Answered step by step

Verified Expert Solution

Question

1 Approved Answer

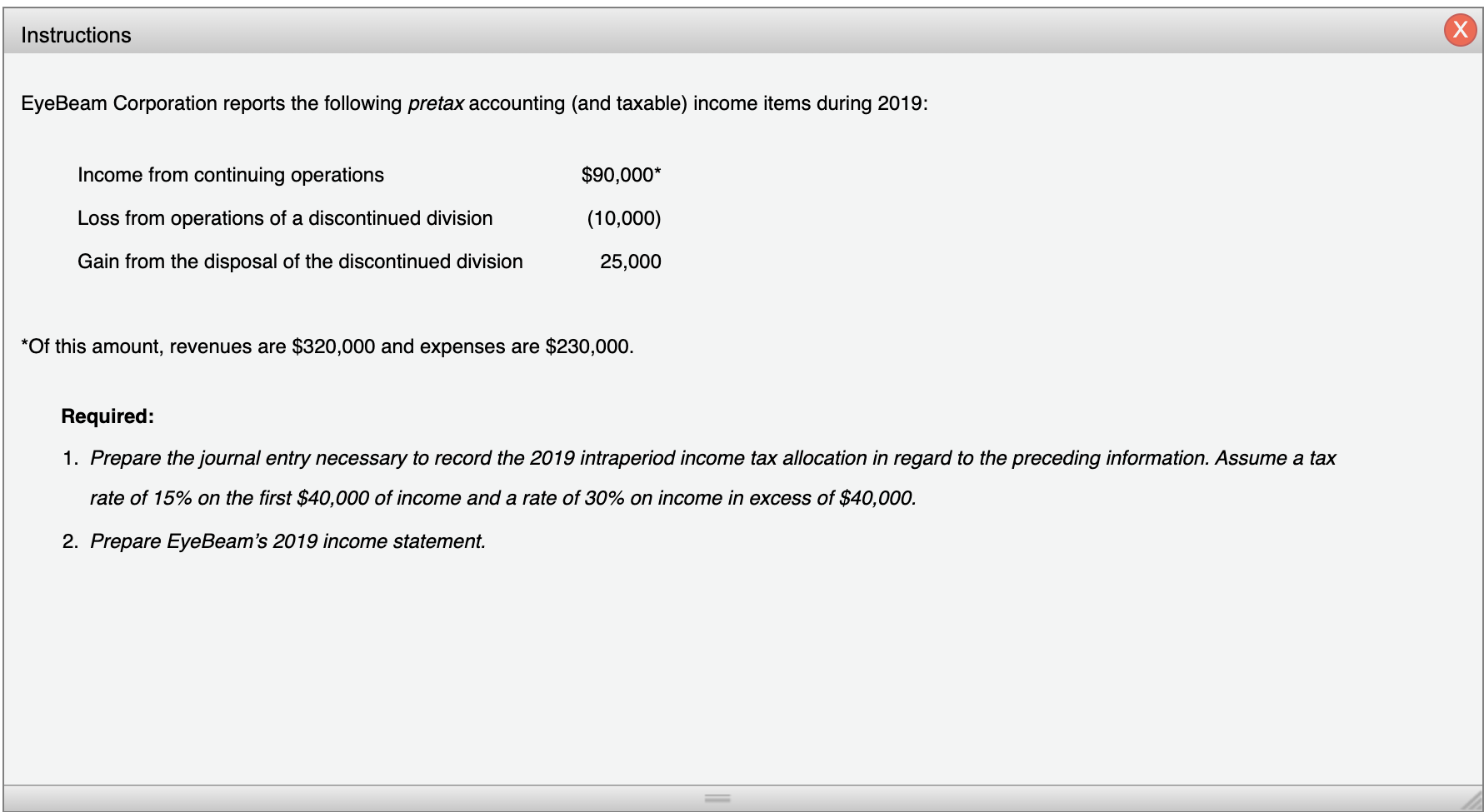

EyeBeam Corporation reports the following pretax accounting (and taxable) income items during 2019: *Of this amount, revenues are $320,000 and expenses are $230,000. Required: 1.

