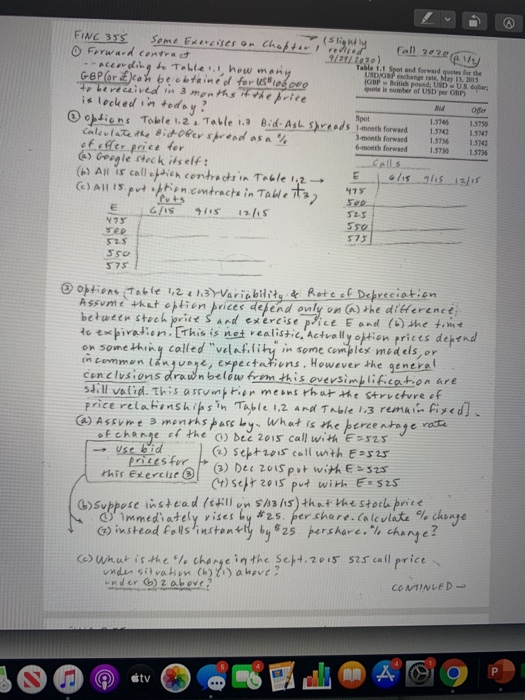

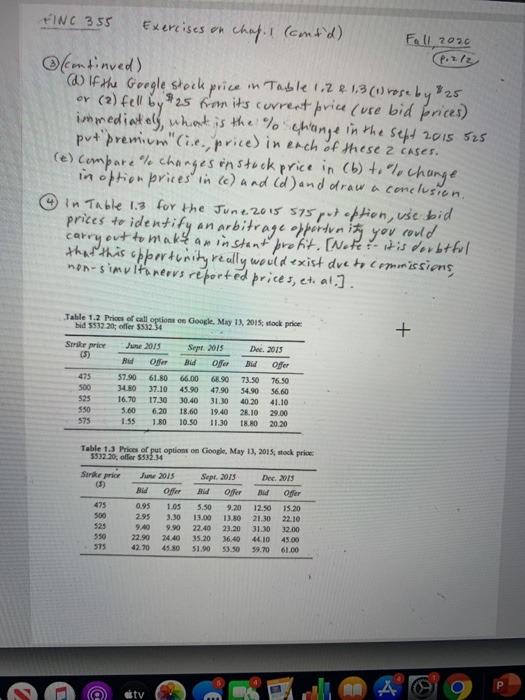

Fall zone pily (slightly FINC 355 Some Exercises or Chapter I revised 0 Forward contract 9/01/202) GBP (orch becbtained for US ce pro According to Toble!! how many to be received in 3 months if the price is locked in today? options Table 1.2. Table 1.3 Bid-Ash Shreads incet forward calculate the bidofer spread as a % ofeffer price for Calls ) Cogle stock itself: 6/15 glis 12/15 (1) All is calledhich contractsin Table 12 - (6) All 15. put option contracts in Table ita, GAS 12/15 Table 1. Spol and forward for the USD GBP exchange May 13, 2015 Opritish pound USDUS, el umber of USD per AM Ofer Spot 1.5745 1.5750 1.570 1.5741 month forward 1.576 1.5742 6-month forward 1.57 1.5736 E 475 E 475 500 525 550 573 525 550 575 rate options Table 1, 2 & 3)-Variability of Rate of Depreciation Assume that option prices depend only on (a) the difference between stoch prices and exercise price & and (6) the time to expiration. (This is not realistic. Actually oftion prices depend on something called "velaf.lity in some complex models, or in common language, expectations. However the general conclusions drawn below from this oversimplification are still valid. This assumption means that the structure of price relationships in Table 1,2 and Table 1,3 remain fixed] (a) Assume 3 months pass by. What is the percentage of charge of the Dec 2015 call with ' E525 - Use bid (2) sept 2015 call with E3525 prices for this exercise (3) Dec Zo is put with > 525 (4) sept 2015 put with Ex525 > suppose instead Istill in $13/s) that the stock price immediately rises by *25. ber share. Calculate chonge (2) instead falls instantly by 825 pershare to change? (c) What is the of change in the sept. 2015 525 call price, under situation (b)li) above? under (6) 2 above? CONTINLED- otv P O TINC 355 Exercises on chap.! (contd) Fall 2020 or (continued) @ If the Google stock price in Table 12 R 13 (1) rose by (2) fell by 25 from its current price (use bid prices) immediately, what is the % change in the sept 2015 525 put premium" (ie, price) in each of these z cases. (e) compare le changes in stock price in (b) to le change in option prices in (c) and (d) and draw a conclusion. O in Table 1.3 for the June 2015 575 put option, use bid prices to identify an arbitrage opportunity you could carry out to make an instant profit. [Note: it is doubtful that this opportunity really would exist due to commissions, non-simultaneous reported prices, et al.]. + Table 1.2 Prices of all options on Google May 13, 2015, stock price hid 5532.20; offer 5532.34 Serike price June 2015 Sept. 2015 Dec. 2015 (5) Offer Bid Offer Bid Offer 475 57.90 61.80 66.00 68.90 73.50 76.50 500 34.80 37.10 45.90 47.90 54.90 56.60 525 16.70 17.30 30.40 31.30 40.20 41.10 550 5.60 6.20 18.60 19.40 28.10 29.00 575 1.55 1.80 10.50 11.30 18.80 20.20 Table 1.3 Prices of put options on Google, May 13, 2015, stock price: 5532 20, offer 5532,34 Sirke prior (5) Sept. 2015 Bid Offer 475 500 525 550 575 June 2015 Bild Offer 0.95 1.05 2.95 3.30 9.40 9.90 22.90 24.40 42.70 45.80 5.50 13.00 22.40 35.20 51.90 9.20 13.80 23.20 36.40 53.50 Dec. 2015 Bild Offer 12.50 15.20 