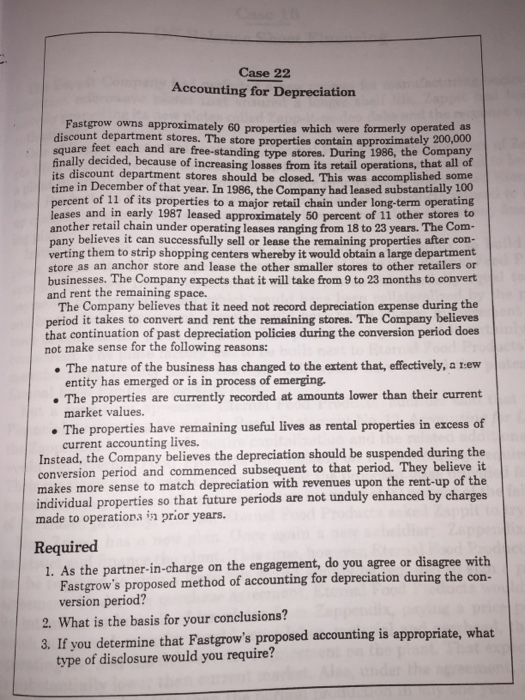

Fastgrow owns approximately 60 properties which were formerly operated as discount department stores. The store properties contain approximately 200,000 square feet each and are free-standing type stores. During 1986 the Company finally decided, because of increasing looses from its retail operations, that all of its discount department stores should be closed. This was accomplished some, time in December of that year. In 1986, the Company had leased substantially 100 percent of 11 of its properties to a major retail chain under long-term operating leases and in early 1987 leased approximately 50 percent of 11 other stores to another retail chain under operating leases ranging from 18 to 23 years. The Company believes it can successfully sell or lease the remaining properties after converting them to strip shopping centers whereby it would obtain a large department store as an anchor store and lease the other smaller stores to other retailers or businesses. The Company expects that it will take from 9 to 23 months to convert and rent the remaining space. The Company believes that it need not record depreciation expense during the period it takes to convert and rent the remaining stores. The Company believes that continuation of past depreciation policies during the conversion period does not make sense for the following reasons: The nature of the business has changed to the extent that, effectively, i-ew entity has emerged or is in process of emerging. The properties are currently recorded at amounts lower than their current market values. The properties have remaining useful lives as rental properties in excess of current accounting lives. Instead, the Company believes the depreciation should be suspended during the conversion period and commenced subsequent to that period. They believe it makes more sense to match depreciation with revenues upon the rent-up of the individual properties so that future periods are not unduly enhanced by charges made to operation in prior years. As the partner in-charge on the engagement, do you agree or disagree with Fastgrow's proposed method of accounting for depreciation during the conversion period? What is the basis for your conclusions? If you determine that Fastgrow's proposed accounting U appropriate, what type of disclosure would you require