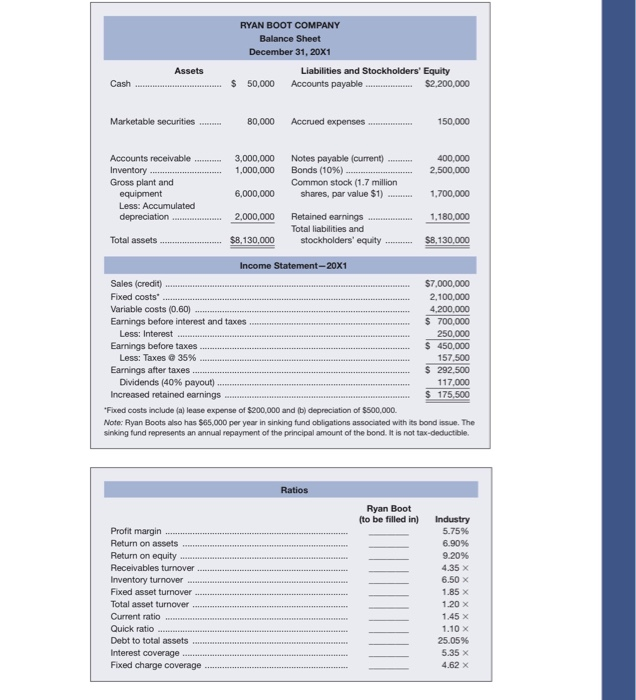

f. Do not calculate-only comment on these questions. How would required new funds change if the company (1) Were at full capacity? (2) Raised the dividend payout ratio? (3) Suffered a decreased growth in sales? (4) Faced an accelerated inflation rate? Ryan Boot Company is trying to plan the funds needed for 20X2. The management anticipates an increase in sales of 20 percent, which can be absorbed without increas- ing fixed assets. d. What would be Ryan's needs for external funds based on the current balance sheet? Compute RNF (required new funds). Notes payable (current) and bonds are not part of the liability calculation. e. What would be the required new funds if the company brings its ratios into line with the industry average during 20X2? Specifically examine receivables turn- over, inventory turnover, and the profit margin. Use the new values to recompute the factors in RNF (assume liabilities stay the same). RYAN BOOT COMPANY Balance Sheet December 31, 20X1 Liabilities and Stockholders' Equity $ 50,000 Accounts payable.... $2,200,000 Assets Cash Marketable securities.... 80,000 Accrued expenses 150,000 3,000,000 1,000,000 400,000 2,500,000 Accounts receivable Inventory Gross plant and equipment Less: Accumulated depreciation 6,000,000 Notes payable (current) ... Bonds (10%) Common stock (1.7 million shares, par value $1) .......... Retained earnings Total liabilities and stockholders' equity 1,700,000 2,000,000 1,180,000 Total assets $8,130,000 $8,130,000 Income Statement-20X1 Sales (credit) $7,000,000 Fixed costs 2,100,000 Variable costs (0.60) 4,200,000 Earnings before interest and taxes $ 700.000 Less: Interest 250,000 Earnings before taxes $ 450,000 Less: Taxes @ 35% 157.500 Earnings after taxes $ 292,500 Dividends (40% payout) 117.000 Increased retained earnings $ 175,500 'Fixed costs include (a) lease expense of $200,000 and (b) depreciation of $500,000. Note: Ryan Boots also has $65,000 per year in sinking fund obligations associated with its bond issue. The sinking fund represents an annual repayment of the principal amount of the bond. It is not tax-deductible Ratios Ryan Boot (to be filled in) Profit margin Return on assets Return on equity Receivables turnover Inventory turnover Fixed asset turnover Total asset turnover Current ratio Quick ratio Debt to total assets Interest coverage Fixed charge coverage Industry 5.75% 6.90% 9.20% 4.35 x 6.50 x 1.85 x 1.20 x 1.45 X 1.10 X 25.05% 5.35 x 4.62 x