Answered step by step

Verified Expert Solution

Question

1 Approved Answer

F On October 23 , the closing exchange rate of British pounds was ( $ 1.70 ). Calls that would mature the following January with

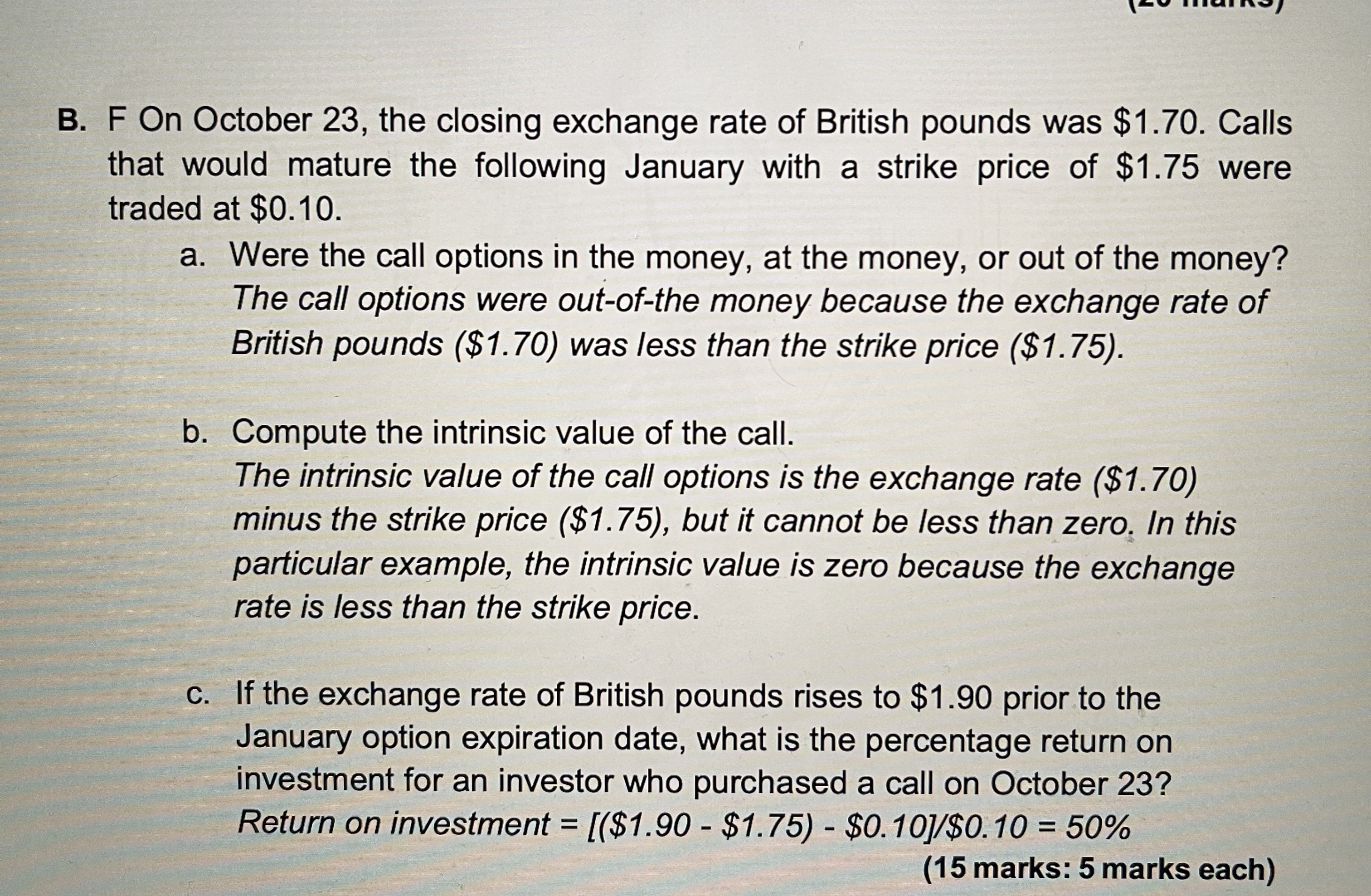

F On October 23 , the closing exchange rate of British pounds was \\( \\$ 1.70 \\). Calls that would mature the following January with a strike price of \\( \\$ 1.75 \\) were traded at \\( \\$ 0.10 \\). a. Were the call options in the money, at the money, or out of the money? The call options were out-of-the money because the exchange rate of British pounds (\\$1.70) was less than the strike price (\\$1.75). b. Compute the intrinsic value of the call. The intrinsic value of the call options is the exchange rate (\\$1.70) minus the strike price (\\$1.75), but it cannot be less than zero. In this particular example, the intrinsic value is zero because the exchange rate is less than the strike price. c. If the exchange rate of British pounds rises to \\( \\$ 1.90 \\) prior to the January option expiration date, what is the percentage return on investment for an investor who purchased a call on October 23? Return on investment \\( =[(\\$ 1.90-\\$ 1.75)-\\$ 0.10] / \\$ 0.10=50 \\% \\) (15 marks: 5 marks each)

F On October 23 , the closing exchange rate of British pounds was \\( \\$ 1.70 \\). Calls that would mature the following January with a strike price of \\( \\$ 1.75 \\) were traded at \\( \\$ 0.10 \\). a. Were the call options in the money, at the money, or out of the money? The call options were out-of-the money because the exchange rate of British pounds (\\$1.70) was less than the strike price (\\$1.75). b. Compute the intrinsic value of the call. The intrinsic value of the call options is the exchange rate (\\$1.70) minus the strike price (\\$1.75), but it cannot be less than zero. In this particular example, the intrinsic value is zero because the exchange rate is less than the strike price. c. If the exchange rate of British pounds rises to \\( \\$ 1.90 \\) prior to the January option expiration date, what is the percentage return on investment for an investor who purchased a call on October 23? Return on investment \\( =[(\\$ 1.90-\\$ 1.75)-\\$ 0.10] / \\$ 0.10=50 \\% \\) (15 marks: 5 marks each) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started