Answered step by step

Verified Expert Solution

Question

1 Approved Answer

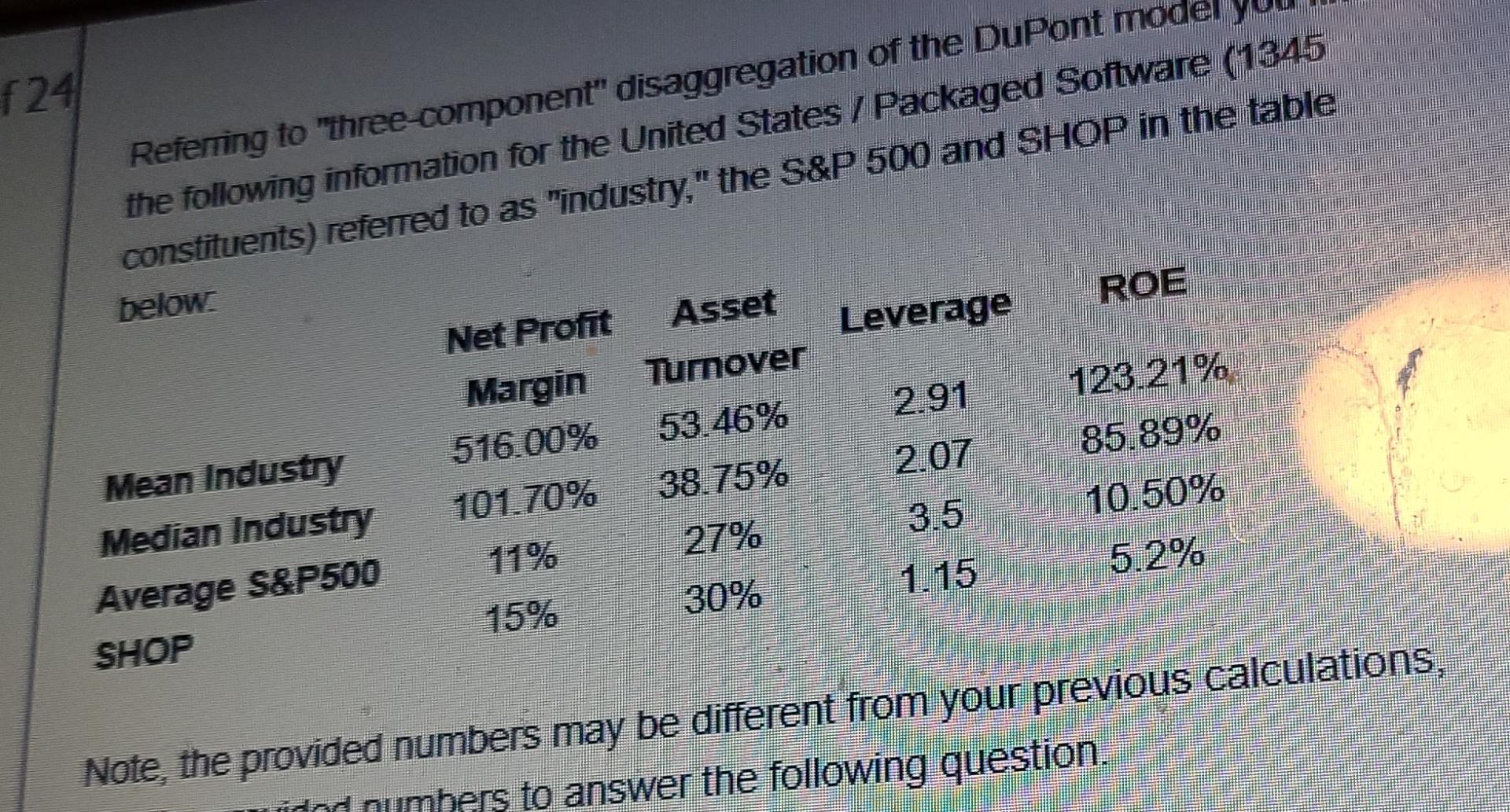

f24 Referring to three-component disaggregation of the DuPont mode the following information for the United States / Packaged Software (1345 constituents) referred to as industry,

