Question

Faced with headquarters desire to add a new product line, Stefan Grenier, manager of Bilti Products East Division, felt that he had to see the

Faced with headquarters desire to add a new product line, Stefan Grenier, manager of Bilti Products East Division, felt that he had to see the numbers before he made a move. His divisions ROI has led the company for three years, and he doesnt want any letdown.

Bilti Products is a decentralized wholesaler with four autonomous divisions. The divisions are evaluated on the basis of ROI, with year-end bonuses given to divisional managers who have the highest ROI. Operating results for the companys East Division for last year are given below:

| Sales | $ | 27,300,000 | |

| Variable expenses | 14,210,000 | ||

| Contribution margin | 13,090,000 | ||

| Fixed expenses | 10,906,000 | ||

| Operating income | $ | 2,184,000 | |

| Divisional operating assets | $ | 9,100,000 | |

The company had an overall ROI of 12% last year (considering all divisions). The new product line that headquarters wants Greniers East Division to add would require an investment of $5,850,000. The cost and revenue characteristics of the new product line per year would be as follows:

| Sales | $ | 11,700,000 | |

| Variable expenses | 70% of sales | ||

| Fixed expenses | $ | 2,691,000 | |

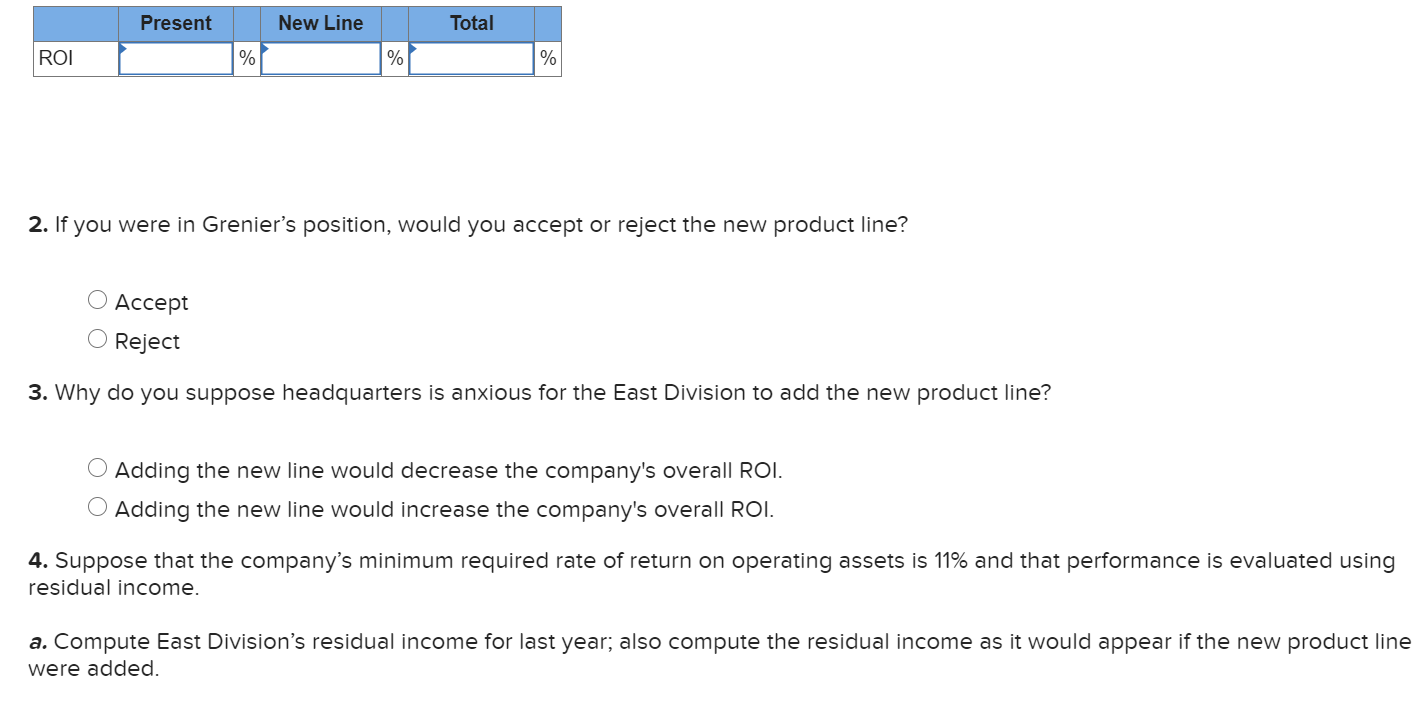

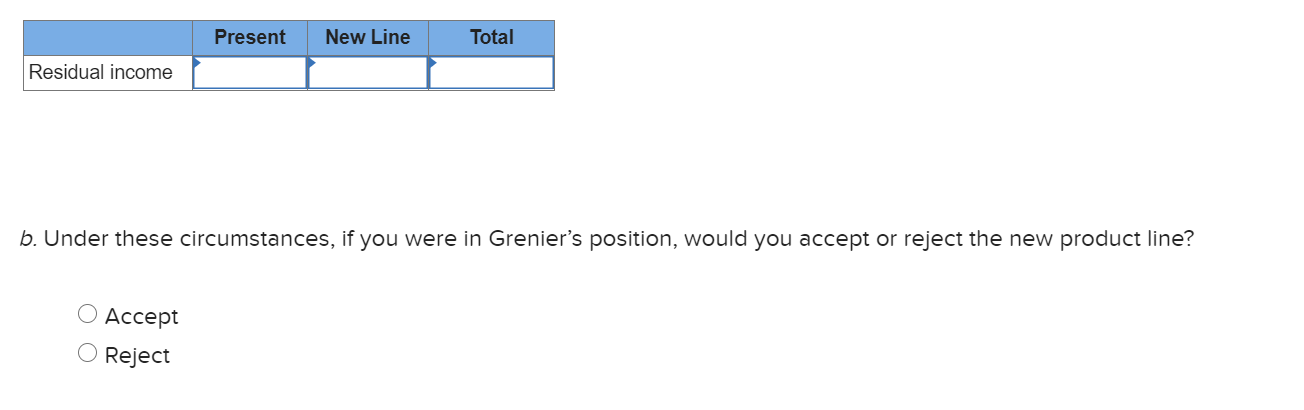

Required: 1. Compute the East Divisions ROI for last year; also compute the ROI as it would appear if the new product line were added. (Do not round intermediate calculations. )

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started