FCFF for year 0 is 1,341,000.00,the expected growth rate in operating income=6.46%, WACC=7%, mv of debt is 12,968,000, shares outstanding=904,330,000. Please do a high growth, stable growth and fcff valuation like in the example

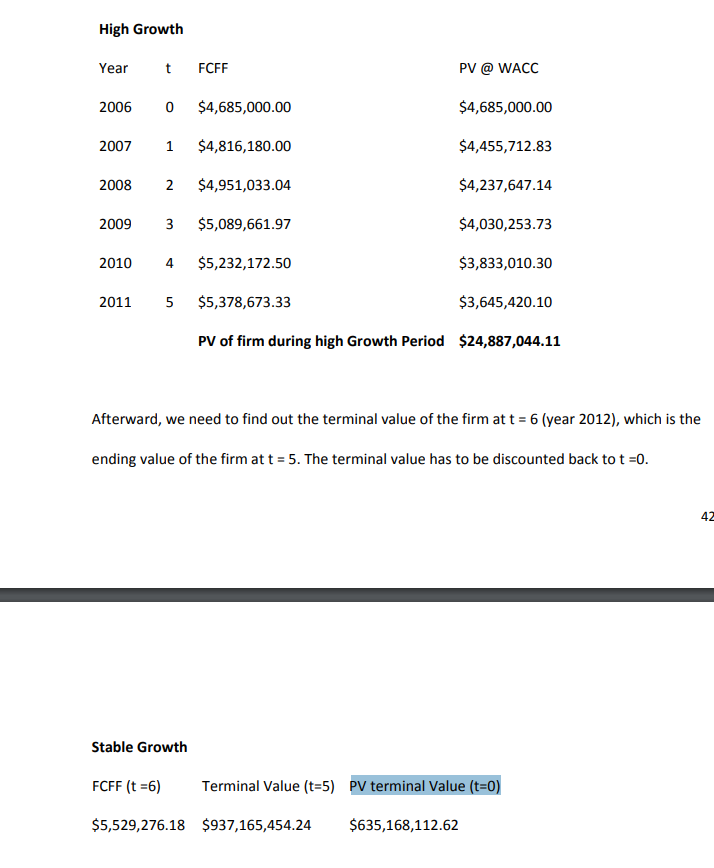

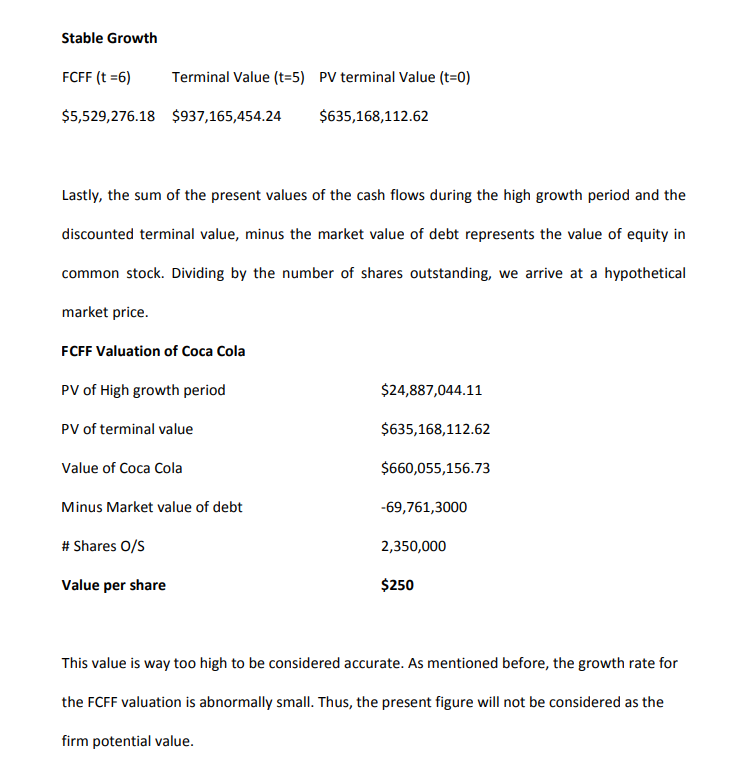

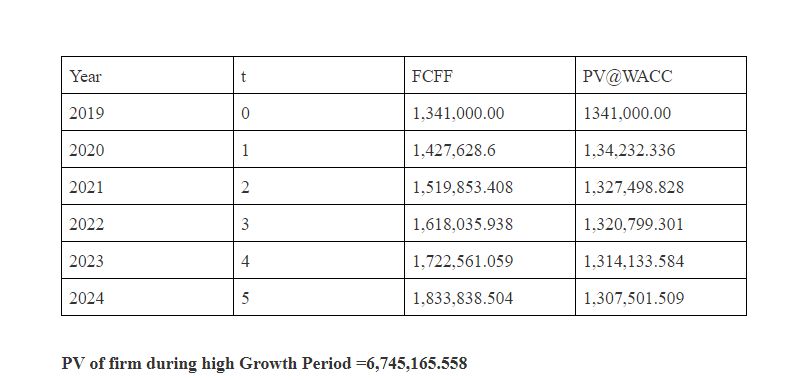

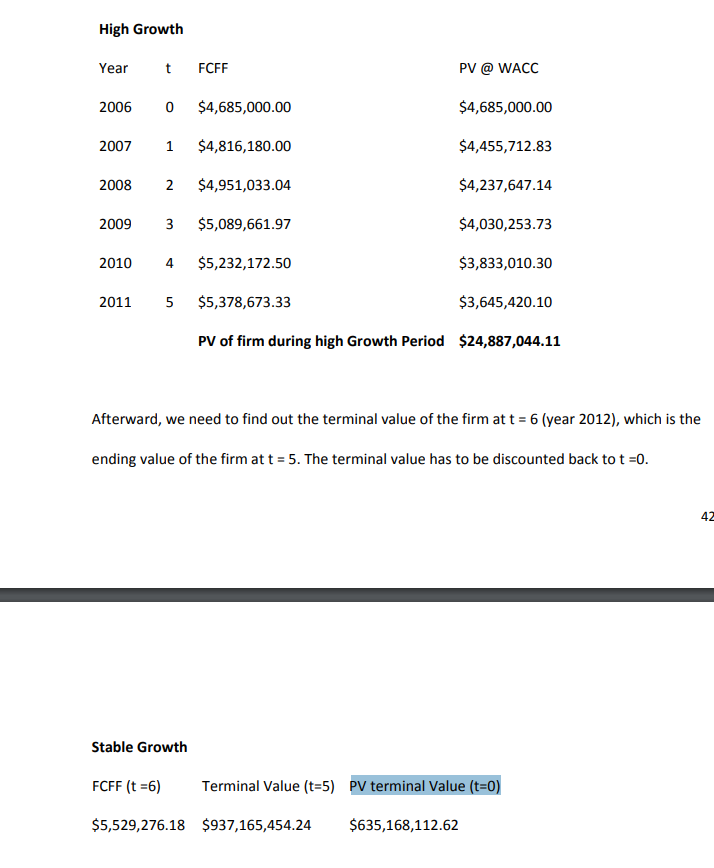

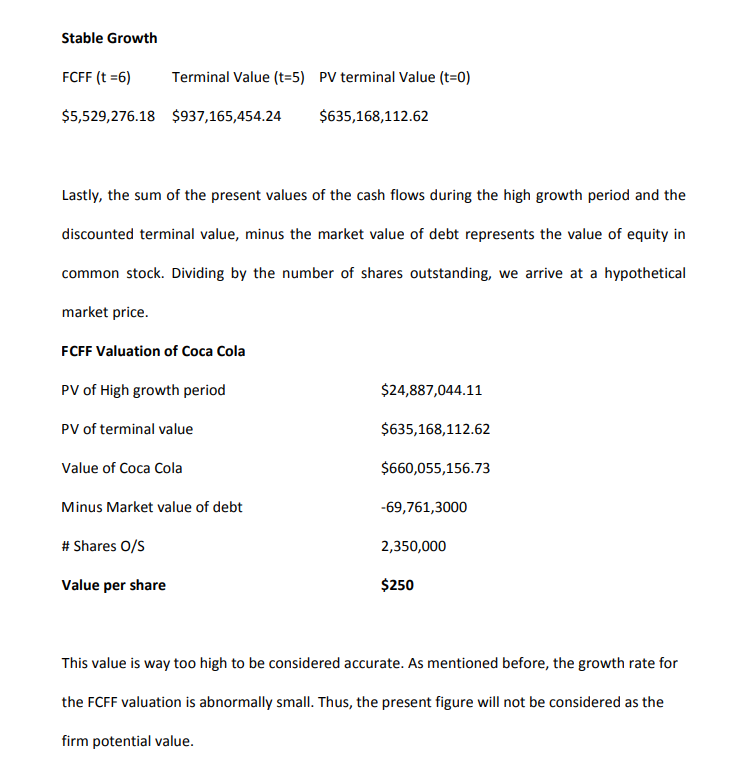

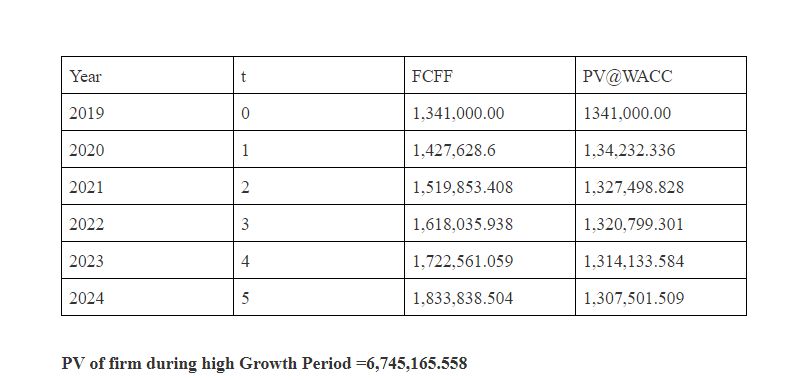

High Growth Yeart FCFF PV @ WACC 2006 0 $4,685,000.00 $4,685,000.00 2007 1 $4,816,180.00 $4,455,712.83 2008 2 $4,951,033.04 $4,237,647.14 2009 3 $5,089,661.97 $4,030,253.73 $3,833,010.30 2010 2011 4 5 $5,232,172.50 $5,378,673.33 $3,645,420.10 PV of firm during high Growth Period $24,887,044.11 Afterward, we need to find out the terminal value of the firm at t = 6 (year 2012), which is the ending value of the firm at t = 5. The terminal value has to be discounted back to t =0. Stable Growth FCFF (t =6) Terminal Value (t=5) PV terminal Value (t=0) $5,529,276.18 $937,165,454.24 $635,168,112.62 Stable Growth FCFF (t =6) Terminal Value (t=5) PV terminal Value (t=0) $5,529,276.18 $937,165,454.24 $635,168,112.62 Lastly, the sum of the present values of the cash flows during the high growth