Question

Facts: Delia Alvarez, owner of Delias Lawn Service, wants to borrow money to buy new lawn equipment. A local bank has asked for financial statements.

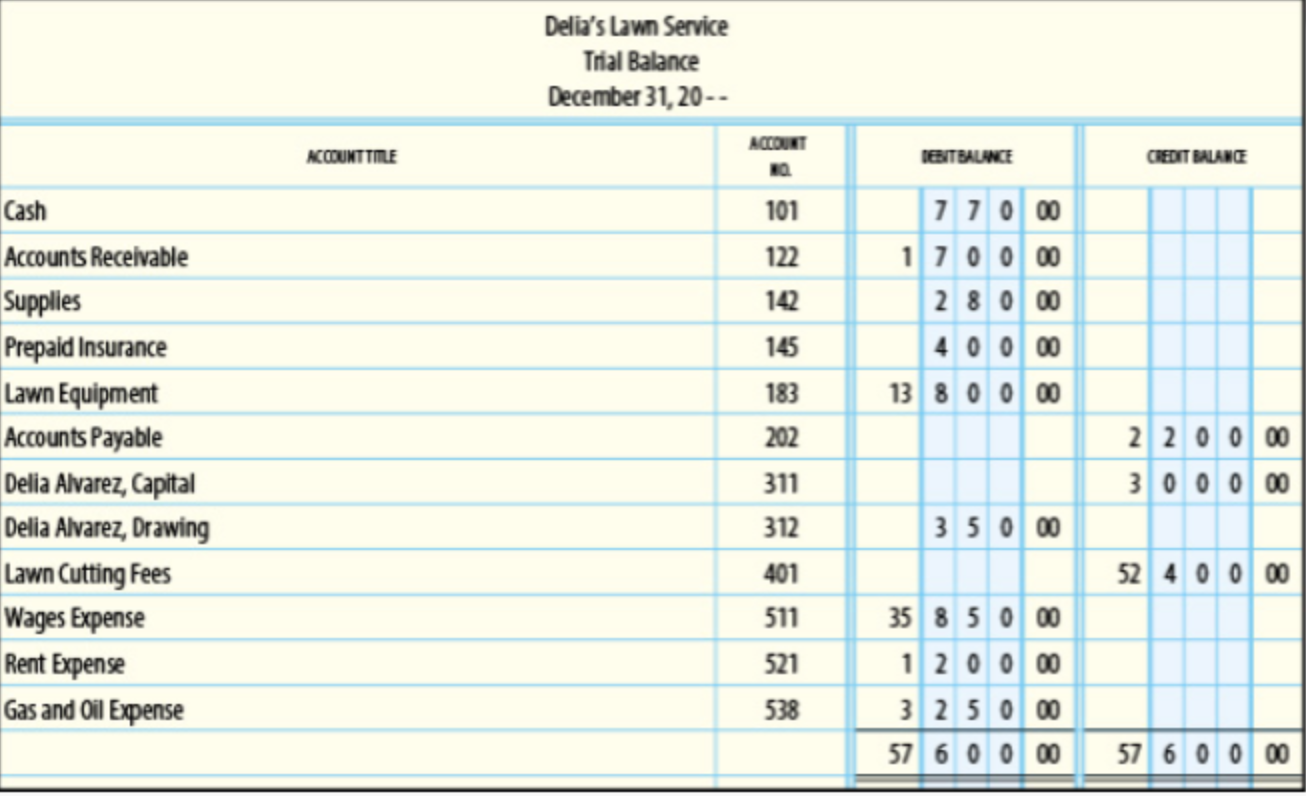

Facts: Delia Alvarez, owner of Delias Lawn Service, wants to borrow money to buy new lawn equipment. A local bank has asked for financial statements. Alvarez has asked you to prepare financial statements for the year ended December 31, 20--. You have been given the unadjusted trial balance (shown below) and suspect that Alvarez expects you to base your statements on this information. You are concerned, however, that some of the account balances may need to be adjusted. Write a memo to Alvarez explaining what additional information you need before you can prepare the financial statements. Alvarez is not familiar with accounting issues. Therefore, explain in your memo why you need this information, the potential impact of this information on the financial statements, and the importance of making these adjustments before approaching the bank for a loan.

Write a minimum 3 paragraph, grammatically correct, business memo to Alvarez explaining what additional information you need before you can prepare the financial statements. Alvarez is not familiar with accounting issues; therefore, explain in your memo the following (use each item required as a paragraph within your response memo to Alvarez): Why you need this information. The potential impact of this information on the financial statements. The importance of making these adjustments before approaching the bank for a loan.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started