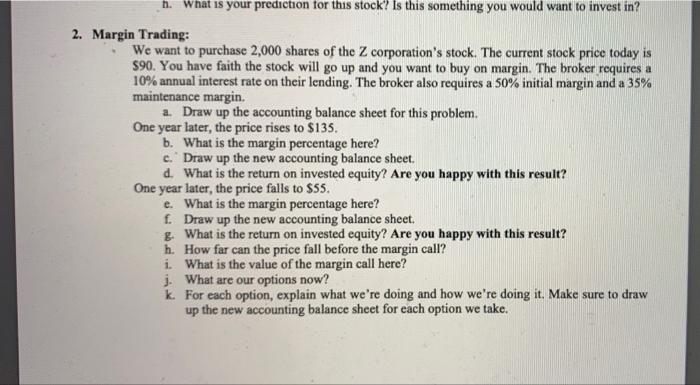

f. What is your prediction for this stock? Is this something you would want to invest in? 2. Margin Trading: We want to purchase 2,000 shares of the Z corporation's stock. The current stock price today is $90. You have faith the stock will go up and you want to buy on margin. The broker requires a 10% annual interest rate on their lending. The broker also requires a 50% initial margin and a 35% maintenance margin. a. Draw up the accounting balance sheet for this problem. One year later, the price rises to $135. b. What is the margin percentage here? c. Draw up the new accounting balance sheet. d. What is the return on invested equity? Are you happy with this result? One year later, the price falls to $55. e. What is the margin percentage here? f. Draw up the new accounting balance sheet. g. What is the return on invested equity? Are you happy with this result? h. How far can the price fall before the margin call? i. What is the value of the margin call here? j. What are our options now? k. For each option, explain what we're doing and how we're doing it. Make sure to draw up the new accounting balance sheet for each option we take. f. What is your prediction for this stock? Is this something you would want to invest in? 2. Margin Trading: We want to purchase 2,000 shares of the Z corporation's stock. The current stock price today is $90. You have faith the stock will go up and you want to buy on margin. The broker requires a 10% annual interest rate on their lending. The broker also requires a 50% initial margin and a 35% maintenance margin. a. Draw up the accounting balance sheet for this problem. One year later, the price rises to $135. b. What is the margin percentage here? c. Draw up the new accounting balance sheet. d. What is the return on invested equity? Are you happy with this result? One year later, the price falls to $55. e. What is the margin percentage here? f. Draw up the new accounting balance sheet. g. What is the return on invested equity? Are you happy with this result? h. How far can the price fall before the margin call? i. What is the value of the margin call here? j. What are our options now? k. For each option, explain what we're doing and how we're doing it. Make sure to draw up the new accounting balance sheet for each option we take