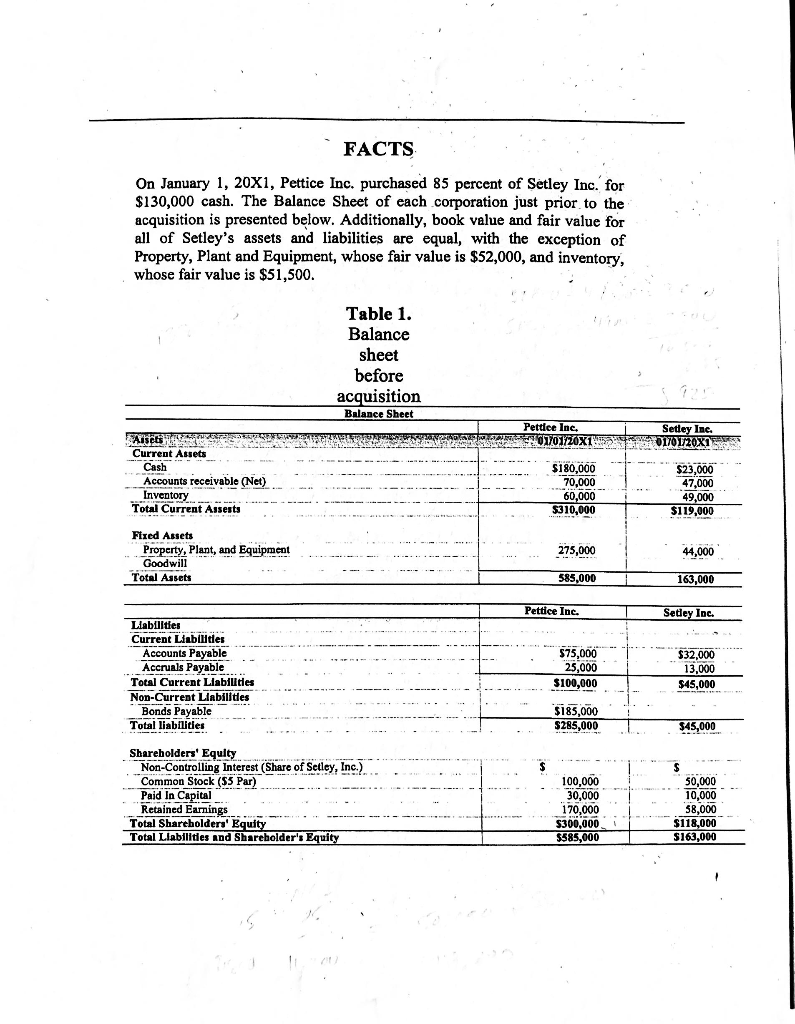

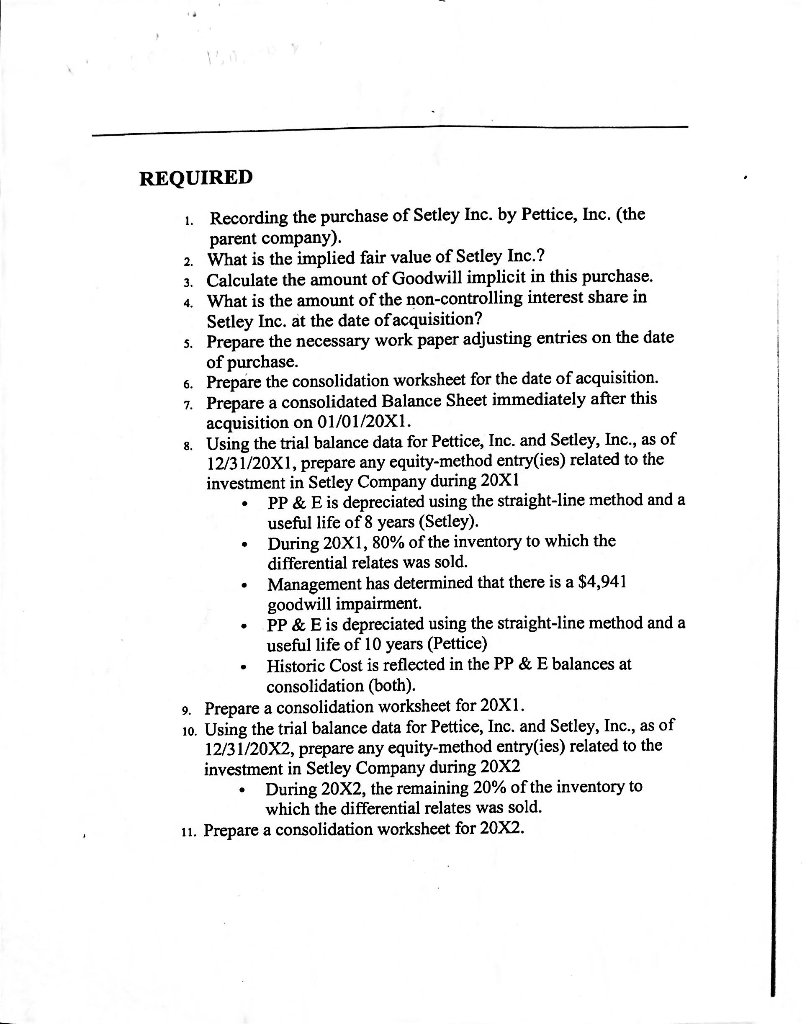

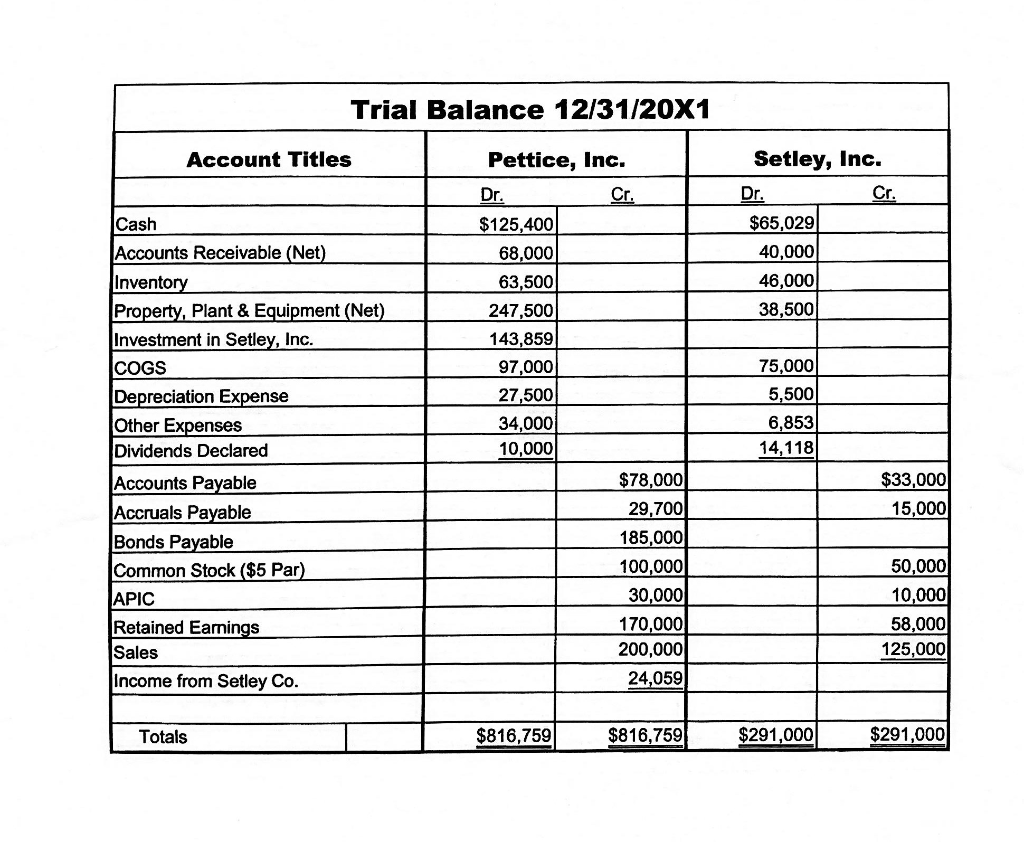

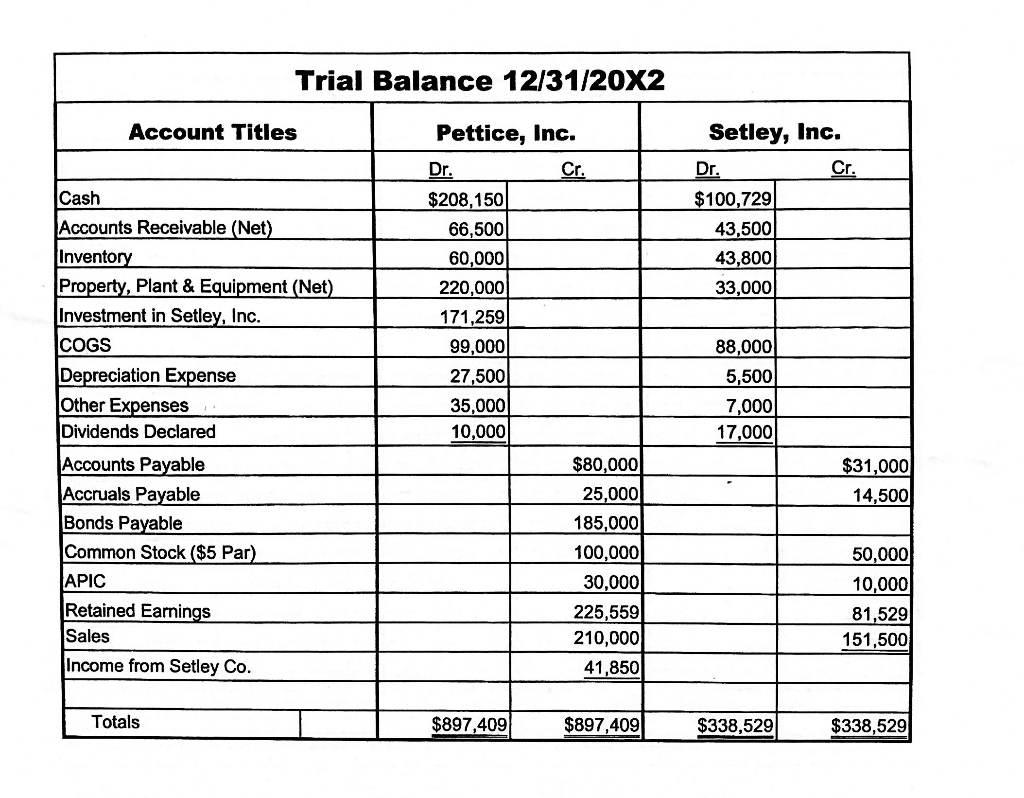

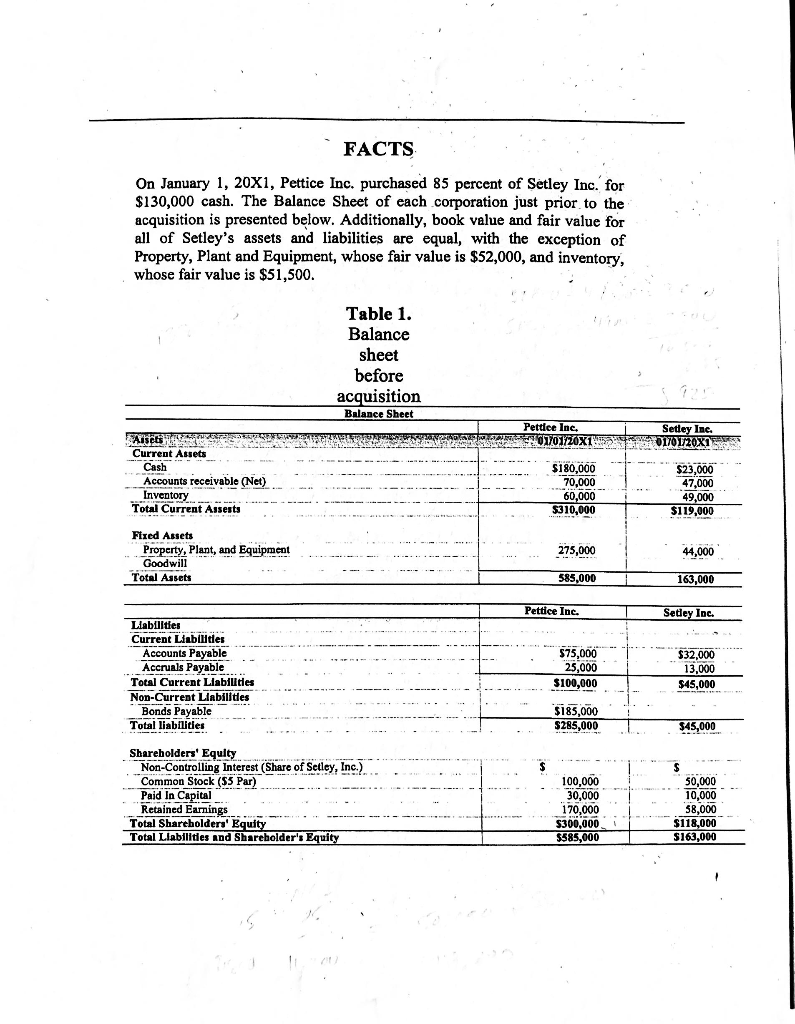

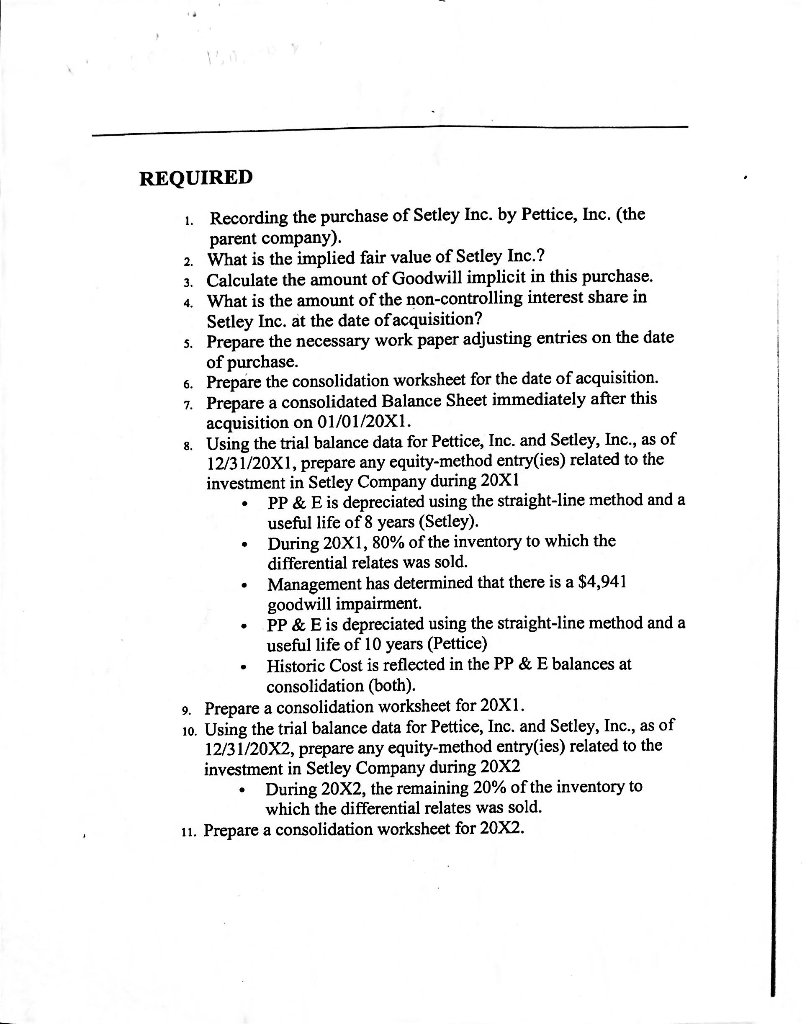

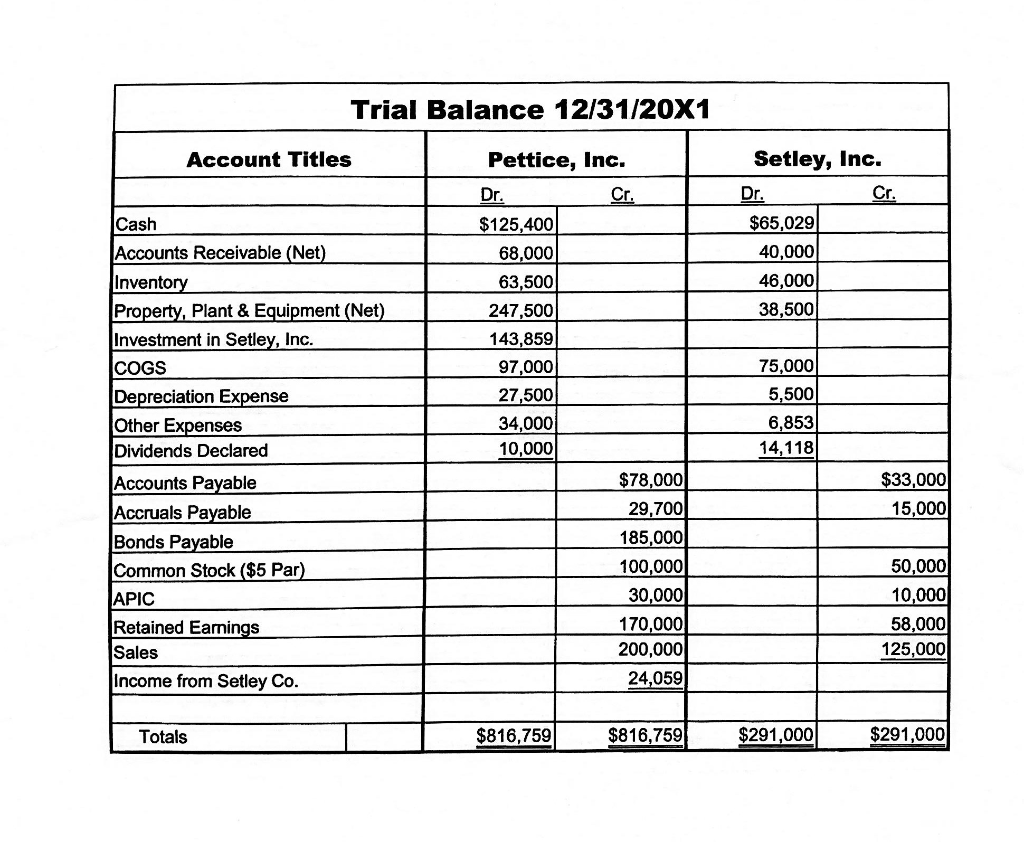

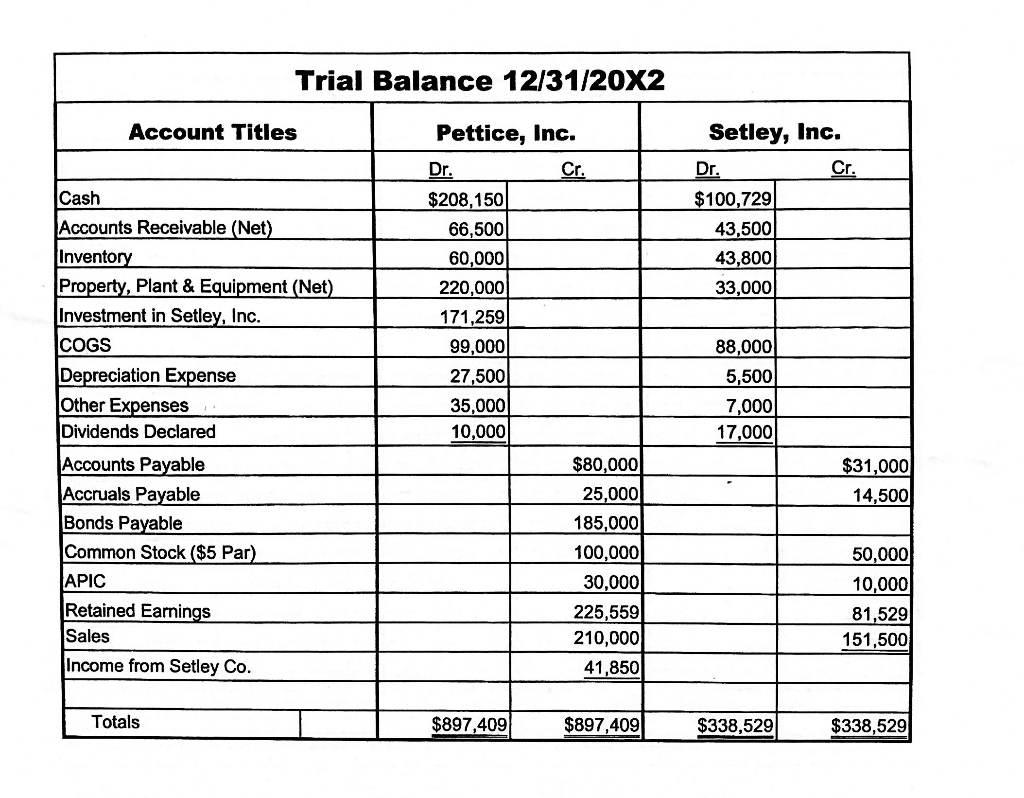

FACTS On January 1, 20X1, Pettice Inc. purchased 85 percent of Setley Inc. for $130,000 cash. The Balance Sheet of each corporation just prior to the acquisition is presented below. Additionally, book value and fair value for all of Setley's assets and liabilities are