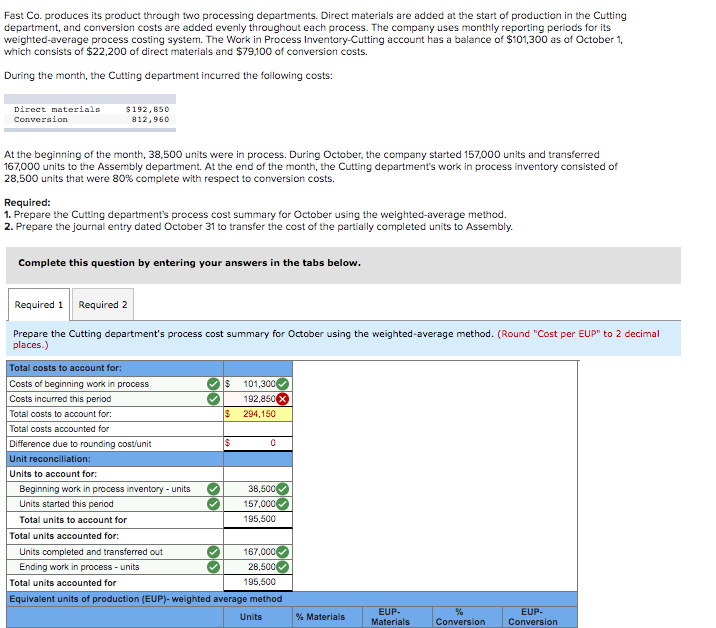

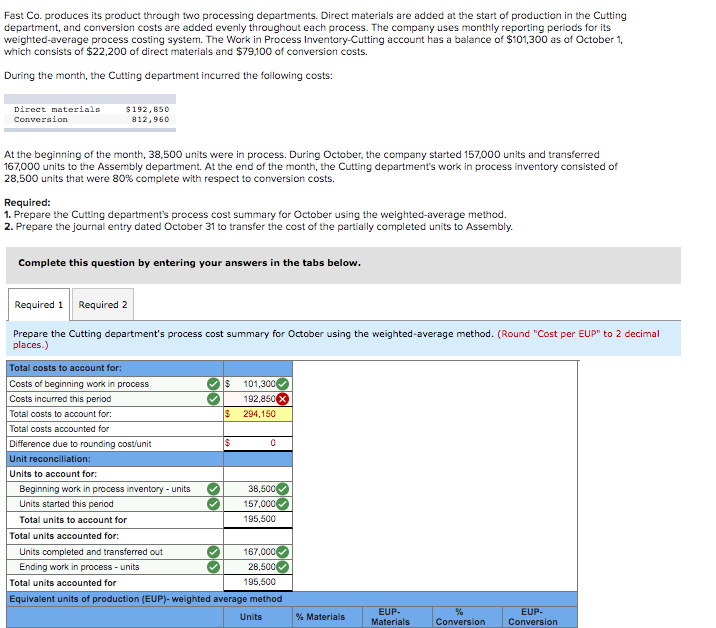

Fast Co. produces its product through two processing departments. Direct materials are added at the start of production in the Cutting department, and conversion costs are added evenly throughout each process. The company uses monthly reporting periods for its weighted-average process costing system. The Work in Process Inventory-Cutting account has a balance of $101,300 as of October 1, which consists of $22,200 of direct materials and $79,100 of conversion costs. During the month, the Cutting department incurred the following costs: Direct materials $ 192,850 Conversion 812,960 At the beginning of the month, 38,500 units were in process. During October, the company started 157,000 units and transferred 167,000 units to the Assembly department. At the end of the month, the Cutting department's work in process inventory consisted of 28,500 units that were 80% complete with respect to conversion costs. Required: 1. Prepare the Cutting department's process cost summary for October using the weighted-average method. 2. Prepare the journal entry dated October 31 to transfer the cost of the partially completed units to Assembly.

