Answered step by step

Verified Expert Solution

Question

1 Approved Answer

FACULTY OF COMMERCE, MANAGEMENT AND LAW OLD CURRICULUM MODULES QUESTION 2 (20 MARKS) Kaume Enterprises (KE) is a business that sells sweets. The company buys

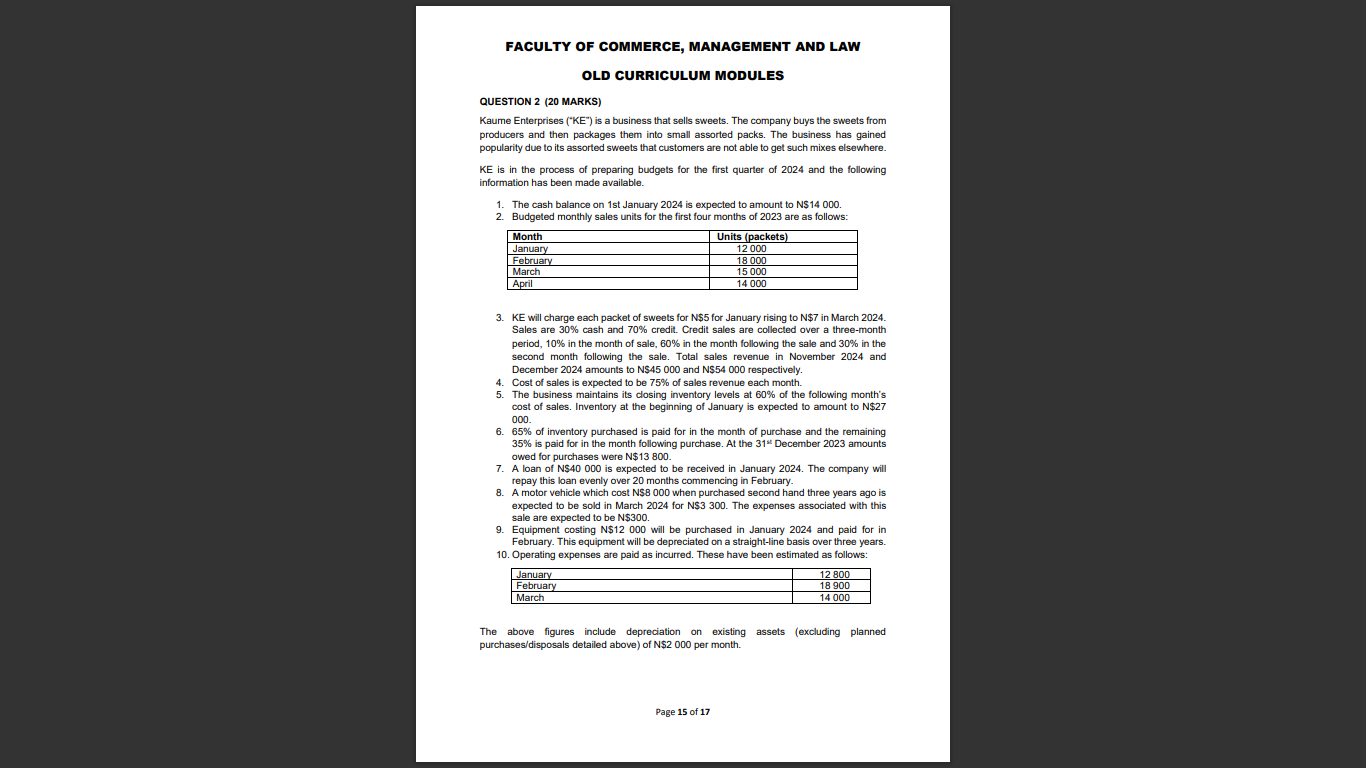

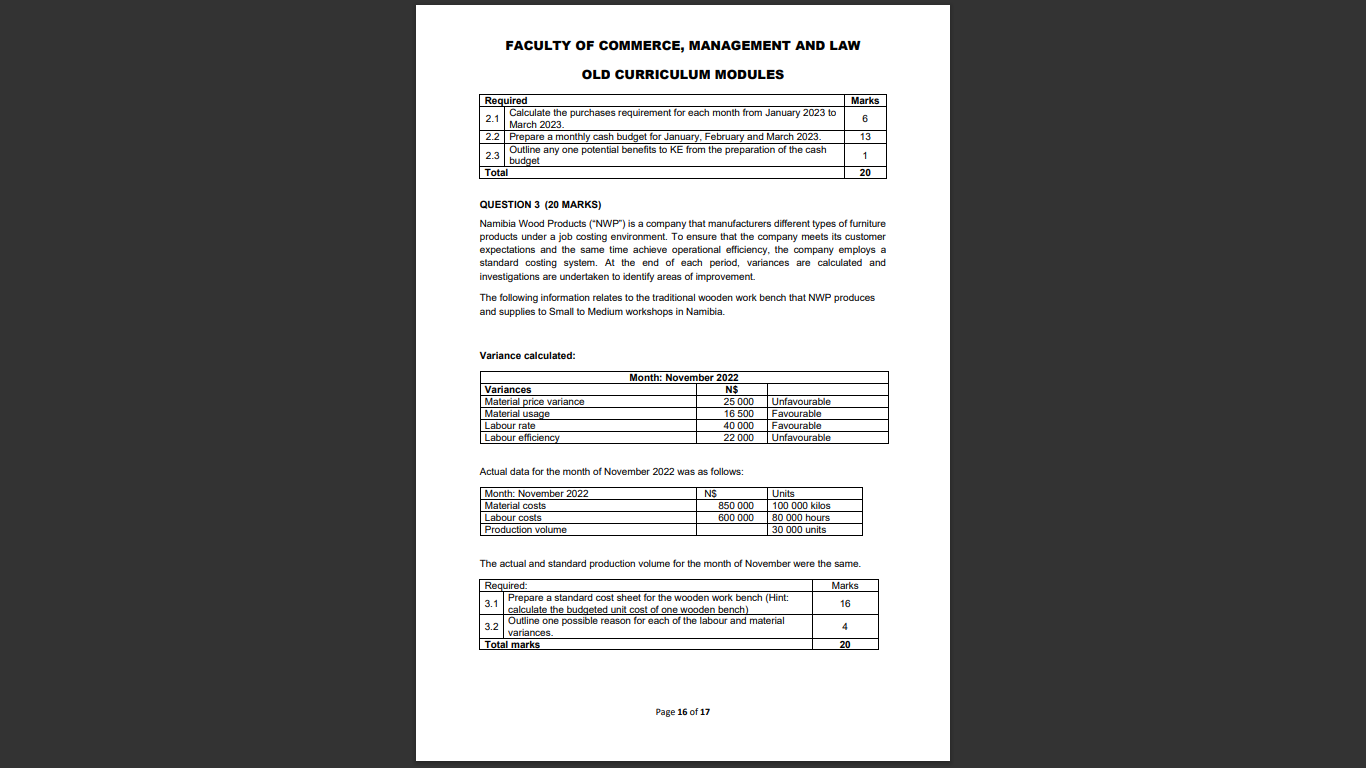

FACULTY OF COMMERCE, MANAGEMENT AND LAW OLD CURRICULUM MODULES QUESTION 2 (20 MARKS) Kaume Enterprises ("KE") is a business that sells sweets. The company buys the sweets from producers and then packages them into small assorted packs. The business has gained popularity due to its assorted sweets that customers are not able to get such mixes elsewhere. KE is in the process of preparing budgets for the first quarter of 2024 and the following information has been made available. 1. The cash balance on 1st January 2024 is expected to amount to N\$14 000 . 2. Budgeted monthly sales units for the first four months of 2023 are as follows: 3. KE will charge each packet of sweets for N\$5 for January rising to N\$7 in March 2024. Sales are 30% cash and 70% credit. Credit sales are collected over a three-month period, 10% in the month of sale, 60% in the month following the sale and 30% in the second month following the sale. Total sales revenue in November 2024 and December 2024 amounts to N\$45 000 and N\$54 000 respectively. 4. Cost of sales is expected to be 75% of sales revenue each month. 5. The business maintains its closing inventory levels at 60% of the following month's cost of sales. Inventory at the beginning of January is expected to amount to N$27 000 . 6. 65% of inventory purchased is paid for in the month of purchase and the remaining 35% is paid for in the month following purchase. At the 31t2 December 2023 amounts owed for purchases were N$13800. 7. A loan of N\$40 000 is expected to be received in January 2024. The company will repay this loan evenly over 20 months commencing in February. 8. A motor vehicle which cost N\$B 000 when purchased second hand three years ago is expected to be sold in March 2024 for N\$3 300. The expenses associated with this sale are expected to be N$300. 