Answered step by step

Verified Expert Solution

Question

1 Approved Answer

fast Assignment Brief Completing Your Assignment What am I required to do in this assignment? Introduction Capital investment appraisal is concerned with organizational management decisions

fast

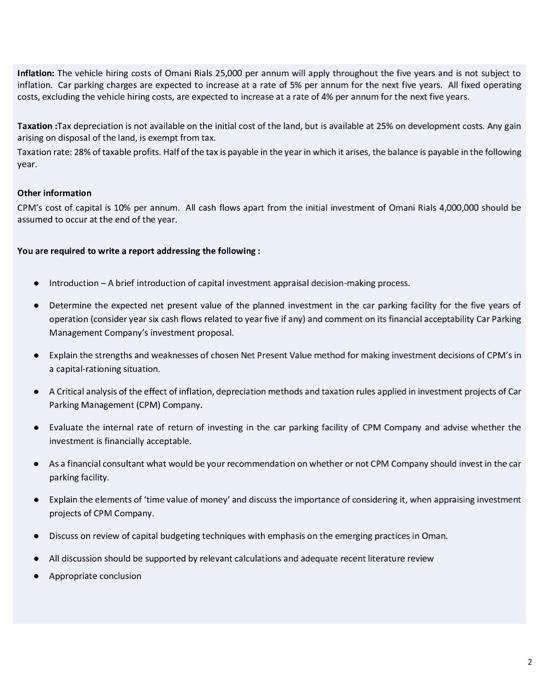

Assignment Brief Completing Your Assignment What am I required to do in this assignment? Introduction Capital investment appraisal is concerned with organizational management decisions about which projects or assets to invest in and how to finance them to achieve corporate goals. In relation to decision-making under conditions of risk and uncertainty, the purpose expressing an opinion about the likelihood of an event occurring is to facilitate the development of decision-making procedures that are explicit and consistent with the decision maker's beliefs. The purpose of the assignment is to apply the knowledge gained in the area of investment appraisal techniques including inflation and tax allowable depreciation Topic for your Report: Capital Investment Appraisal Please read the following case and write a report on investment proposal of Car Parking Management: City Parking Management (CPM) is a company managing car-parking facilities in key locations in Muscat and other major cities in the country. For this purpose, CPM secures land either by purchase or by entering into long-term lease agreements. A special feature of the facility provided by CPM is that it also operates a shuttle service from the car park to nearby locations CPM finds that there is a significant scarcity of car parking space in city center Muscat and is considering whether to purchase a piece of land available for sale. The land could be used to provide 60 car parking spaces. The cost of the land is Omani Rials 3,000,000 but further expenditure of Omani Rials 1,000,000 will be required immediately to develop the land to provide access roads and suitable surfacing for car parking. CPM is planning to operate the car park for five years. At the end of Year 5 the land will be sold for Omani Rials 5,000,000 at Year 5 prices. Revenues: It is estimated that the car park will operate at 75% capacity during each year of the project. Car Parking charges will depend on the prices being charged by competitors. There is a 40% chance that the price will be Omani Rial 325 per vehicle per week, a 30% chance the price will be Omani Rial 250 per vehicle per week and a 25% chance the price will be Omani Rial 400 per vehicle per week. CPM expects that it will earn a contribution to sales ratio of 80%. Assume 52 weeks per annum. Fixed operating costs: CPM will hire a number of vehicles to be used to provide the shuttle service. It is expected that the vehicle hiring costs will be Omani Rials 25,000 per annum. The company will hire a security system at a cost of Omani Rials 50,000 per annum and staff costs are estimated to be Omani Rial 175,000 per annum Inflation: The vehicle hiring costs of Omani Rials 25,000 per annum will apply throughout the five years and is not subject to inflation. Car parking charges are expected to increase at a rate of 5% per annum for the next five years. All fixed operating costs, excluding the vehicle hiring costs, are expected to increase at a rate of 4% per annum for the next five years. Taxation :Tax depreciation is not available on the initial cost of the land, but is available at 25% on development costs. Any gain arising on disposal of the land, is exempt from tax. Taxation rate: 28% of taxable profits. Half of the tax is payable in the year in which it arises, the balance is payable in the following year. Other information CPM's cost of capital is 10% per annum. All cash flows apart from the initial investment of Omani Rials 4,000,000 should be assumed to occur at the end of the year. You are required to write a report addressing the following: Introduction-Abrief introduction of capital investment appraisal decision-making process. Determine the expected net present value of the planned investment in the car parking facility for the five years of operation (consider year six cash flows related to year five if any) and comment on its financial acceptability Car Parking Management Company's investment proposal. Explain the strengths and weaknesses of chosen Net Present Value method for making investment decisions of CPM's in a capital-rationing situation A Critical analysis of the effect of inflation, depreciation methods and taxation rules applied in investment projects of Car Parking Management (CPM) Company. Evaluate the internal rate of return of investing in the car parking facility of CPM Company and advise whether the investment is financially acceptable. As a financial consultant what would be your recommendation on whether or not CPM Company should invest in the car parking facility Explain the elements of time value of money and discuss the importance of considering it, when appraising investment projects of CPM Company Discuss on review of capital budgeting techniques with emphasis on the emerging practices in Oman. All discussion should be supported by relevant calculations and adequate recent literature review Appropriate conclusion Your report should include a Title, Table of contents and References. You may make any suitable assumptions while writing the report. For Operational Guidelines refer to Student HandbookSection IV: ASSESSMENTS, Dellverables Submission Submission of the Group report will be done via Tumitin Link on MOVE. At the time of submission, you need to make sure that the assignment is your own and all the sources have been acknowledged Is there a word limit (Number of Words + 10%)? 