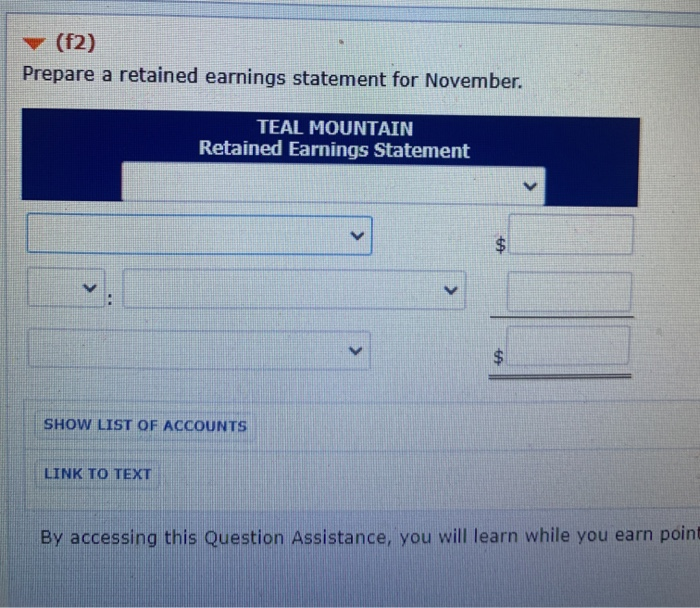

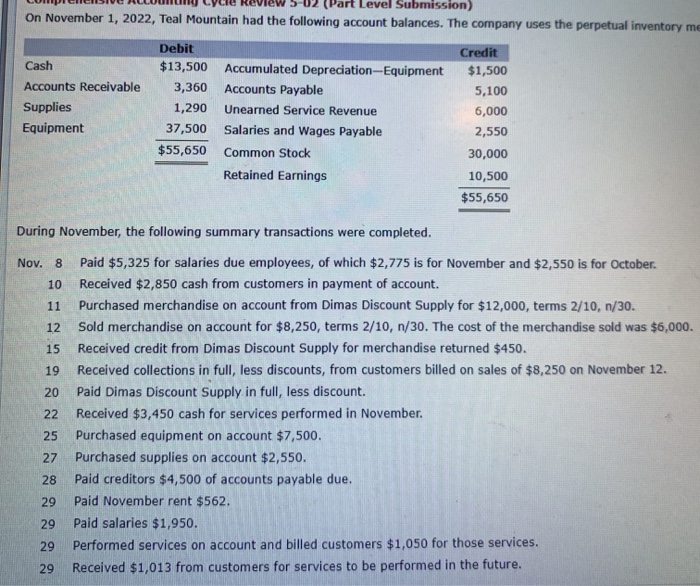

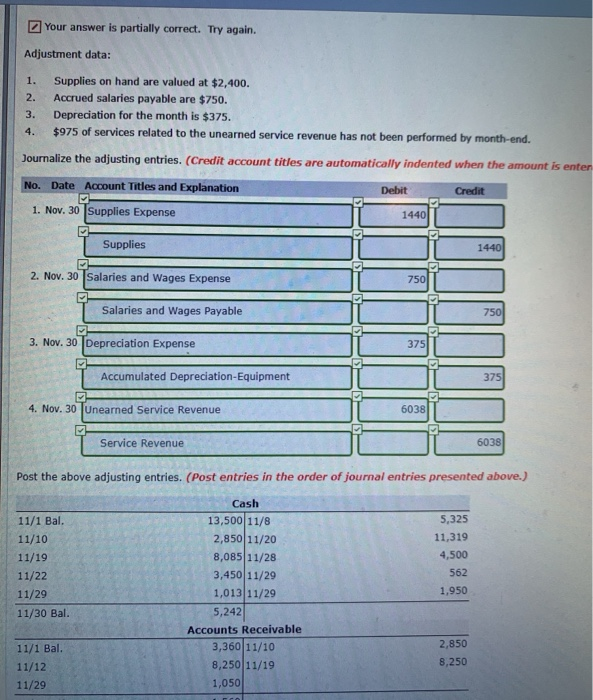

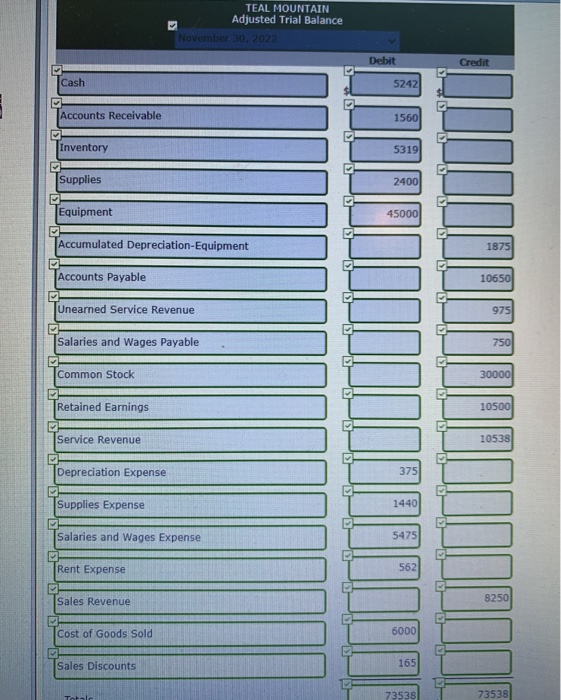

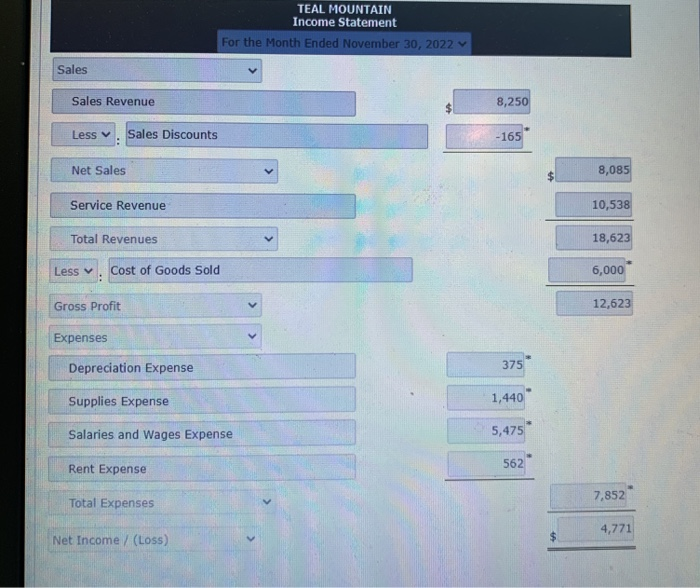

(f2) Prepare a retained earnings statement for November. TEAL MOUNTAIN Retained Earnings Statement $ V $ SHOW LIST OF ACCOUNTS LINK TO TEXT By accessing this Question Assistance, you will learn while you earn point (Part Level Submission) On November 1, 2022, Teal Mountain had the following account balances. The company uses the perpetual inventory me Cash Accounts Receivable Supplies Equipment Debit $13,500 3,360 1,290 37,500 $55,650 Accumulated Depreciation-Equipment Accounts Payable Unearned Service Revenue Salaries and Wages Payable Common Stock Retained Earnings Credit $1,500 5,100 6,000 2,550 30,000 10,500 $55,650 11 During November, the following summary transactions were completed. Nov. 8 Paid $5,325 for salaries due employees, of which $2,775 is for November and $2,550 is for October. 10 Received $2,850 cash from customers in payment of account. Purchased merchandise on account from Dimas Discount Supply for $12,000, terms 2/10, n/30. 12 Sold merchandise on account for $8,250, terms 2/10, n/30. The cost of the merchandise sold was $6,000. 15 Received credit from Dimas Discount Supply for merchandise returned $450. 19 Received collections in full, less discounts, from customers billed on sales of $8,250 on November 12. 20 Paid Dimas Discount Supply in full, less discount. 22 Received $3,450 cash for services performed in November. 25 Purchased equipment on account $7,500. 27 Purchased supplies on account $2,550. 28 Paid creditors $4,500 of accounts payable due. 29 Paid November rent $562. 29 Paid salaries $1,950. 29 Performed services on account and billed customers $1,050 for those services. 29 Received $1,013 from customers for services to be performed in the future. Your answer is partially correct. Try again. Adjustment data: 1. 