Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Thanks guys. really need help for this question. and these steps are what this question needs to flow. Company M is a CCPC, Year end

Thanks guys. really need help for this question.

and these steps are what this question needs to flow.

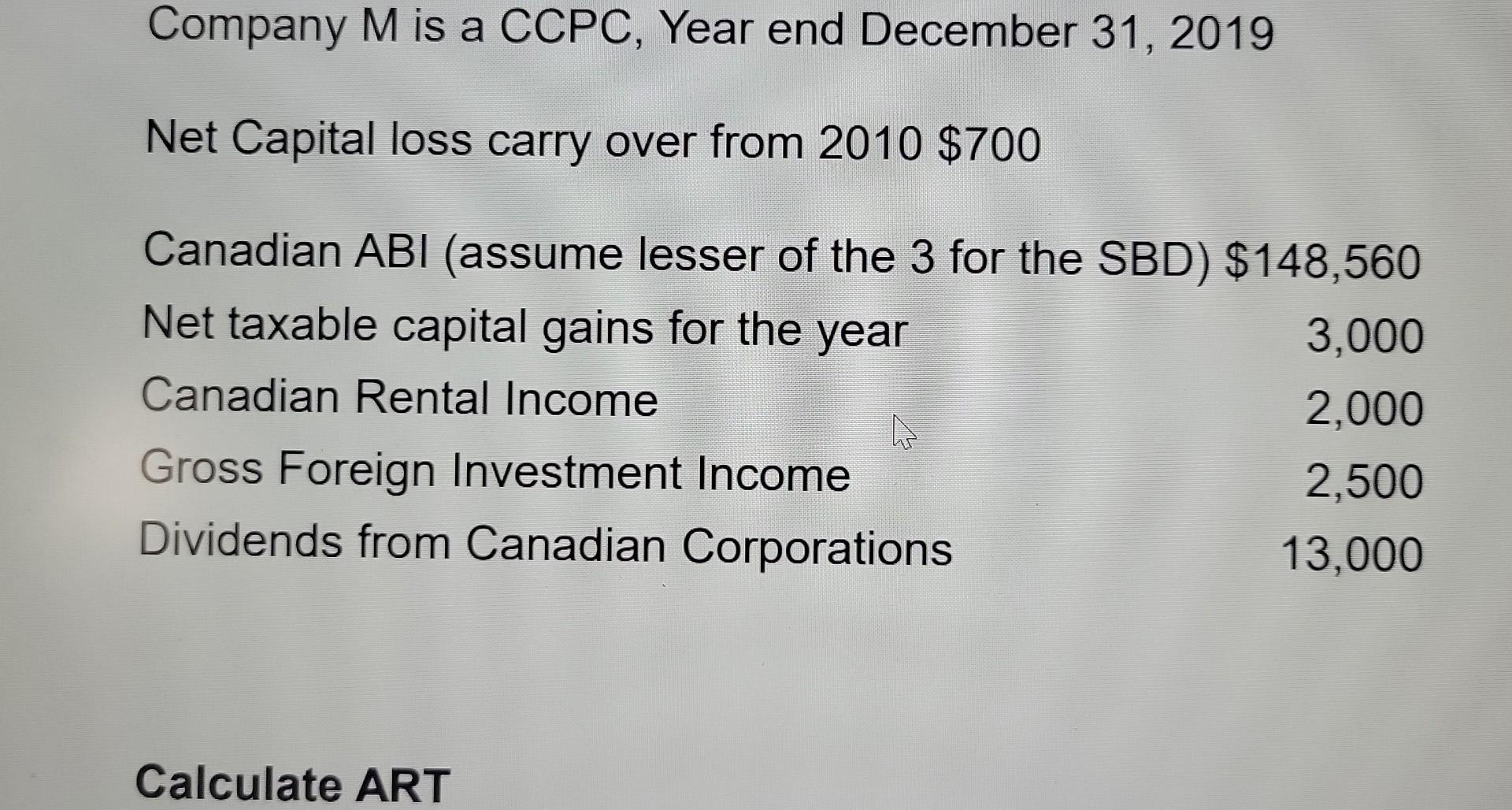

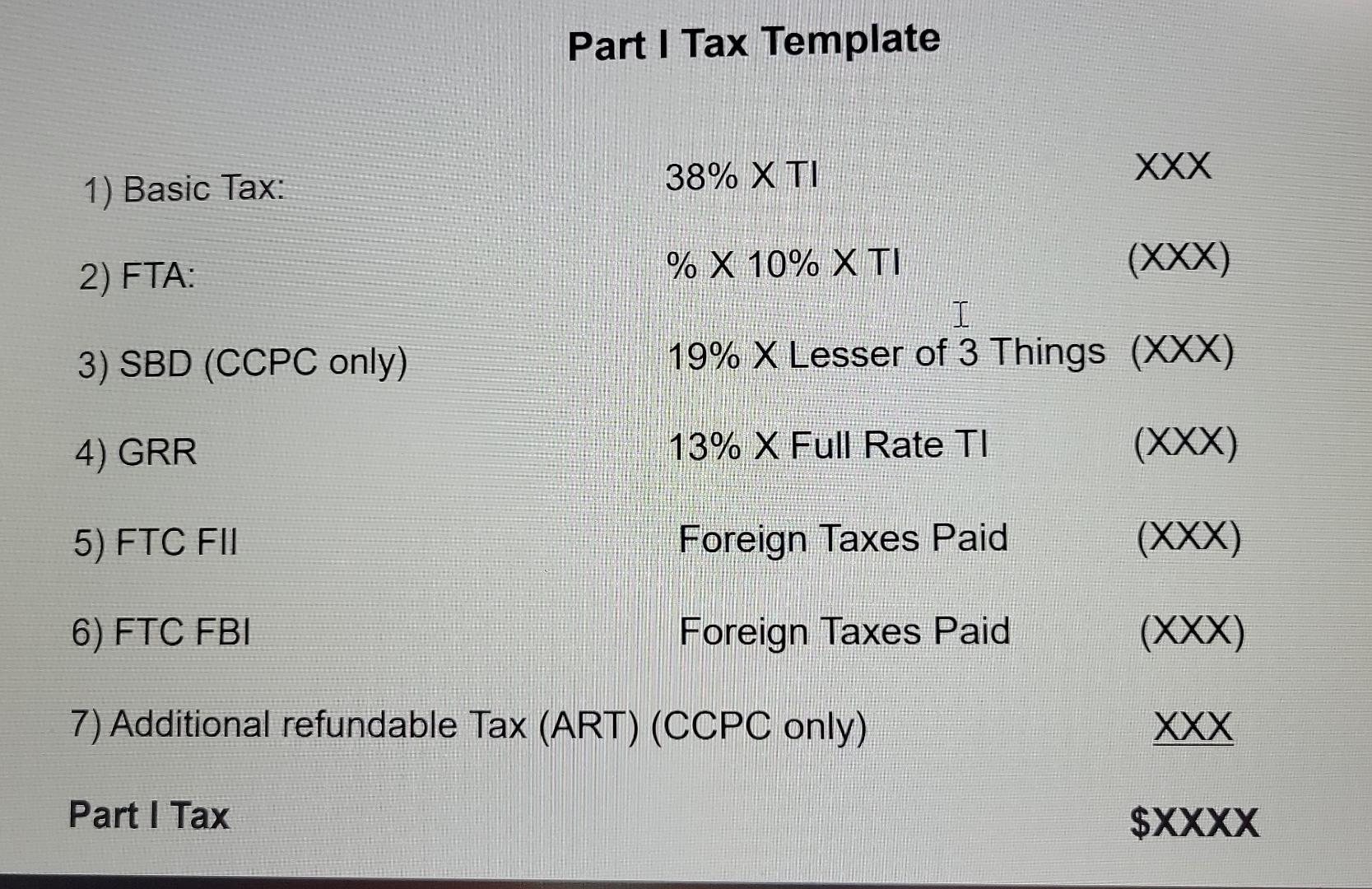

Company M is a CCPC, Year end December 31, 2019 Net Capital loss carry over from 2010$700 Canadian ABI (assume lesser of the 3 for the SBD) $148,560 Net taxable capital gains for the year 3,000 Canadian Rental Income 2,000 Gross Foreign Investment Income 2,500 Dividends from Canadian Corporations 13,000 Calculate ART Part I Tax Template 1) Basic Tax: 38%T1 2) FTA: %10%T1 (XX) 3) SBD (CCPC only) 19% Lesser of 3 Things (XXX) 4) GRR 13% Full Rate TI (XXX) 5) FTCFII Foreign Taxes Paid (XXX) 6) FTC FBl Foreign Taxes Paid (XX) 7) Additional refundable Tax (ART) (CCPC only) XXX Part I Tax $XXXXStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started