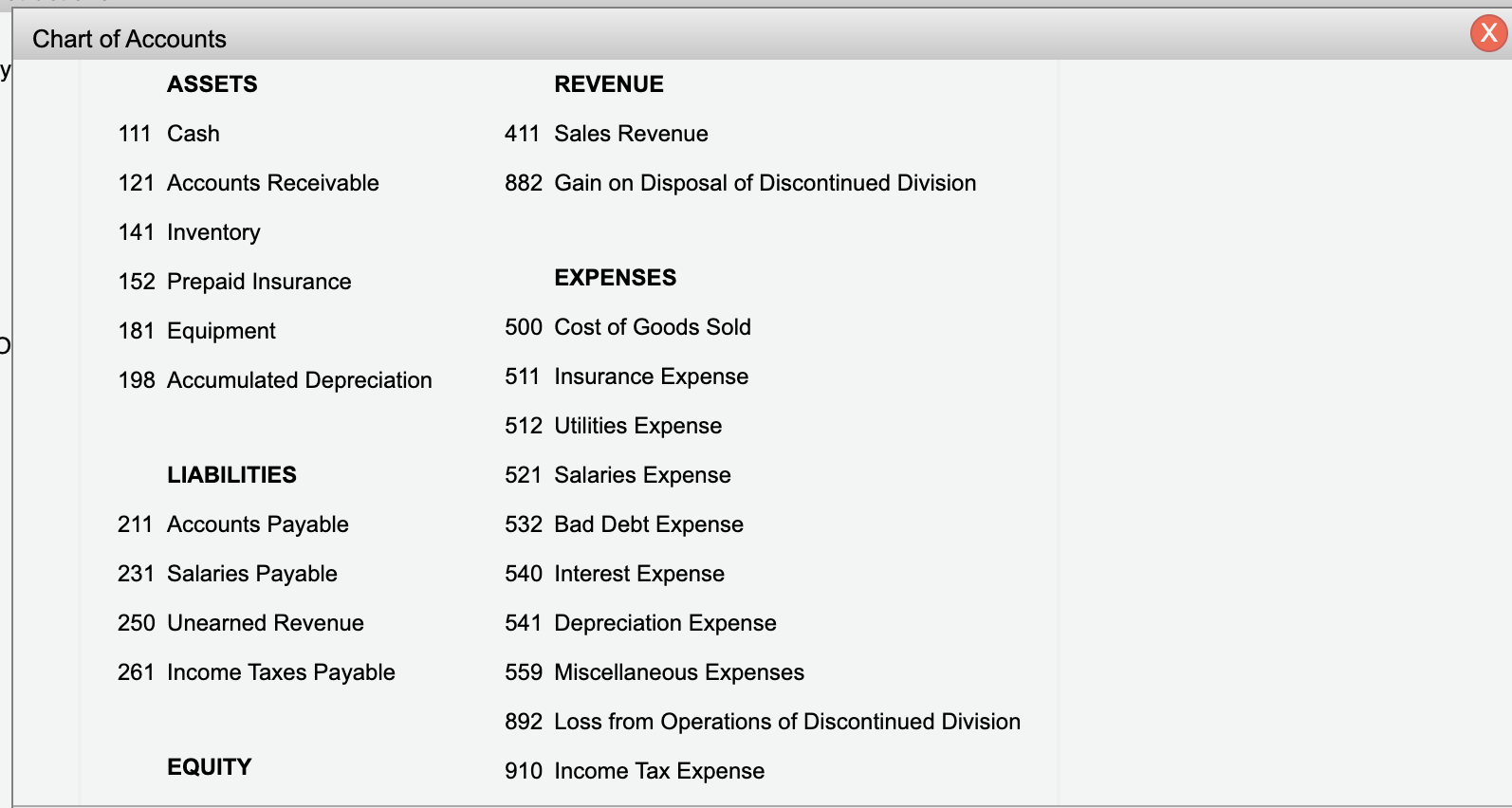

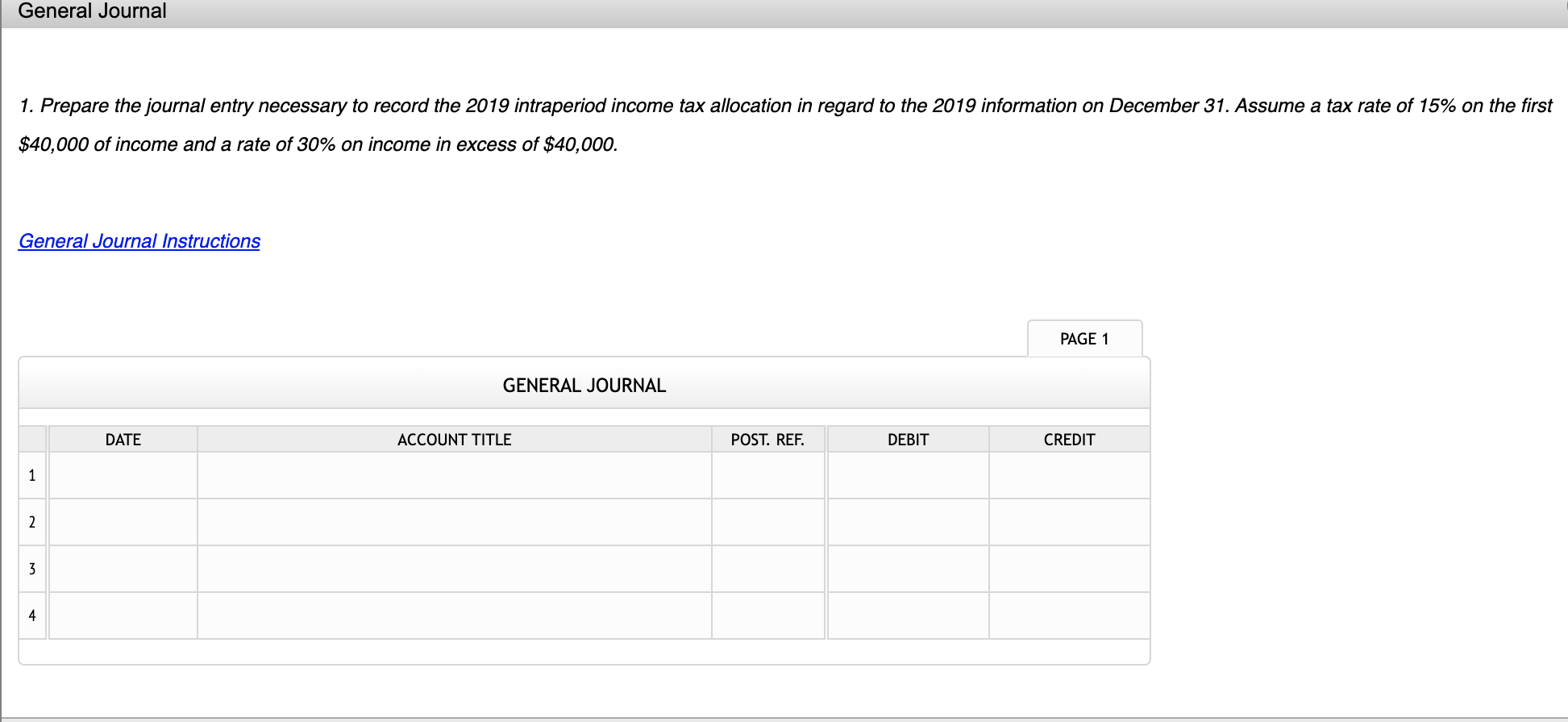

EyeBeam Corporation reports the following pretax accounting (and taxable) income items during 2019: *Of this amount, revenues are $320,000 and expenses are $230,000. Required: 1. Prepare the journal entry necessary to record the 2019 intraperiod income tax allocation in regard to the preceding information. Assume a tax rate of 15% on the first $40,000 of income and a rate of 30% on income in excess of $40,000. 2. Prepare EyeBeam's 2019 income statement. Chart of Accounts ASSETS REVENUE 111 Cash 411 Sales Revenue 121 Accounts Receivable 882 Gain on Disposal of Discontinued Division 141 Inventory 152 Prepaid Insurance EXPENSES 181 Equipment 500 Cost of Goods Sold 198 Accumulated Depreciation 511 Insurance Expense 512 Utilities Expense LIABILITIES 521 Salaries Expense 211 Accounts Payable 532 Bad Debt Expense 231 Salaries Payable 540 Interest Expense 250 Unearned Revenue 541 Depreciation Expense 261 Income Taxes Payable 559 Miscellaneous Expenses 892 Loss from Operations of Discontinued Division EQUITY 910 Income Tax Expense 1. Prepare the journal entry necessary to record the 2019 intraperiod income tax allocation in regard to the 2019 information on December 31 . Assume a tax rate of 15% on the first $40,000 of income and a rate of 30% on income in excess of $40,000. Income Statement EYEBEAM CORPORATION Income Statement For Year Ended December 31, 2019 1 2 3 4 5 6 (Label) 7 8 9 10

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started