2. 3. 4. Supplies on hand are valued at $2,400. Accrued salaries payable are $750. Depreciation for the month is $375. $975 of services related to the unearned service revenue has not been performed by month-end. Journalize the adjusting entries. (Credit account titles are automatically indented when the amount is enter No. Date Account Titles and Explanation Debit Credit 1. Nov. 30 Supplies Expense 1440 Supplies 1440 2. Nov. 30 Salaries and Wages Expense 7501 Salaries and Wages Payable 750 3. Nov. 30 Depreciation Expense 3751 Accumulated Depreciation-Equipment 375 4. Nov. 30 Unearned Service Revenue 6038 Service Revenue 6038 Post the above adjusting entries. (Post entries in the order of journal entries presented above.) 11/1 Bal. 11/10 11/19 11/22 11/29 11/30 Bal. Cash 13,500 11/8 2,850 11/20 8,085 11/28 3,450 11/29 1,013 11/29 5,242 Accounts Receivable 3,360 11/10 8,250 11/19 1,050 5,325 11,319 4,500 562 1,950 11/1 Ball 11/12 11/29 2,850 8,250 TEAL MOUNTAIN Adjusted Trial Balance November 0202 Debit Credit Cash 5242 Accounts Receivable 1560 Inventory 5319 Supplies 2400 Equipment 45000 Accumulated Depreciation-Equipment 1875 Accounts Payable 10650 Unearned Service Revenue 975 Salaries and Wages Payable 750 Common Stock 30000 Retained Earnings 10500 Service Revenue 10538 Depreciation Expense 375 Supplies Expense 1440 Salaries and Wages Expense 5475 E Rent Expense 562 Sales Revenue 8250 Cost of Goods Sold 6000 Sales Discounts 165 Total 73538 73538 TEAL MOUNTAIN Income Statement For the Month Ended November 30, 2022 Sales Sales Revenue 8,250 Less Sales Discounts -165 Net Sales 8,085 Service Revenue 10,538 Total Revenues 18,623 Less Cost of Goods Sold 6,000 Gross Profit 12,623 Expenses Depreciation Expense 375 Supplies Expense 1,440 Salaries and Wages Expense 5,475 562 Rent Expense Total Expenses 7,852 4,771 Net Income (Loss)