Answered step by step

Verified Expert Solution

Question

1 Approved Answer

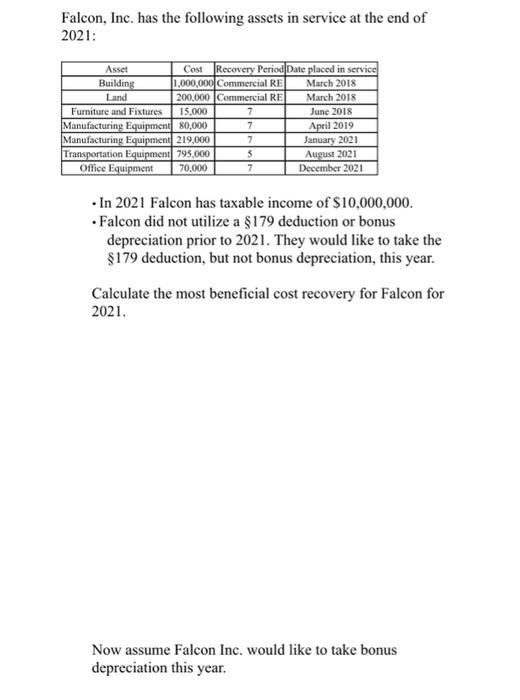

Falcon, Inc. has the following assets in service at the end of 2021: Asset Cost Recovery Period Date placed in service Building 1,000,000 Commercial

Falcon, Inc. has the following assets in service at the end of 2021: Asset Cost Recovery Period Date placed in service Building 1,000,000 Commercial RE March 2018 Land 200,000 Commercial RE March 2018 7 June 2018 7 April 2019 Furniture and Fixtures 15,000 Manufacturing Equipment 80,000 Manufacturing Equipment 219,000 Transportation Equipment 795,000 Office Equipment 70,000 7 January 2021 5 August 2021 December 2021 7 . In 2021 Falcon has taxable income of $10,000,000. Falcon did not utilize a 179 deduction or bonus depreciation prior to 2021. They would like to take the $179 deduction, but not bonus depreciation, this year. Calculate the most beneficial cost recovery for Falcon for 2021. Now assume Falcon Inc. would like to take bonus depreciation this year.

Step by Step Solution

★★★★★

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Most Beneficial cost recovery means the optimum way through which we can recover our costs Alternat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started