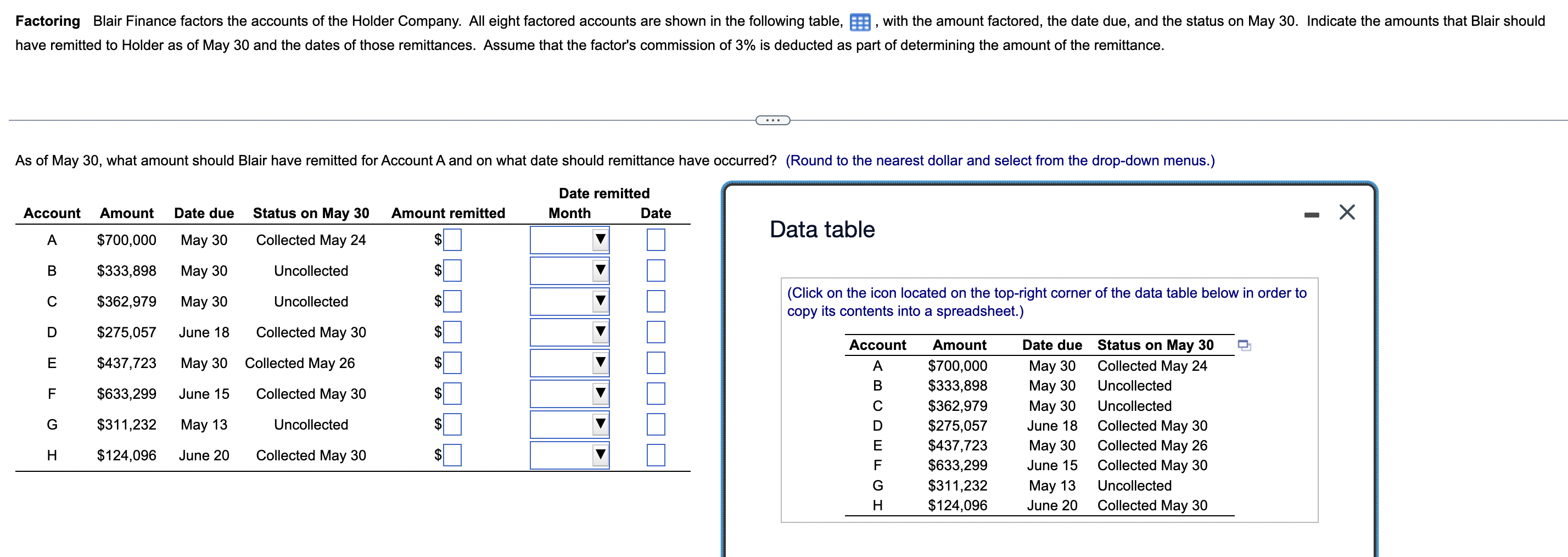

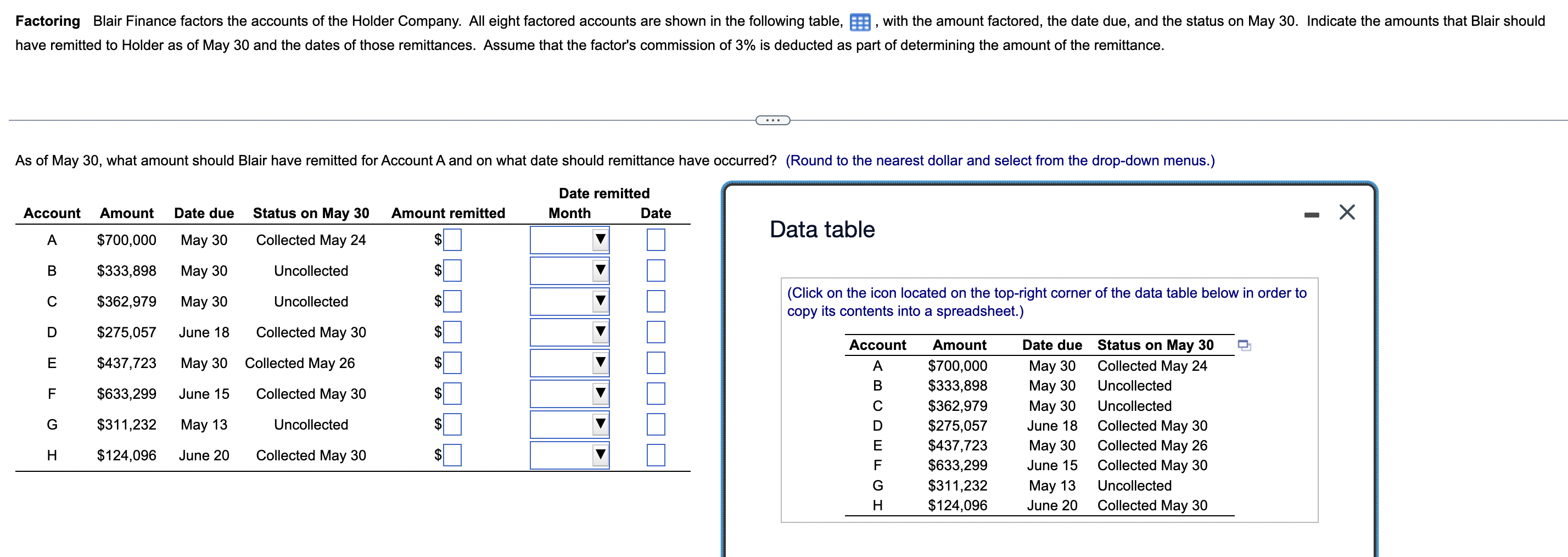

Factoring Blair Finance factors the accounts of the Holder Company. All eight factored accounts are shown in the following table, 5, with the amount factored, the date due, and the status on May 30. Indicate the amounts that Blair should have remitted to Holder as of May 30 and the dates of those remittances. Assume that the factor's commission of 3% is deducted as part of determining the amount of the remittance. As of May 30, what amount should Blair have remitted for Account A and on what date should remittance have occurred? (Round to the nearest dollar and select from the drop-down menus.) Date remitted Month Date Account Amount Date due Status on May 30 Amount remitted - X Data table A $700,000 May 30 Collected May 24 $ B $333,898 May 30 Uncollected $ $362,979 May 30 Uncollected (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) D $275,057 June 18 Collected May 30 $ $ $ Account E $437,723 May 30 Collected May 26 A B F $633,299 June 15 Collected May 30 $ C G $311,232 May 13 Uncollected D $ $ Amount $700,000 $333,898 $362,979 $275,057 $437,723 $633,299 $311,232 $124,096 Date due May 30 May 30 May 30 June 18 May 30 June 15 May 13 June 20 Status on May 30 Collected May 24 Uncollected Uncollected Collected May 30 Collected May 26 Collected May 30 Uncollected Collected May 30 E