Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Extreme Clean Ltd (hereafter Extreme Clean) is a manufacturing company that specialises in manufacturing cleaning supplies and equipment Extreme Clean has a 31 March financial

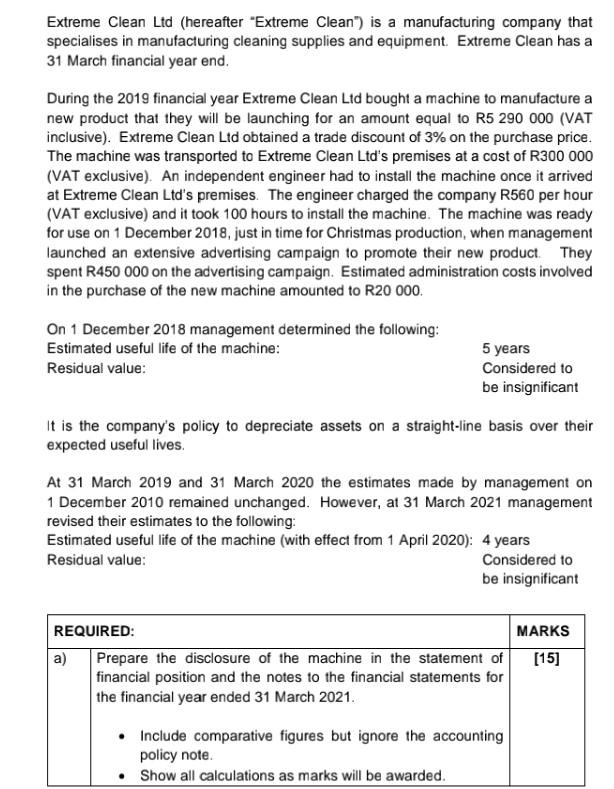

Extreme Clean Ltd (hereafter "Extreme Clean") is a manufacturing company that specialises in manufacturing cleaning supplies and equipment Extreme Clean has a 31 March financial year end. During the 2019 financial year Extreme Clean Lid bought a machine to manufacture a new product that they will be launching for an amount equal to R5 290 000 (VAT inclusive). Extreme Clean Lid obtained a trade discount of 3% on the purchase price. The machine was transported to Extreme Clean Ltd's premises at a cost of R300 000 (VAT exclusive). An independent engineer had to install the machine once it arrived at Extreme Clean Ltd's premises. The engineer charged the company R560 per hour (VAT exclusive) and it took 100 hours to install the machine. The machine was ready for use on 1 December 2018, just in time for Christmas production, when management launched an extensive advertising campaign to promote their new product. They spent R450 000 on the advertising campaign. Estimated administration costs involved in the purchase of the new machine amounted to R20 000 On 1 December 2018 management determined the following: Estimated useful life of the machine: Residual value: 5 years Considered to be insignificant It is the company's policy to depreciate assets on a straight-line basis over their expected useful lives. At 31 March 2019 and 31 March 2020 the estimates made by management on 1 December 2010 remained unchanged. However, at 31 March 2021 management revised their estimates to the following: Estimated useful life of the machine (with effect from 1 April 2020): 4 years Residual value: Considered to be insignificant REQUIRED: a) Prepare the disclosure of the machine in the statement of financial position and the notes to the financial statements for the financial year ended 31 March 2021. MARKS [15] Include comparative figures but ignore the accounting policy note. Show all calculations as marks will be awarded. Extreme Clean Ltd (hereafter "Extreme Clean") is a manufacturing company that specialises in manufacturing cleaning supplies and equipment Extreme Clean has a 31 March financial year end. During the 2019 financial year Extreme Clean Lid bought a machine to manufacture a new product that they will be launching for an amount equal to R5 290 000 (VAT inclusive). Extreme Clean Lid obtained a trade discount of 3% on the purchase price. The machine was transported to Extreme Clean Ltd's premises at a cost of R300 000 (VAT exclusive). An independent engineer had to install the machine once it arrived at Extreme Clean Ltd's premises. The engineer charged the company R560 per hour (VAT exclusive) and it took 100 hours to install the machine. The machine was ready for use on 1 December 2018, just in time for Christmas production, when management launched an extensive advertising campaign to promote their new product. They spent R450 000 on the advertising campaign. Estimated administration costs involved in the purchase of the new machine amounted to R20 000 On 1 December 2018 management determined the following: Estimated useful life of the machine: Residual value: 5 years Considered to be insignificant It is the company's policy to depreciate assets on a straight-line basis over their expected useful lives. At 31 March 2019 and 31 March 2020 the estimates made by management on 1 December 2010 remained unchanged. However, at 31 March 2021 management revised their estimates to the following: Estimated useful life of the machine (with effect from 1 April 2020): 4 years Residual value: Considered to be insignificant REQUIRED: a) Prepare the disclosure of the machine in the statement of financial position and the notes to the financial statements for the financial year ended 31 March 2021. MARKS [15] Include comparative figures but ignore the accounting policy note. Show all calculations as marks will be awarded

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started