2500 words (+/-10%) What do I need to do to pass? (Threshold Expectations) Discuss importance of performance management using information from both financial and non-financial perspective. Show an ability to use relevant theories, concepts and tools for Investment Appraisal and to make appropriate and informed decision. Apply the skill to appraise the performance of an entity, division or a manager using various performance evaluation techniques and suggest remedial measures. How do I produce high quality work that merits a higher grade? Critical reasoning is consistently evident across the discussions. The tasks have exemplary discussion and detailed narration. Evidence of exemplary understanding of relevant theory and research. Reference to appropriate theoretical background How does assignment relate to what we are doing in scheduled sessions? During the scheduled sessions, guidance and mini case discussions relating to various techniques for investment appraisal analysis and forecast the return on the investment and the return is subject to probable risks and uncertainties will be given. Assignment Brief Completing Your Assignment What am I required to do in this assignment? Introduction Capital investment appraisal is concerned with organizational management decisions about which projects or assets to invest in and how to finance them to achieve corporate goals. In relation to decision-making under conditions of risk and uncertainty, the purpose expressing an opinion about the likelihood of an event occurring is to facilitate the development of decision-making procedures that are explicit and consistent with the decision maker's beliefs. The purpose of the assignment is to apply the knowledge gained in the area of investment appraisal techniques including inflation and tax allowable depreciation Topic for your Report: Capital Investment Appraisal Please read the following case and write a report on investment proposal of Car Parking Management: City Parking Management (CPM) is a company managing car-parking facilities in key locations in Muscat and other major cities in the country. For this purpose, CPM secures land either by purchase or by entering into long-term lease agreements. A special feature of the facility provided by CPM is that it also operates a shuttle service from the car park to nearby locations CPM finds that there is a significant scarcity of car parking space in city center Muscat and is considering whether to purchase a piece of land available for sale. The land could be used to provide 60 car parking spaces. The cost of the land is Omani Rials 3,000,000 but further expenditure of Omani Rials 1,000,000 will be required immediately to develop the land to provide access roads and suitable surfacing for car parking. CPM is planning to operate the car park for five years. At the end of Year 5 the land will be sold for Omani Rials 5,000,000 at Year 5 prices. Revenues: It is estimated that the car park will operate at 75% capacity during each year of the project. Car Parking charges will depend on the prices being charged by competitors. There is a 40% chance that the price will be Omani Rial 325 per vehicle per week, a 30% chance the price will be Omani Rial 250 per vehicle per week and a 25% chance the price will be Omani Rial 400 per vehicle per week. CPM expects that it will earn a contribution to sales ratio of 80%. Assume 52 weeks per annum. Fixed operating costs: CPM will hire a number of vehicles to be used to provide the shuttle service. It is expected that the vehicle hiring costs will be Omani Rials 25,000 per annum. The company will hire a security system at a cost of Omani Rials 50,000 per annum and staff costs are estimated to be Omani Rial 175,000 per annum Inflation: The vehicle hiring costs of Omani Rials 25,000 per annum will apply throughout the five years and is not subject to inflation. Car parking charges are expected to increase at a rate of 5% per annum for the next five years. All fixed operating costs, excluding the vehicle hiring costs, are expected to increase at a rate of 4% per annum for the next five years. Taxation :Tax depreciation is not available on the initial cost of the land, but is available at 25% on development costs. Any gain arising on disposal of the land, is exempt from tax. Taxation rate: 28% of taxable profits. Half of the tax is payable in the year in which it arises, the balance is payable in the following year. Other information CPM's cost of capital is 10% per annum. All cash flows apart from the initial investment of Omani Rials 4,000,000 should be assumed to occur at the end of the year. You are required to write a report addressing the following: Introduction-Abrief introduction of capital investment appraisal decision-making process. Determine the expected net present value of the planned investment in the car parking facility for the five years of operation (consider year six cash flows related to year five if any) and comment on its financial acceptability Car Parking Management Company's investment proposal. Explain the strengths and weaknesses of chosen Net Present Value method for making investment decisions of CPM's in a capital-rationing situation A Critical analysis of the effect of inflation, depreciation methods and taxation rules applied in investment projects of Car Parking Management (CPM) Company. Evaluate the internal rate of return of investing in the car parking facility of CPM Company and advise whether the investment is financially acceptable. As a financial consultant what would be your recommendation on whether or not CPM Company should invest in the car parking facility Explain the elements of time value of money and discuss the importance of considering it, when appraising investment projects of CPM Company Discuss on review of capital budgeting techniques with emphasis on the emerging practices in Oman. All discussion should be supported by relevant calculations and adequate recent literature review Appropriate conclusion Your report should include a Title, Table of contents and References. You may make any suitable assumptions while writing the report. For Operational Guidelines refer to Student HandbookSection IV: ASSESSMENTS, Dellverables Submission Submission of the Group report will be done via Tumitin Link on MOVE. At the time of submission, you need to make sure that the assignment is your own and all the sources have been acknowledged Is there a word limit (Number of Words + 10%)? 2500 words (+/-10%) What do I need to do to pass? (Threshold Expectations) Discuss importance of performance management using information from both financial and non-financial perspective. Show an ability to use relevant theories, concepts and tools for Investment Appraisal and to make appropriate and informed decision. Apply the skill to appraise the performance of an entity, division or a manager using various performance evaluation techniques and suggest remedial measures. How do I produce high quality work that merits a higher grade? Critical reasoning is consistently evident across the discussions. The tasks have exemplary discussion and detailed narration. Evidence of exemplary understanding of relevant theory and research. Reference to appropriate theoretical background How does assignment relate to what we are doing in scheduled sessions? During the scheduled sessions, guidance and mini case discussions relating to various techniques for investment appraisal analysis and forecast the return on the investment and the return is subject to probable risks and uncertainties will be given

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started