equal, with the exception of Property, Plant and Equipment, whose fair value is $52,000, and inventory, whose fair value is $51,500 Table 1. Balance sheet before acquisition Balance Sheet Pettiee Ine. Setley Inc. X1 Current Assets Cash S180,000 $23,000 47,000 49,000 $119,000 Accounts receivable Net) Inventory 60 Total Current Aisest $310,000 Fired Assets Property, Plant, and Equipment Goodwil1 275,000 44,000 163,000 Sedey Inc. Total Assets 585,000 Pettice Inc. Liabilities Current Liabilities Accounts Payable 575,000 Accruals Payable Total Corrent Llabilitdes Non-Current Liabilittes 25,000 $100,000 $32,000 13,000 $45,000 Bonds Payable Total liabilities $185,000! 285,000 345,000 Shareholders Equity Non-Controlling Interest(Share of Seley, Inc.) - Common Stock (S5 Par) Paid In Capital Retained Earnings 100,000 30,000 170,000 5300,000 $585,000 50,000 10,000 58,000 $118,000 $163,000 . Total Shareholders' E Total Liabilities A d Shreholder's E it REQUIRED Recording the purchase of Setley Inc. by Pettice, Inc. (the parent company) 2. What is the implied fair value of Setley Inc.? 3. Calculate the amount of Goodwill implicit in this purchase 4. What is the amount of the non-controlling interest share in Setley