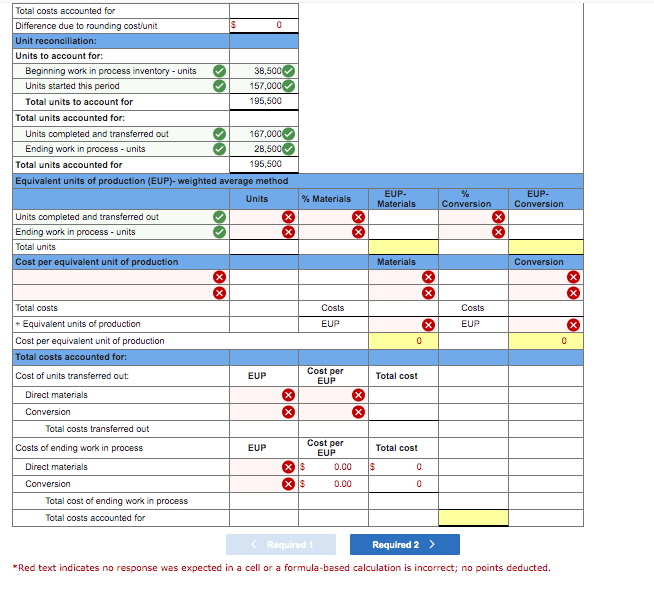

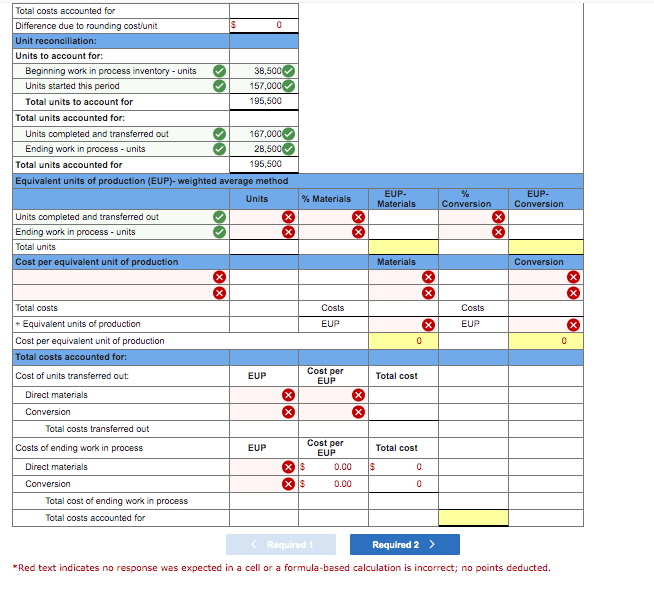

Fast Co. produces its product through two processing departments. Direct materials are added at the start of production in the Cutting department, and conversion costs are added evenly throughout each process. The company uses monthly reporting periods for its weighted-average process costing system. The Work in Process Inventory-Cutting account has a balance of $101,300 as of October 1, which consists of $22,200 of direct materials and $79,100 of conversion costs. During the month, the Cutting department incurred the following costs: Direct materials Conversion $ 192,850 812,960 At the beginning of the month, 38,500 units were in process. During October, the company started 157,000 units and transferred 167,000 units to the Assembly department. At the end of the month, the Cutting department's work in process inventory consisted of 28,500 units that were 80% complete with respect to conversion costs. Required: 1. Prepare the Cutting department's process cost summary for October using the weighted-average method. 2. Prepare the journal entry dated October 31 to transfer the cost of the partially completed units to Assembly. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare the Cutting department's process cost summary for October using the weighted average method. (Round "Cost per EUP" to 2 decimal places.) Total costs to account for: Costs of beginning work in process $ 101,300 Costs incurred this period 192,850 x Total costs to account for: $ 294,150 Total costs accounted for Difference due to rounding cost/unit IS 0 Unit reconciliation: Units to account for: Beginning work in process inventory - units 36,500 Units started this period 157,000 Total units to account for 195,500 Total units accounted for: Units completed and transferred out 167,000 Ending work in process - units 26,500 Total units accounted for 195,500 Equivalent units of production (EUP)- weighted average method Units % Materials EUP- Materials Conversion EUP- Conversion Total costs accounted for Difference due to rounding cost/unit 0 Unit reconciliation: Units to account for: Beginning work in process inventory - units 38,500 Units started this period 157,000 Total units to account for 195,500 Total units accounted for: Units completed and transferred out 167,000 Ending work in process- units 28,500 Total units accounted for 195,500 Equivalent units of production (EUP)-weighted average method Units Units completed and transferred out X Ending work in process - units Total units Cost per equivalent unit of production % Materials EUP- Materials Conversion EUP- Conversion Materials Conversion x X Costs Costs EUP X EUP X Total costs + Equivalent units of production Cost per equivalent unit of production Total costs accounted for: EUP Cost per EUP Total cost Cost of units transferred out: Direct materials Conversion Total costs transferred out Costs of ending work in process Direct materials Cost per EUP Total cost EUP 0.00 x $ IS 0 x $ 0.00 0 Conversion Total cost of ending work in process Total costs accounted for Required 1 Required 2 > *Red text indicates no response was expected in a cell or a formula-based calculation is incorrect; no points deducted