are debited to the insurance expense account on payment 4. Puffer Fish Potters makes use of a prepaid electricity meter. Total payments of R13 600 had been made during the year and posted to the prepaid electricity account. The meter indicated that electricity of R1 030 was still unused on 31 May 2021. Electricity of R870 had been unused on 31 May 2020 5. Puffer Fish Potters had an exhibition in the last week of May 2021. If a customer was interested in purchasing an artwork at this exhibition, they could reserve it by paying a 10% deposit. The deposit then entitles the customers to take two weeks to decide whether they wish to purchase the artwork. Deposits Totalling R24 000 were received during the exhibition. By 31 May 2021. customers had paid for artworks corresponding to 60% of these deposits, and other customers were still deciding about the remaining 40%. The bookkeeper credits all receipts from customers to sales income. 6. Using the information in the pre-adjustment trial balance (i.e. before processing adjustments). the bookkeeper calculated that the profit for the year ended 31 May 2021 amounted to R360 000. You are required to 1. Prepare any adjusting journal entries required for Puffer Fish Potters to process the information provided in points 2-5 above. Ignore dates and narrations. (12 marks) 2. Calculate the correct profit for the period ended 31 May 2021 after all the adjustments given above have been taken into account. Provide a brief reason for each correction to the profit figure. Marks are awarded for sensible reasons. (6 marks) 3. Prepare the reversing journal entry required for Puffer Fish Potters to process the information provided in point 5 above. Ignore dates and narrations. (2 marks) 4. Explain why the reversing journal entry in your answer to part 3 is necessary. Also, explain what the bookkeeper will do if in the 2022 financial year some customers return artworks to Puffer Fish (4 marks) Potters