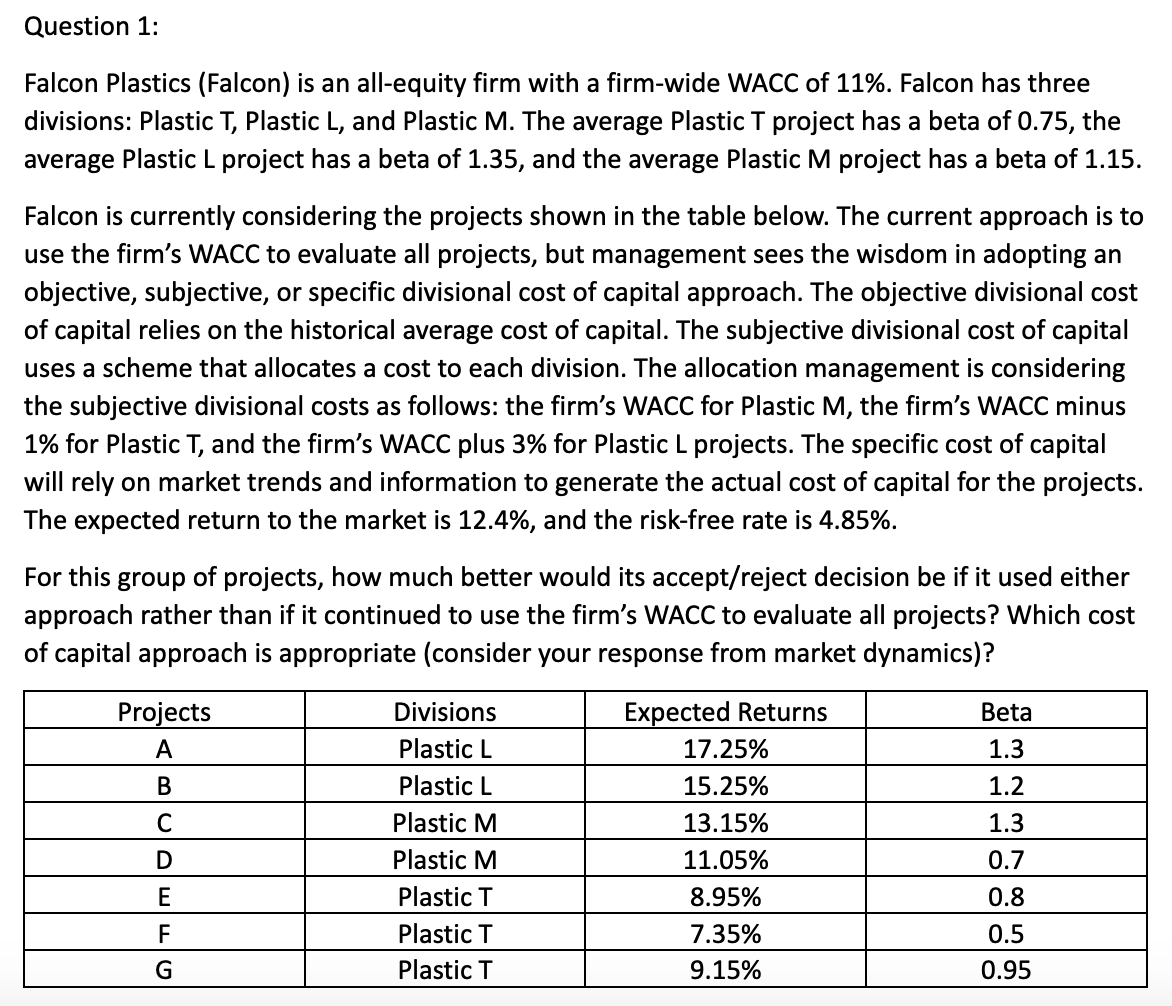

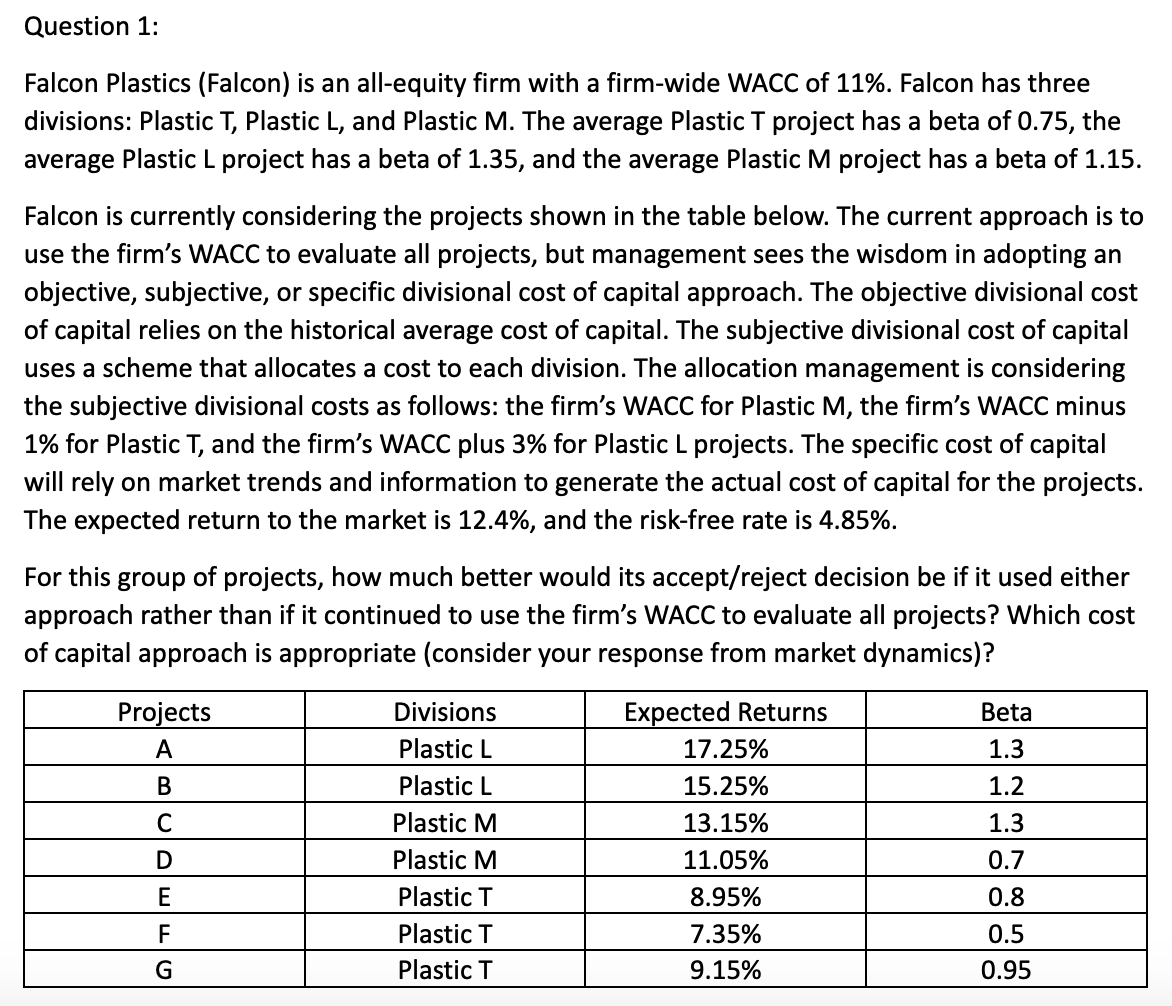

Falcon Plastics (Falcon) is an all-equity firm with a firm-wide WACC of 11%. Falcon has three divisions: Plastic T, Plastic L, and Plastic M. The average Plastic T project has a beta of 0.75 , the average Plastic L project has a beta of 1.35 , and the average Plastic M project has a beta of 1.15 . Falcon is currently considering the projects shown in the table below. The current approach is to use the firm's WACC to evaluate all projects, but management sees the wisdom in adopting an objective, subjective, or specific divisional cost of capital approach. The objective divisional cost of capital relies on the historical average cost of capital. The subjective divisional cost of capital uses a scheme that allocates a cost to each division. The allocation management is considering the subjective divisional costs as follows: the firm's WACC for Plastic M, the firm's WACC minus 1% for Plastic T, and the firm's WACC plus 3% for Plastic L projects. The specific cost of capital will rely on market trends and information to generate the actual cost of capital for the projects. The expected return to the market is 12.4%, and the risk-free rate is 4.85%. For this group of projects, how much better would its accept/reject decision be if it used either approach rather than if it continued to use the firm's WACC to evaluate all projects? Which cost of capital approach is appropriate (consider your response from market dynamics)? Falcon Plastics (Falcon) is an all-equity firm with a firm-wide WACC of 11%. Falcon has three divisions: Plastic T, Plastic L, and Plastic M. The average Plastic T project has a beta of 0.75 , the average Plastic L project has a beta of 1.35 , and the average Plastic M project has a beta of 1.15 . Falcon is currently considering the projects shown in the table below. The current approach is to use the firm's WACC to evaluate all projects, but management sees the wisdom in adopting an objective, subjective, or specific divisional cost of capital approach. The objective divisional cost of capital relies on the historical average cost of capital. The subjective divisional cost of capital uses a scheme that allocates a cost to each division. The allocation management is considering the subjective divisional costs as follows: the firm's WACC for Plastic M, the firm's WACC minus 1% for Plastic T, and the firm's WACC plus 3% for Plastic L projects. The specific cost of capital will rely on market trends and information to generate the actual cost of capital for the projects. The expected return to the market is 12.4%, and the risk-free rate is 4.85%. For this group of projects, how much better would its accept/reject decision be if it used either approach rather than if it continued to use the firm's WACC to evaluate all projects? Which cost of capital approach is appropriate (consider your response from market dynamics)