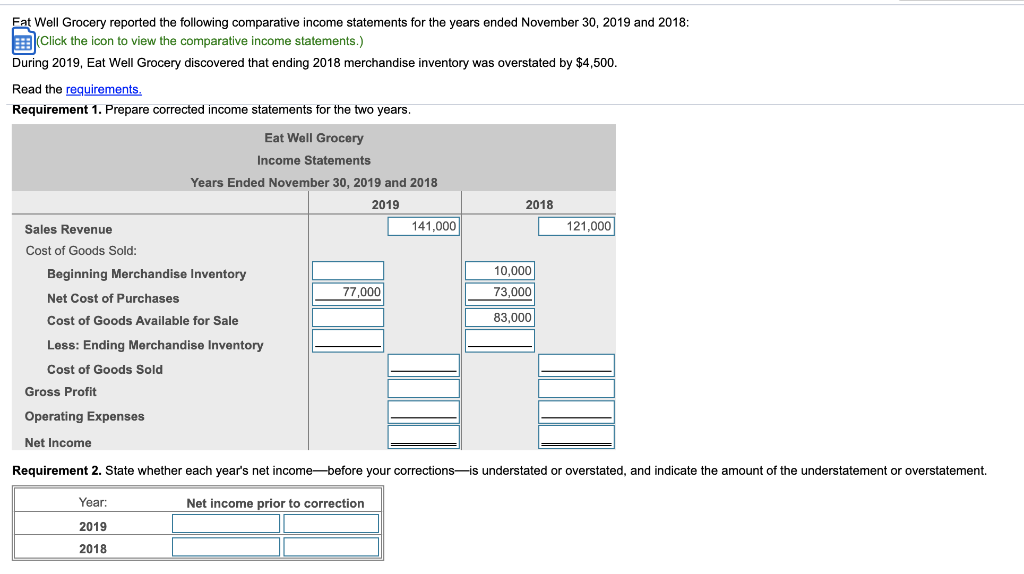

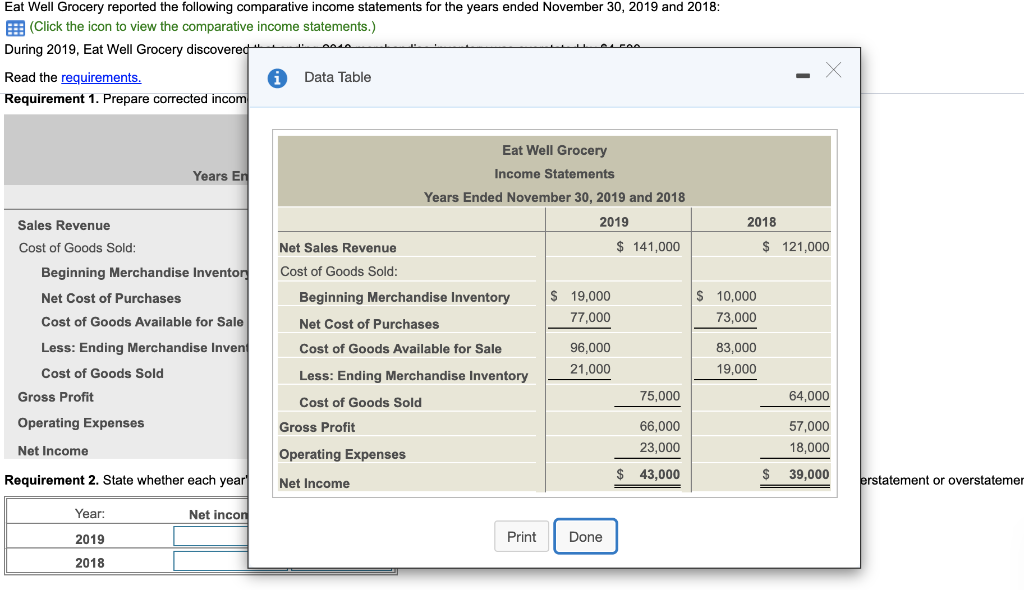

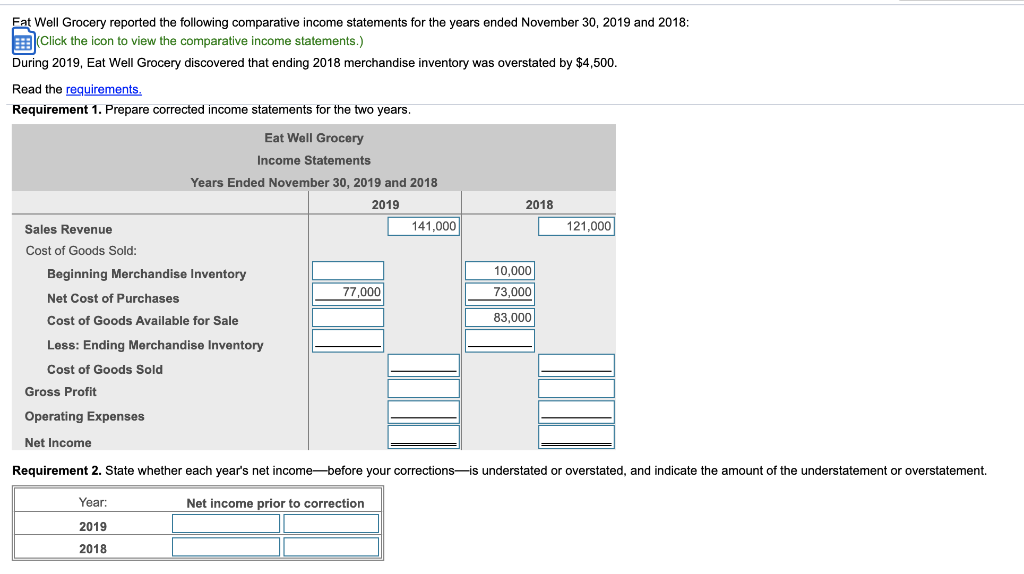

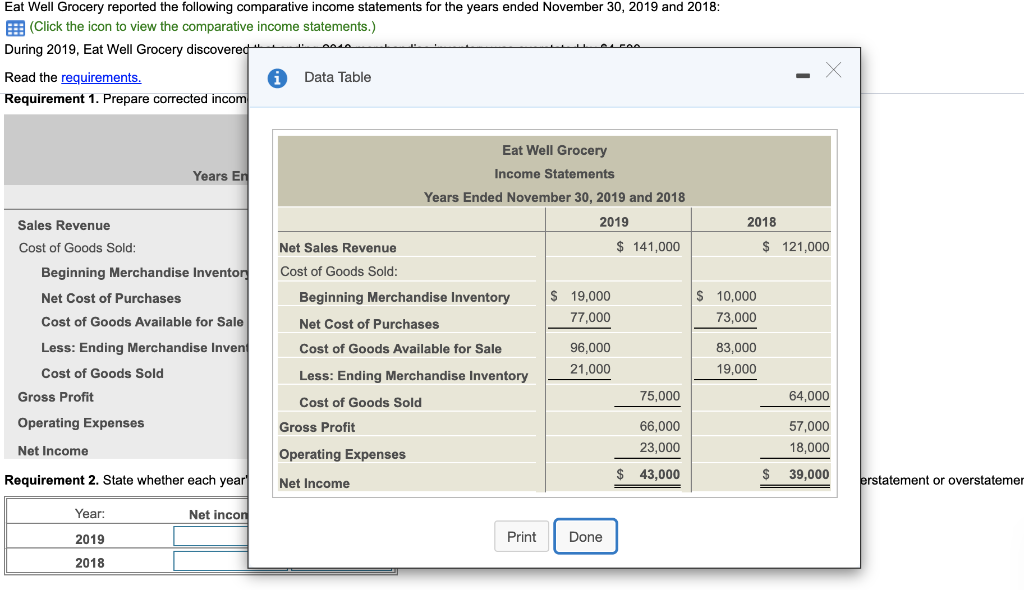

Fat Well Grocery reported the following comparative income statements for the years ended November 30, 2019 and 2018: Click the icon to view the comparative income statements.) During 2019, Eat Well Grocery discovered that ending 2018 merchandise inventory was overstated by $4,500. Read the requirements. Requirement 1. Prepare corrected income statements for the two years. 2018 121,000 Eat Well Grocery Income Statements Years Ended November 30, 2019 and 2018 2019 Sales Revenue 141,000 Cost of Goods Sold: Beginning Merchandise Inventory 77,000 Net Cost of Purchases Cost of Goods Available for Sale Less: Ending Merchandise Inventory Cost of Goods Sold Gross Profit 10,000 73,000 83,000 Operating Expenses Net Income Requirement 2. State whether each year's net income-before your correctionsis understated or overstated, and indicate the amount of the understatement or overstatement. Year: Net income prior to correction 2019 2018 Eat Well Grocery reported the following comparative income statements for the years ended November 30, 2019 and 2018: (Click the icon to view the comparative income statements.) During 2019, Eat Well Grocery discovered Read the requirements, Data Table Requirement 1. Prepare corrected incom Eat Well Grocery Years En Income Statements Years Ended November 30, 2019 and 2018 2019 2018 Sales Revenue Cost of Goods Sold: Beginning Merchandise Inventor $ 141,000 $ 121,000 Net Sales Revenue Cost