Answered step by step

Verified Expert Solution

Question

1 Approved Answer

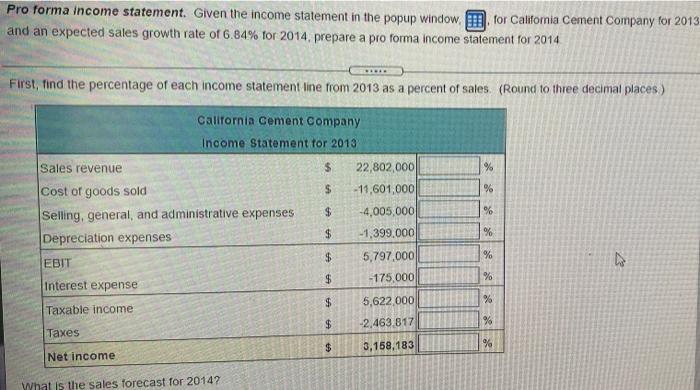

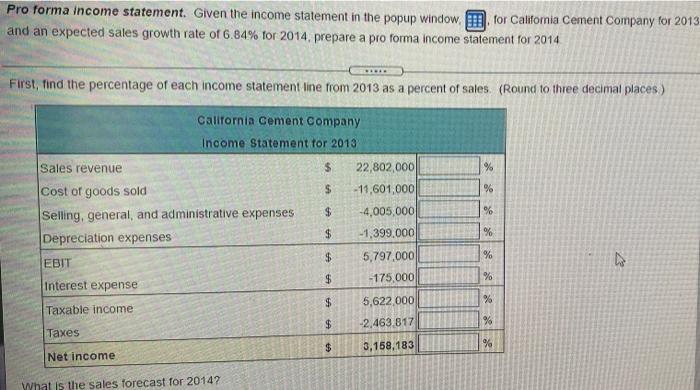

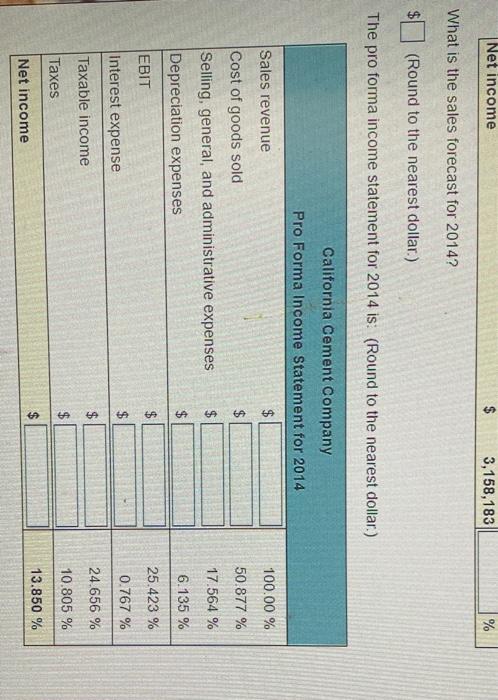

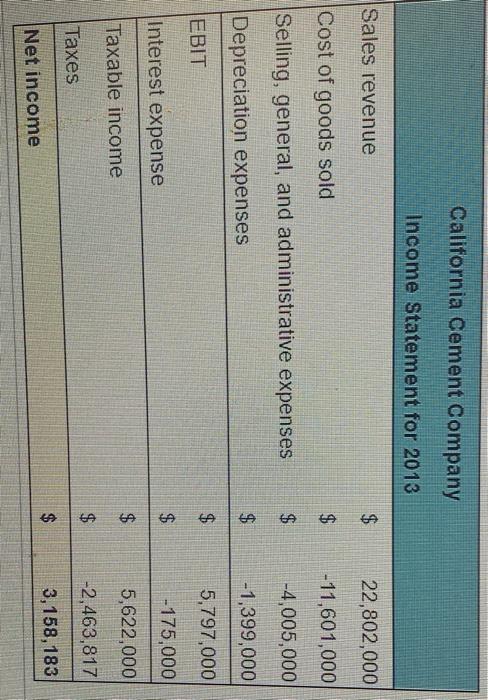

F-23 Pro forma income statement. Given the income statement in the popup window, for California Cement Company for 2013 and an expected sales growth rate

