Answered step by step

Verified Expert Solution

Question

1 Approved Answer

profit and the spot price follow the same trend in increasing and decreasing. Please help and explain when possible. 2. A manufacturer of gold jewelry

profit and the spot price follow the same trend in increasing and decreasing.

Please help and explain when possible.

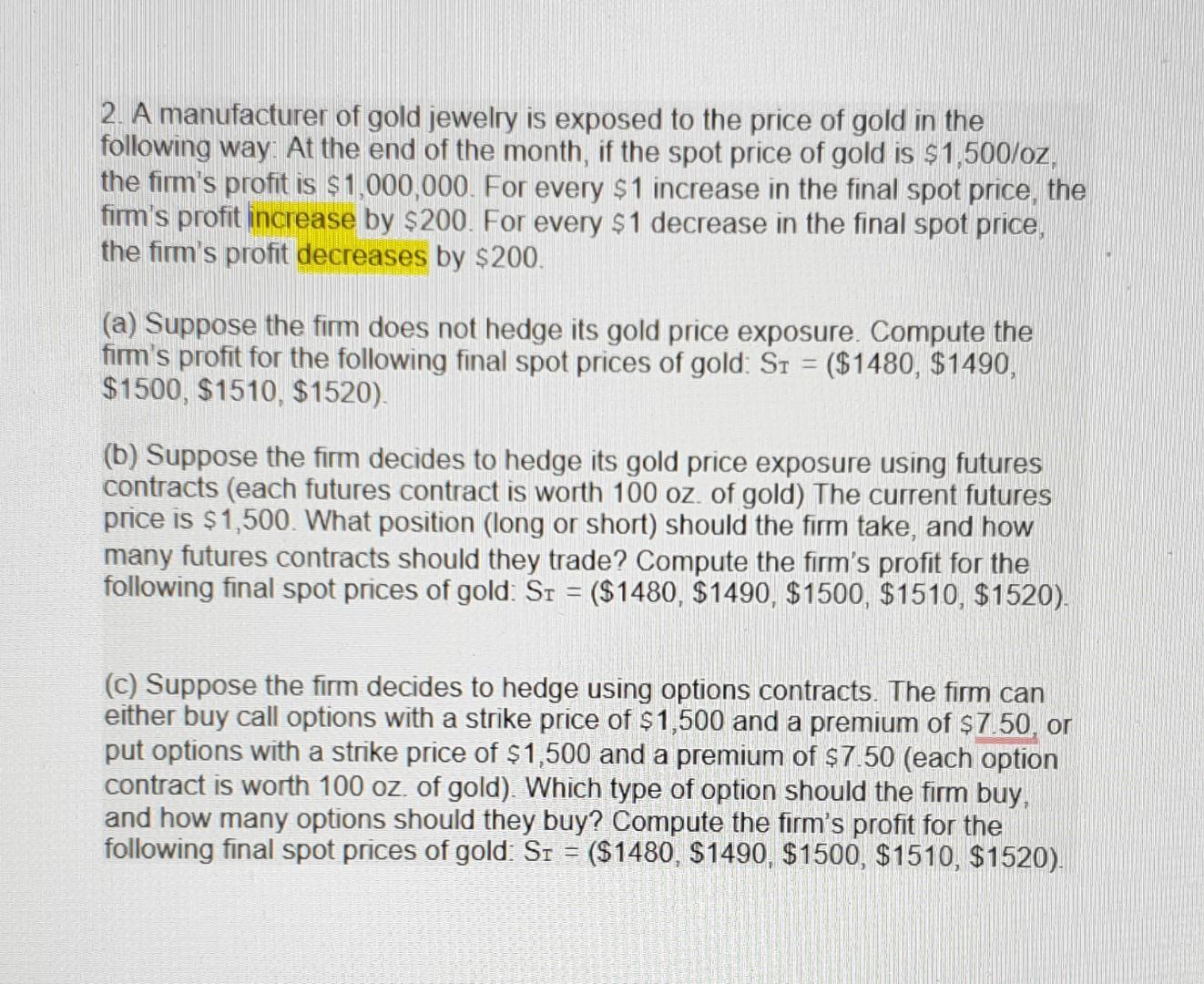

2. A manufacturer of gold jewelry is exposed to the price of gold in the following way: At the end of the month, if the spot price of gold is $1,500/0z, the firm's profit is $1,000,000. For every $1 increase in the final spot price, the firm's profit increase by $200. For every $1 decrease in the final spot price, the firm's profit decreases by $200. (a) Suppose the firm does not hedge its gold price exposure. Compute the firm's profit for the following final spot prices of gold: ST=($1480,$1490, $1500,$1510,$1520) (b) Suppose the firm decides to hedge its gold price exposure using futures contracts (each futures contract is worth 100oz. of gold) The current futures price is $1,500. What position (long or short) should the firm take, and how many futures contracts should they trade? Compute the firm's profit for the following final spot prices of gold: ST=($1480,$1490,$1500,$1510,$1520). (c) Suppose the firm decides to hedge using options contracts. The firm can either buy call options with a strike price of $1,500 and a premium of $7.50, or put options with a strike price of $1,500 and a premium of $7.50 (each option contract is worth 100oz of gold). Which type of option should the firm buy, and how many options should they buy? Compute the firm's profit for the following final spot prices of gold: SI=($1480,$1490,$1500,$1510,$1520)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started