Answered step by step

Verified Expert Solution

Question

1 Approved Answer

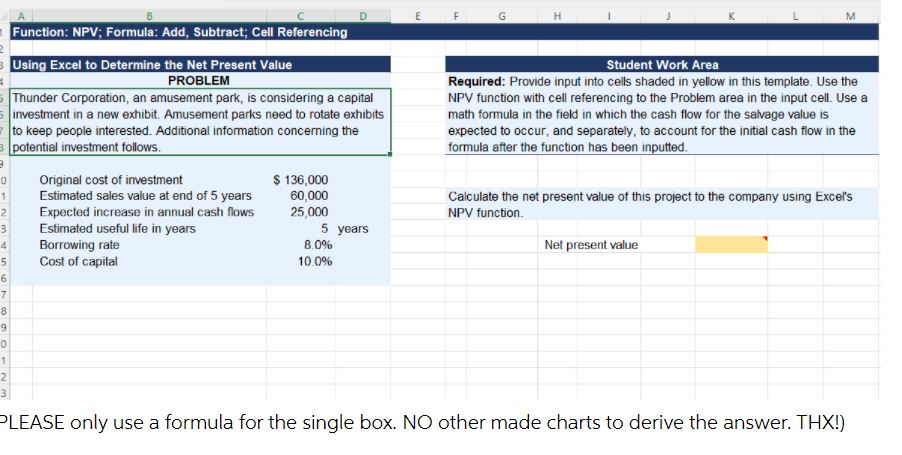

F H Function: NPV; Formula: Add, Subtract; Cell Referencing # Using Excel to Determine the Net Present Value PROBLEM Thunder Corporation, an amusement park,

F H Function: NPV; Formula: Add, Subtract; Cell Referencing # Using Excel to Determine the Net Present Value PROBLEM Thunder Corporation, an amusement park, is considering a capital 5 investment in a new exhibit. Amusement parks need to rotate exhibits to keep people interested. Additional information concerning the potential investment follows. Student Work Area Required: Provide input into cells shaded in yellow in this template. Use the NPV function with cell referencing to the Problem area in the input cell. Use a math formula in the field in which the cash flow for the salvage value is expected to occur, and separately, to account for the initial cash flow in the formula after the function has been inputted. 9 0 Original cost of investment $136,000 1 Estimated sales value at end of 5 years 60,000 2 Expected increase in annual cash flows 25,000 3 Estimated useful life in years Borrowing rate 5 Cost of capital 5 years 8.0% 10.0% 6 7 8 9 0 1 2 Calculate the net present value of this project to the company using Excel's NPV function. Net present value PLEASE only use a formula for the single box. NO other made charts to derive the answer. THX!)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started