21.30 22.10 31.30 32.00 44.10 59.70 61.00 tv Fall zone pily (slightly FINC 355 Some Exercises or Chapter I revised 0 Forward contract 9/01/202) GBP (orch becbtained for US ce pro According to Toble!! how many to be received in 3 months if the price is locked in today? options Table 1.2. Table 1.3 Bid-Ash Shreads incet forward calculate the bidofer spread as a % ofeffer price for Calls ) Cogle stock itself: 6/15 glis 12/15 (1) All is calledhich contractsin Table 12 - (6) All 15. put option contracts in Table ita, GAS 12/15 Table 1. Spol and forward for the USD GBP exchange May 13, 2015 Opritish pound USDUS, el umber of USD per AM Ofer Spot 1.5745 1.5750 1.570 1.5741 month forward 1.576 1.5742 6-month forward 1.57 1.5736 E 475 E 475 500 525 550 573 525 550 575 rate options Table 1, 2 & 3)-Variability of Rate of Depreciation Assume that option prices depend only on (a) the difference between stoch prices and exercise price & and (6) the time to expiration. (This is not realistic. Actually oftion prices depend on something called "velaf.lity in some complex models, or in common language, expectations. However the general conclusions drawn below from this oversimplification are still valid. This assumption means that the structure of price relationships in Table 1,2 and Table 1,3 remain fixed] (a) Assume 3 months pass by. What is the percentage of charge of the Dec 2015 call with ' E525 - Use bid (2) sept 2015 call with E3525 prices for this exercise (3) Dec Zo is put with > 525 (4) sept 2015 put with Ex525 > suppose instead Istill in $13/s) that the stock price immediately rises by *25. ber share. Calculate chonge (2) instead falls instantly by 825 pershare to change? (c) What is the of change in the sept. 2015 525 call price, under situation (b)li) above? under (6) 2 above? CONTINLED- otv P O TINC 355 Exercises on chap.! (contd) Fall 2020 or (continued) @ If the Google stock price in Table 12 R 13 (1) rose by (2) fell by 25 from its current price (use bid prices) immediately, what is the % change in the sept 2015 525 put premium" (ie, price) in each of these z cases. (e) compare le changes in stock price in (b) to le change in option prices in (c) and (d) and draw a conclusion. O in Table 1.3 for the June 2015 575 put option, use bid prices to identify an arbitrage opportunity you could carry out to make an instant profit. [Note: it is doubtful that this opportunity really would exist due to commissions, non-simultaneous reported prices, et al.]. + Table 1.2 Prices of all options on Google May 13, 2015, stock price hid 5532.20; offer 5532.34 Serike price June 2015 Sept. 2015 Dec. 2015 (5) Offer Bid Offer Bid Offer 475 57.90 61.80 66.00 68.90 73.50 76.50 500 34.80 37.10 45.90 47.90 54.90 56.60 525 16.70 17.30 30.40 31.30 40.20 41.10 550 5.60 6.20 18.60 19.40 28.10 29.00 575 1.55 1.80 10.50 11.30 18.80 20.20 Table 1.3 Prices of put options on Google, May 13, 2015, stock price: 5532 20, offer 5532,34 Sirke prior (5) Sept. 2015 Bid Offer 475 500 525 550 575 June 2015 Bild Offer 0.95 1.05 2.95 3.30 9.40 9.90 22.90 24.40 42.70 45.80 5.50 13.00 22.40 35.20 51.90 9.20 13.80 23.20 36.40 53.50 Dec. 2015 Bild Offer 12.50 15.20 21.30 22.10 31.30 32.00 44.10 59.70 61.00 tv