period and the discounted terminal value, minus the market value of debt represents the value of equity in common stock. Dividing by the number of shares outstanding, we arrive at a hypothetical market price. FCFF Valuation of Coca Cola PV of High growth period $24,887,044.11 PV of terminal value $635,168,112.62 Value of Coca Cola $660,055,156.73 Minus Market value of debt -69,761,3000 # Shares O/S 2,350,000 Value per share $250 This value is way too high to be considered accurate. As mentioned before, the growth rate for the FCFF valuation is abnormally small. Thus, the present figure will not be considered as the firm potential value. Year FCFF PV@WACC 2019 1,341,000.00 1341,000.00 2020 1,427,628.6 1,34.232.336 2021 1,519,853.408 1,327,498.828 2022 1,618,035.938 1,320,799.301 2023 1,722,561.059 1,314,133.584 2024 1.833,838.504 1,307,501.509 PV of firm during high Growth Period =6,745,165.558 High Growth Yeart FCFF PV @ WACC 2006 0 $4,685,000.00 $4,685,000.00 2007 1 $4,816,180.00 $4,455,712.83 2008 2 $4,951,033.04 $4,237,647.14 2009 3 $5,089,661.97 $4,030,253.73 $3,833,010.30 2010 2011 4 5 $5,232,172.50 $5,378,673.33 $3,645,420.10 PV of firm during high Growth Period $24,887,044.11 Afterward, we need to find out the terminal value of the firm at t = 6 (year 