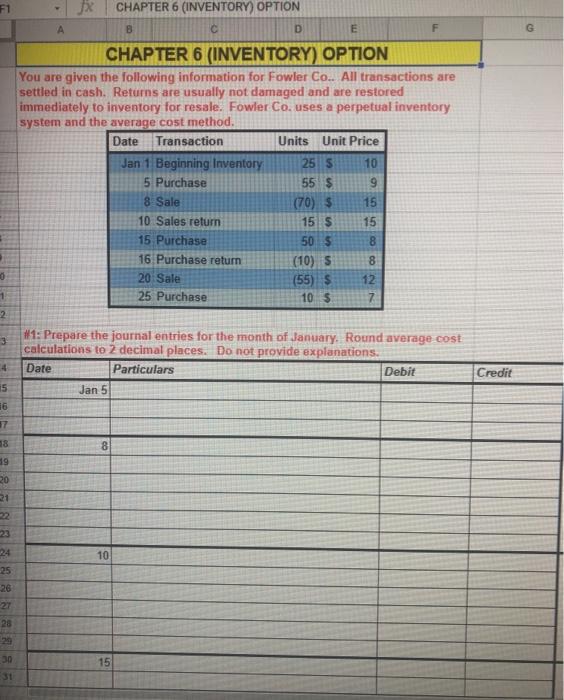

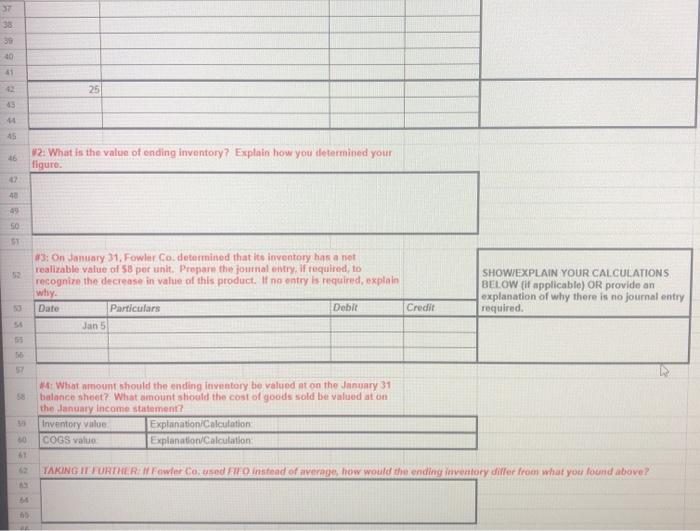

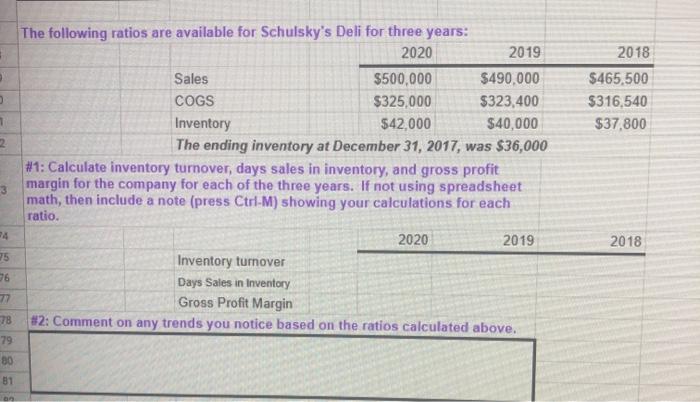

F1 FX CHAPTER 6 (INVENTORY) OPTION D E G CHAPTER 6 (INVENTORY) OPTION You are given the following information for Fowler Co. All transactions are settled in cash. Returns are usually not damaged and are restored immediately to inventory for resale. Fowler Co. uses a perpetual inventory system and the average cost method. Date Transaction Units Unit Price Jan 1 Beginning Inventory 25 S 10 5 Purchase 55 $ 9 8 Sale (70) $ 15 10 Sales return 15 s 15 15 Purchase 50 $ 8 16 Purchase return (10) S 8 20 Sale (55) 5 12 25 Purchase 10 $ 7 0 1 2 3 #1: Prepare the journal entries for the month of January. Round average cost calculations to 2 decimal places. Do not provide explanations. Date Particulars Debit Jan 50 4 Credit 15 16 18 8 19 20 21 10 24 25 26 28 20 30 15 31 35 50 40 43 25 13 4 45 16 2. What is the value of ending inventory? Explain how you determined your figure. 2 $3: On January 31. Fowler Cor determined that its inventory has a net realizable value of 58 per unit. Propare the journal entry, if required to recognize the decrease in value of this product. If no ontry is required, explain why. Date Particulars Debit Credit Jan 5 SHOW/EXPLAIN YOUR CALCULATIONS BELOW (if applicable) OR provide an explanation of why there is no journal entry required What amount should the ending Inventory be valued at on the January 31 balance sheet? What amount should the cost of goods sold be valued at on the January Income statement? Inventory value Explanation Calculation COGS value Explanation Calculation 5315 TAKING IT FURTHER Fowler Cosed FIFO instead of average how would the ending inventory differ from what you found above? 2018 $465,500 $316,540 $37,800 1 2 The following ratios are available for Schulsky's Deli for three years: 2020 2019 Sales $500,000 $490,000 COGS $325,000 $323,400 Inventory $42.000 $40,000 The ending inventory at December 31, 2017, was $36,000 #1: Calculate inventory turnover, days sales in inventory, and gross profit margin for the company for each of the three years. If not using spreadsheet math, then include a note (press Ctrl-M) showing your calculations for each ratio. 2020 2019 Inventory turnover Days Sales in Inventory Gross Profit Margin #2: Comment on any trends you notice based on the ratios calculated above. 3 24 2018 75 26 78 79 80 B1