F-23

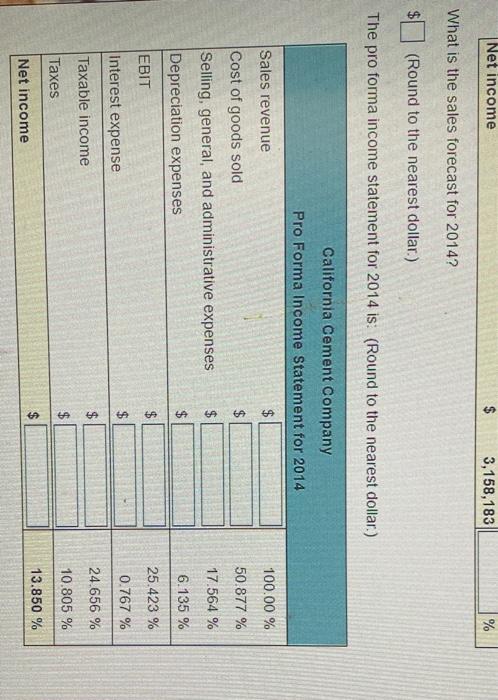

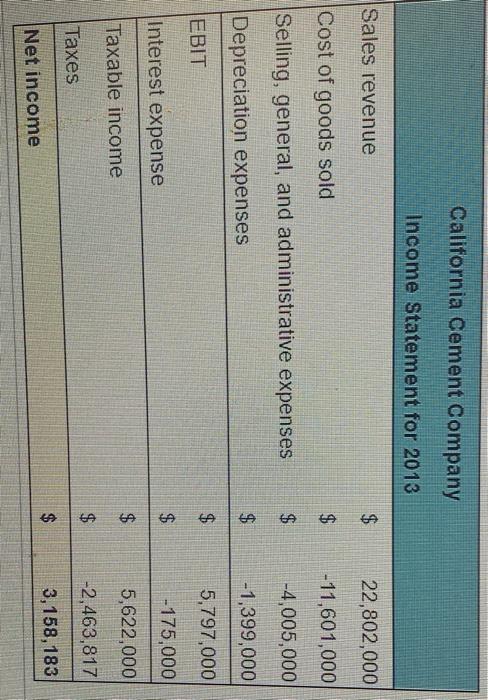

Pro forma income statement. Given the income statement in the popup window, for California Cement Company for 2013 and an expected sales growth rate of 6.84% for 2014, prepare a pro forma income statement for 2014 First, find the percentage of each income statement line from 2013 as a percent of sales. (Round to three decimal places) % % % % California Cement Company Income Statement for 2013 Sales revenue $ 22,802,000 Cost of goods sold $ - 11,601,000 Selling, general, and administrative expenses $ -4,005,000 Depreciation expenses $ -1,399.000 EBIT $ 5,797.000 Interest expense $ -175.000 Taxable income $ 5,622.000 Taxes -2,463 817 $ Net income 3,158,183 % D % % $ % % What is the sales forecast for 2014? Net income $ 3,158,183 % What is the sales forecast for 2014? (Round to the nearest dollar) The pro forma income statement for 2014 is: (Round to the nearest dollar.) California Cement Company Pro Forma Income Statement for 2014 Sales revenue $ 100.00 % $ 50.877 % $ 17.564 % Cost of goods sold Selling, general, and administrative expenses Depreciation expenses 6.135 % $ $ $ 25.423 % EBIT $ Interest expense 0.767 % (A 24.656 % Taxable income 10.805 % Taxes $ $ 13.850 % Net income California Cement Company Income Statement for 2013 Sales revenue $ 22,802,000 Cost of goods sold $ -11,601,000 -4,005,000 $ Selling, general, and administrative expenses Depreciation expenses GA $ -1,399,000 5,797,000 $ EBIT $ Interest expense -175,000 $ 5,622,000 Taxable income $ -2,463,817 Taxes $ 3,158,183 Net income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started