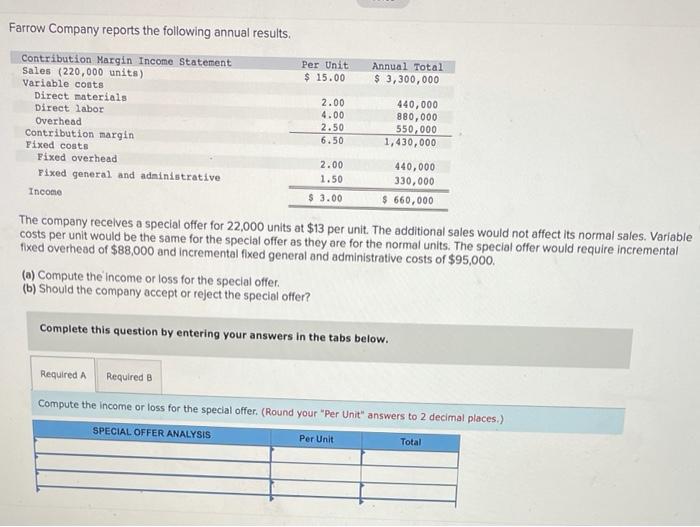

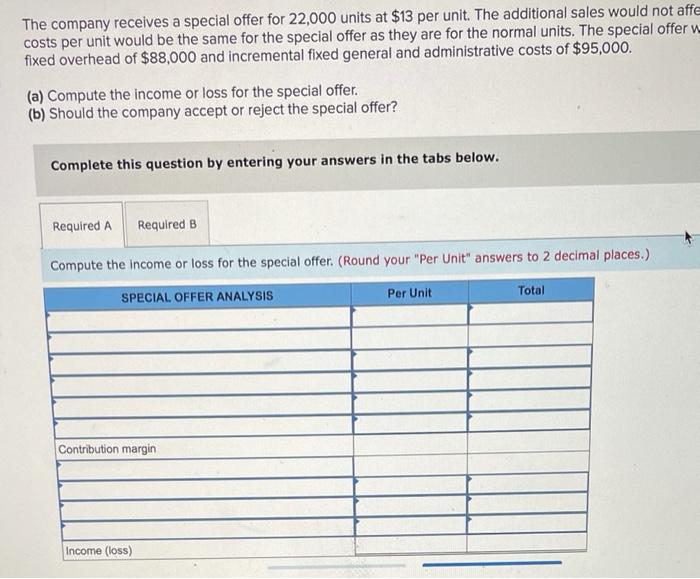

Farrow Company reports the following annual results. Per Unit $ 15.00 Contribution Margin Income Statement Annual Total Sales (220,000 units) $ 3,300,000 Variable costs Direct materials 2.00 440,000 Direct labor 4.00 880,000 Overhead 2.50 550,000 Contribution margin 6.50 1,430,000 Fixed costs Fixed overhead 2.00 440,000 Fixed general and administrative 330,000 Income $ 660,000 The company receives a special offer for 22,000 units at $13 per unit. The additional sales would not affect its normal sales. Variable costs per unit would be the same for the special offer as they are for the normal units. The special offer would require incremental fixed overhead of $88,000 and incremental fixed general and administrative costs of $95,000. (a) Compute the income or loss for the special offer. (b) should the company accept or reject the special offer? 1.50 $ 3.00 Complete this question by entering your answers in the tabs below. Required A Required B Compute the income or loss for the special offer. (Round your "Per Unit" answers to 2 decimal places) SPECIAL OFFER ANALYSIS Per Unit Total The company receives a special offer for 22,000 units at $13 per unit. The additional sales would not affe costs per unit would be the same for the special offer as they are for the normal units. The special offer fixed overhead of $88,000 and incremental fixed general and administrative costs of $95,000. (a) Compute the income or loss for the special offer. (b) Should the company accept or reject the special offer? Complete this question by entering your answers in the tabs below. Required A Required B Compute the income or loss for the special offer. (Round your "Per Unit" answers to 2 decimal places.) SPECIAL OFFER ANALYSIS Per Unit Total Contribution margin Income (loss) Fixed costs Fixed overhead Fixed general and administrative Income 2.00 1.50 440,000 330,000 $ 3.00 $ 660,000 The company receives a special offer for 22,000 units at $13 per unit. The additional sales would not costs per unit would be the same for the special offer as they are for the normal units. The special offe fixed overhead of $88,000 and incremental fixed general and administrative costs of $95,000. (a) Compute the income or loss for the special offer. (b) Should the company accept or reject the special offer? Complete this question by entering your answers in the tabs below. Required a Required B Should the company accept or reject the special offer? Should the company accept or reject the special offer?