9. Equipment costing N$12000 will be purchased in January 2024 and paid for in February. This equipment will be depreciated on a straight-line basis over three years. 10. Operating expenses are paid as incurred. These have been estimated as follows: The above figures include depreciation on existing assets (excluding planned purchases/disposals detailed above) of N\$2 000 per month. FACULTY OF COMMERCE, MANAGEMENT AND LAW OLD CURRICULUM MODULES QUESTION 3 (20 MARKS) Namibia Wood Products ("NWP") is a company that manufacturers different types of furniture products under a job costing environment. To ensure that the company meets its customer expectations and the same time achieve operational efficiency, the company employs a standard costing system. At the end of each period, variances are calculated and investigations are undertaken to identify areas of improvement. The following information relates to the traditional wooden work bench that NWP produces and supplies to Small to Medium workshops in Namibia. Variance calculated: Actual data for the month of November 2022 was as follows: The actual and standard production volume for the month of November were the same. Page 16 of 17

FACULTY OF COMMERCE, MANAGEMENT AND LAW OLD CURRICULUM MODULES QUESTION 2 (20 MARKS) Kaume Enterprises ("KE") is a business that sells sweets. The company buys the sweets from producers and then packages them into small assorted packs. The business has gained popularity due to its assorted sweets that customers are not able to get such mixes elsewhere. KE is in the process of preparing budgets for the first quarter of 2024 and the following information has been made available. 1. The cash balance on 1st January 2024 is expected to amount to N\$14 000 . 2. Budgeted monthly sales units for the first four months of 2023 are as follows: 3. KE will charge each packet of sweets for N\$5 for January rising to N\$7 in March 2024. Sales are 30% cash and 70% credit. Credit sales are collected over a three-month period, 10% in the month of sale, 60% in the month following the sale and 30% in the second month following the sale. Total sales revenue in November 2024 and December 2024 amounts to N\$45 000 and N\$54 000 respectively. 