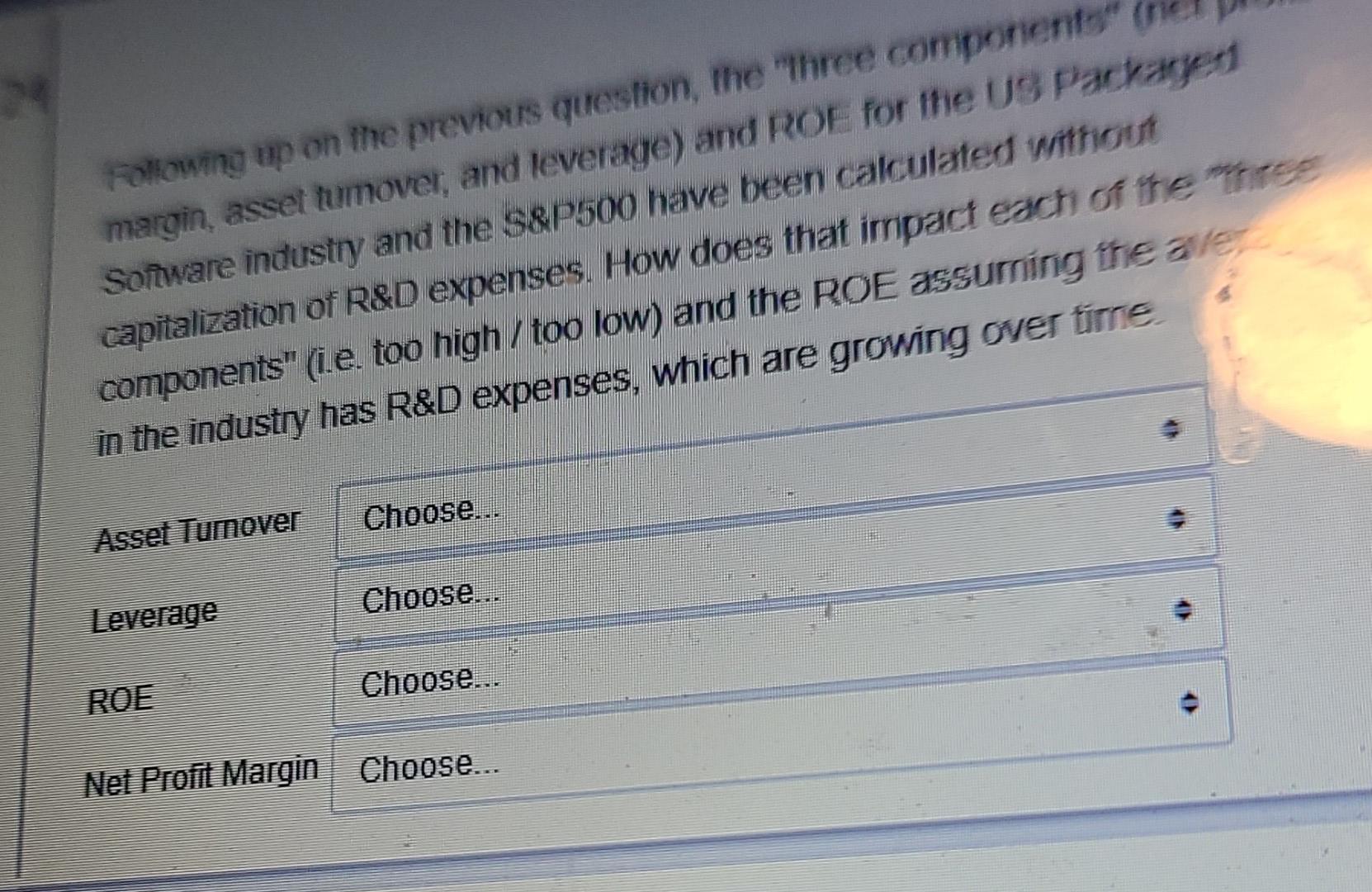

f24 Referring to "three-component" disaggregation of the DuPont mode the following information for the United States / Packaged Software (1345 constituents) referred to as "industry," the S&P 500 and SHOP in the table below: ROE Leverage Asset Turnover 53.46% Net Profit Margin 516.00% 101.70% 2.91 123.21% 85.89% 10.50% 2.07 38.75% 3.5 27% Mean Industry Median Industry Average S&P500 SHOP 11% 5.2% 1.15 30% 15% Note, the provided numbers may be different from your previous calculations, mind numbers to answer the following question. Following up on the previous question, The Three components margin asset tumover, and leverage) and ROE for the US Packages Software industry and the S&P500 have been calculated without capitalization of R&D expenses. How does that impact each of the mee components" (i e too high/too low) and the ROE assuming the are in the industry has R&D expenses, which are growing over time Choose... Asset Tumover Choose... Leverage Choose... ROE Net Profit Margin Choose... f24 Referring to "three-component" disaggregation of the DuPont mode the following information for the United States / Packaged Software (1345 constituents) referred to as "industry," the S&P 500 and SHOP in the table below: ROE Leverage Asset Turnover 53.46% Net Profit Margin 516.00% 101.70% 2.91 123.21% 85.89% 10.50% 2.07 38.75% 3.5 27% Mean Industry Median Industry Average S&P500 SHOP 11% 5.2% 1.15 30% 15% Note, the provided numbers may be different from your previous calculations, mind numbers to answer the following question. Following up on the previous question, The Three components margin asset tumover, and leverage) and ROE for the US Packages Software industry and the S&P500 have been calculated without capitalization of R&D expenses. How does that impact each of the mee components" (i e too high/too low) and the ROE assuming the are in the industry has R&D expenses, which are growing over time Choose... Asset Tumover Choose... Leverage Choose... ROE Net Profit Margin Choose

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started