of Goods Sold: Net Cost of Purchases Beginning Merchandise Inventory Net Cost of Purchases $ 19,000 77,000 $ 10,000 73,000 Cost of Goods Available for Sale Less: Ending Merchandise Inven Cost of Goods Available Sale 96,000 21,000 83,000 19,000 Cost of Goods Sold Less: Ending Merchandise Inventory Cost of Goods Sold Gross Profit 75,000 64,000 Gross Profit Operating Expenses Net Income 66,000 23,000 57,000 18,000 Operating Expenses $ $ 43,000 39,000 Requirement 2. State whether each year Net Income erstatement or overstatemer Year: Net incon 2019 Print Done Done 2018 CAA Eat Well Grocery reported the following comparative income statements for the years ended November 30, 2019 and 2018: B (Click the icon to view the comparative income statements.) During 2019, Eat Well Grocery discovered Read the requirements. Data Table Requirement 1. Prepare corrected incom Eat Well Grocery Income Statements Years En Years Ended November 30 2019 and 2018 i Requirements Sales Revenue Cost of Goods Sold: Beginning Merchandise Inventory Net Cost of Purchases Cost of Goods Available for Sale 1. 2. Prepare corrected income statements for the two years. State whether each year's net income-before your correctionsis understated or overstated, and indicate the amount of the understatement or overstatement. Less: Ending Merchandise Invent Cost of Goods Sold Print Done Gross Profit Operating Expenses Gross Profit 66,000 23,000 57,000 18,000 Net Income Operating Expenses $ Requirement 2. State whether each year $ 43,000 39,000 Net Income erstatement or overstate Year: Net incon 2019 Print Done 2018