4. Cost of sales is expected to be 75% of sales revenue each month. 5. The business maintains its closing inventory levels at 60% of the following month's cost of sales. Inventory at the beginning of January is expected to amount to N$27 000 . 6. 65% of inventory purchased is paid for in the month of purchase and the remaining 35% is paid for in the month following purchase. At the 31t2 December 2023 amounts owed for purchases were N$13800. 7. A loan of N\$40 000 is expected to be received in January 2024. The company will repay this loan evenly over 20 months commencing in February. 8. A motor vehicle which cost N\$B 000 when purchased second hand three years ago is expected to be sold in March 2024 for N\$3 300. The expenses associated with this sale are expected to be N$300. 9. Equipment costing N$12000 will be purchased in January 2024 and paid for in February. This equipment will be depreciated on a straight-line basis over three years. 10. Operating expenses are paid as incurred. These have been estimated as follows: The above figures include depreciation on existing assets (excluding planned purchases/disposals detailed above) of N\$2 000 per month. FACULTY OF COMMERCE, MANAGEMENT AND LAW OLD CURRICULUM MODULES QUESTION 3 (20 MARKS) Namibia Wood Products ("NWP") is a company that manufacturers different types of furniture products under a job costing environment. To ensure that the company meets its customer expectations and the same time achieve operational efficiency, the company employs a standard costing system. At the end of each period, variances are calculated and investigations are undertaken to identify areas of improvement. The following information relates to the traditional wooden work bench that NWP produces and supplies to Small to Medium workshops in Namibia. Variance calculated: Actual data for the month of November 2022 was as follows: The actual and standard production volume for the month of November were the same. Page 16 of 17 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started