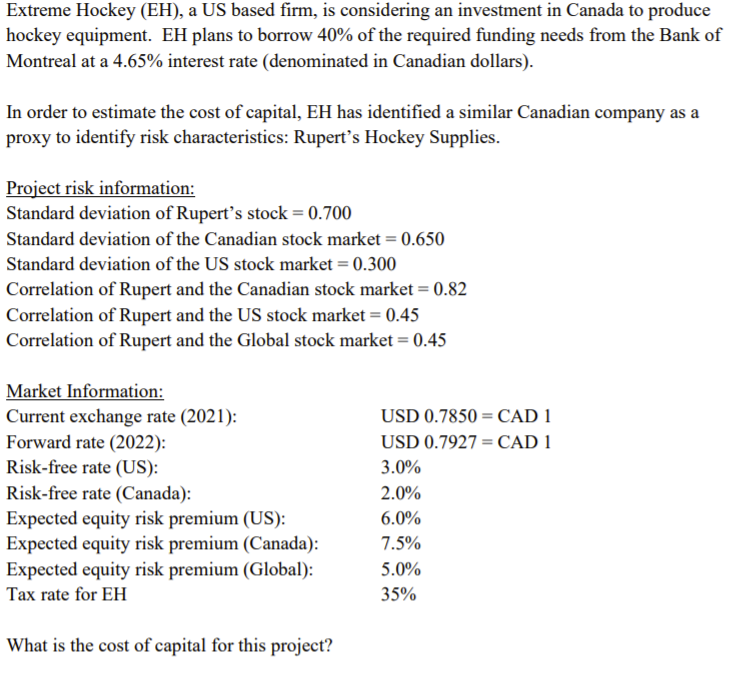

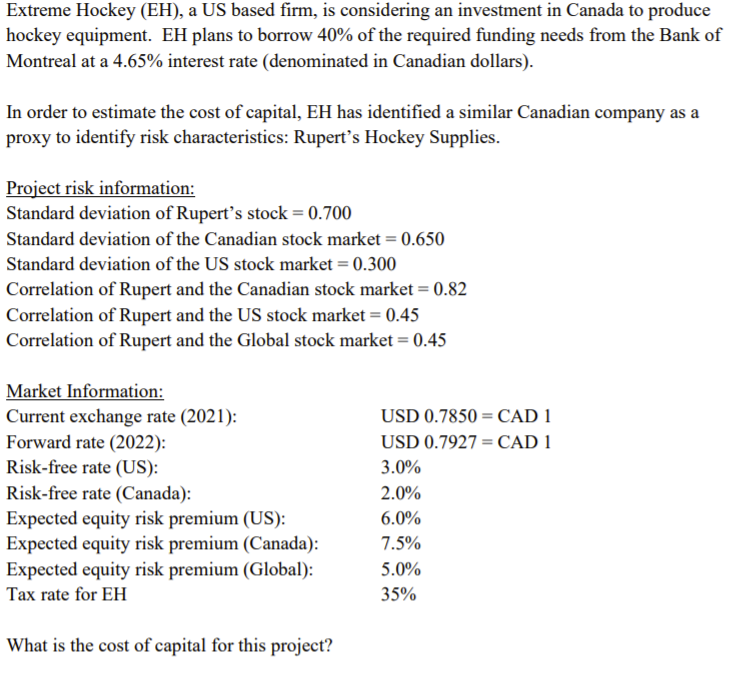

Extreme Hockey (EH), a US based firm, is considering an investment in Canada to produce hockey equipment. EH plans to borrow 40% of the required funding needs from the Bank of Montreal at a 4.65% interest rate (denominated in Canadian dollars). In order to estimate the cost of capital, EH has identified a similar Canadian company as a proxy to identify risk characteristics: Rupert's Hockey Supplies. Project risk information: Standard deviation of Rupert's stock = 0.700 Standard deviation of the Canadian stock market = 0.650 Standard deviation of the US stock market = 0.300 Correlation of Rupert and the Canadian stock market = 0.82 Correlation of Rupert and the US stock market = 0.45 Correlation of Rupert and the Global stock market = 0.45 Market Information: Current exchange rate (2021): Forward rate (2022): Risk-free rate (US): Risk-free rate (Canada): Expected equity risk premium (US): Expected equity risk premium (Canada): Expected equity risk premium (Global): Tax rate for EH USD 0.7850 = CAD 1 USD 0.7927 = CAD 1 3.0% 2.0% 6.0% 7.5% 5.0% 35% What is the cost of capital for this project? Extreme Hockey (EH), a US based firm, is considering an investment in Canada to produce hockey equipment. EH plans to borrow 40% of the required funding needs from the Bank of Montreal at a 4.65% interest rate (denominated in Canadian dollars). In order to estimate the cost of capital, EH has identified a similar Canadian company as a proxy to identify risk characteristics: Rupert's Hockey Supplies. Project risk information: Standard deviation of Rupert's stock = 0.700 Standard deviation of the Canadian stock market = 0.650 Standard deviation of the US stock market = 0.300 Correlation of Rupert and the Canadian stock market = 0.82 Correlation of Rupert and the US stock market = 0.45 Correlation of Rupert and the Global stock market = 0.45 Market Information: Current exchange rate (2021): Forward rate (2022): Risk-free rate (US): Risk-free rate (Canada): Expected equity risk premium (US): Expected equity risk premium (Canada): Expected equity risk premium (Global): Tax rate for EH USD 0.7850 = CAD 1 USD 0.7927 = CAD 1 3.0% 2.0% 6.0% 7.5% 5.0% 35% What is the cost of capital for this project