Inc. at the date ofacquisition? Prepare the necessary work paper adjusting entries on the date of purchase Prepare the consolidation worksheet for the date of acquisition. Prepare a consolidated Balance Sheet immediately after this acquisition on 01/01/20X1. Using the trial balance data for Pettice, Inc. and Setley, Inc., as of 12/31/20X1, prepare any equity-method entry(ies) related to the investment in Setley Company during 20Xl s. 6. 7. 8. PP& E is depreciated using the straight-line method and a useful life of 8 years (Setley) During 20X1, 80% of the inventory to which the differential relates was sold. Management has determined that there is a $4,941 goodwill impairment. . . PP & E is depreciated using the straight-line method and a useful life of 10 years (Pettice) Historic Cost is reflected in the PP & E balances at consolidation (both) 9. Prepare a consolidation worksheet for 20X1. 1o. Using the trial balance data for Pettice, Inc. and Setley, Inc., as of 12/31/20X2, prepare any equity-method entry(ies) related to the investment in Setley Company during 20X'2 During 20X2, the remaining 20% of the inventory to which the differential relates was sold 1. Prepare a consolidation worksheet for 20X2 Trial Balance 12/31/20X2 Account Titles Pettice, Inc. Setley, Inc. Cash Accounts Receivable (Net Invento Property, Plant & Equipment (Net Investment in Setley, Inc COGS Depreciation Expense Other Expenses Dividends Declared Accounts Payable Accruals Payable Bonds Payable Common Stock ($5 Par APIC Retained Earnings $208,150 66,500 60,000 220,000 171,259 99,000 27500 35,000 10,000 $100,729 43,500 43,800 33,000 88,000 5,500 7,000 17,000 $80,000 25,000 185,000 100,000 30,000 225,559 210,000 41,850 $31,000 14,500 50,000 10,000 81,529 151,500 Sales Income from Setley Co Totals $897,409 $897,409 $338,529 $338,529