H $124,096 June 20 Collected May 30 F G H Factoring Blair Finance factors the accounts of the Holder Company. All eight factored accounts are shown in the following table, 5, with the amount factored, the date due, and the status on May 30. Indicate the amounts that Blair should have remitted to Holder as of May 30 and the dates of those remittances. Assume that the factor's commission of 3% is deducted as part of determining the amount of the remittance. As of May 30, what amount should Blair have remitted for Account A and on what date should remittance have occurred? (Round to the nearest dollar and select from the drop-down menus.) Date remitted Month Date Account Amount Date due Status on May 30 Amount remitted - X Data table A $700,000 May 30 Collected May 24 $ B $333,898 May 30 Uncollected $ $362,979 May 30 Uncollected (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) D $275,057 June 18 Collected May 30 $ $ $ Account E $437,723 May 30 Collected May 26 A B F $633,299 June 15 Collected May 30 $ C G $311,232 May 13 Uncollected D $ $ Amount $700,000 $333,898 $362,979 $275,057 $437,723 $633,299 $311,232 $124,096 Date due May 30 May 30 May 30 June 18 May 30 June 15 May 13 June 20 Status on May 30 Collected May 24 Uncollected Uncollected Collected May 30 Collected May 26 Collected May 30 Uncollected Collected May 30 E H $124,096 June 20 Collected May 30 F G H