Answered step by step

Verified Expert Solution

Question

1 Approved Answer

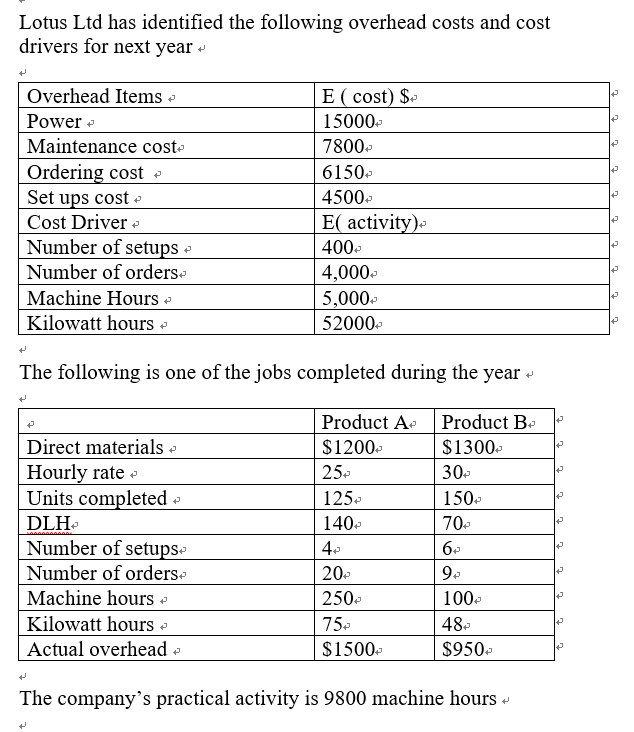

FBC means Function-Based Costing Lotus Ltd has identified the following overhead costs and cost drivers for next year + Overhead Items Power Maintenance cost- Ordering

FBC means Function-Based Costing

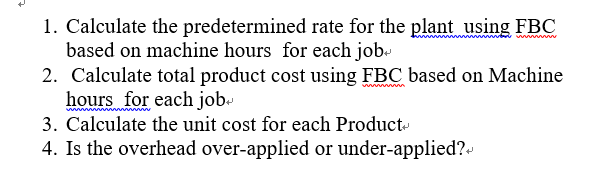

Lotus Ltd has identified the following overhead costs and cost drivers for next year + Overhead Items Power Maintenance cost- Ordering cost- Set ups cost - Cost Driver Number of setups Number of orders- Machine Hours Kilowatt hours E ( cost) $. 15000 7800- 6150- 4500- E( activity) 400- 4,000 5,000- 52000- + The following is one of the jobs completed during the year - + t Product B- $1300- 30- 150- 70- 2 Direct materials - Hourly rate Units completed DLH Number of setups: Number of orders Machine hours Kilowatt hours Actual overhead Product A- $1200- 25. 125- 140- 4 20- 250- 75 $1500- 6. + + 9. 100+ 48- $950- + t The company's practical activity is 9800 machine hours- 1. Calculate the predetermined rate for the plant using FBC based on machine hours for each job- 2. Calculate total product cost using FBC based on Machine hours for each job- 3. Calculate the unit cost for each Product- 4. Is the overhead over-applied or under-appliedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started