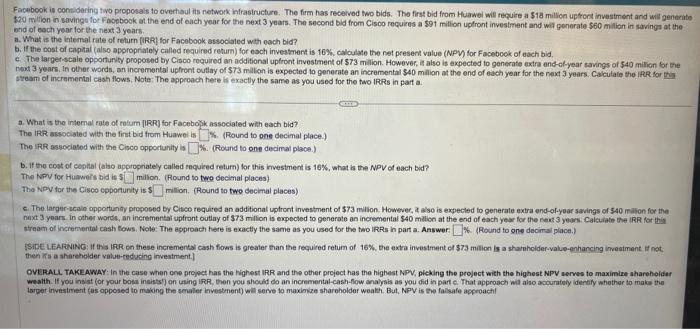

Facebook is comidering two proposals to avertiaul its network intrastructure. The firm has received two bids. The first bid from Huawei will require a 518 milion uptront investment and will genenity $70 mition in savings for Fooebook at the end of each year for the next 3 years. The second bid from Cisco requires a s9t million uplront investment and wila generate $60 millian in savings ot the bend of each yoor for the next 3 years a. What is the intemal rate of return (iRR) for Facebook sssociated whth oach bid? b. If the cost of capital (also approprialoly callod required recum) for each investment is 16\%, calculate the net present value (NPV) for Facebook of each bid. c. The largenscaie opportunly proposed by Cisco roquired an additional uptront investment of $73 million. However, is also is expected to generate extre end-ol-year savings of \$40 milion for Ehe nept 3 years, In other words, an incremental uptront oulthy of $73 million is expected to generate an incremental $40 million ot the end of each year for the next 3 years. Cacculate the IPR far itar steam of incramental cash flows. Note: The approach here it exactly the same as you used for the two IRRs in part a. a. What is the internal rate of rotum [IRRR) for Faceborik associated with each bid? The IRR associated with the fint bid from Huawei is \%. (Round to one decimal place.) The IRR associatod with the Cisco opportunity is K. (Round to one decimal place.) b. If the cost of copital (abo aporopriately called tecueed return) for this investment is 16%, what is the NPV of each bid? The lvpy for Huaweifs bid is 3 milion. (Round to twe decimal places) The Nov for the Cisco epponunity is \$ millon. (Round to two decimal places) E. The largere ceain opportungy proposed by Cico required an additional upptront investment of 573 miltion. However, a also is expecled to generate extra end-of-year savings of 540 malion for the nuxt 3 yoars in other worde, an incremental upfront outliay of 373 millon is expected to generate an incremental S40 milion at the end of each year for the ceat 3 yours. Calaiate the iRR for this tream of incremental cash tows. Nole. The approach here is exactly the same as you used for the two IRRs in part a. Answer % (Round to one decimal place.) FSiDE LEAFivING: If this IRR on these incremental cash fows is greater than the required retum of 16%, the extra invesiment of 573 mition is a sharnholder-value-enhancing imveatiment if not. then iks a shareholder value-ceducing inventment.] OVERALL TAKEAWAY: In the case when one project has the Wighest IRR and the other project has the highest NPV, pleking the project with the highest NPV serves to maximixe aharehoider weath. If you insist (or your bosi insists') on using IRR, then you should do an incremental-cash-fow analysis as you did in part ce. That approach wil aiso accurately identify whether to make the