2012), which is the ending value of the firm at t = 5. The terminal value has to be discounted back to t =0. Stable Growth FCFF (t =6) Terminal Value (t=5) PV terminal Value (t=0) $5,529,276.18 $937,165,454.24 $635,168,112.62 Stable Growth FCFF (t =6) Terminal Value (t=5) PV terminal Value (t=0) $5,529,276.18 $937,165,454.24 $635,168,112.62 Lastly, the sum of the present values of the cash flows during the high growth period and the discounted terminal value, minus the market value of debt represents the value of equity in common stock. Dividing by the number of shares outstanding, we arrive at a hypothetical market price. FCFF Valuation of Coca Cola PV of High growth period $24,887,044.11 PV of terminal value $635,168,112.62 Value of Coca Cola $660,055,156.73 Minus Market value of debt -69,761,3000 # Shares O/S 2,350,000 Value per share $250 This value is way too high to be considered accurate. As mentioned before, the growth rate for the FCFF valuation is abnormally small. Thus, the present figure will not be considered as the firm potential value. Year FCFF PV@WACC 2019 1,341,000.00 1341,000.00 2020 1,427,628.6 1,34.232.336 2021 1,519,853.408 1,327,498.828 2022 1,618,035.938 1,320,799.301 2023 1,722,561.059 1,314,133.584 2024 1.833,838.504 1,307,501.509 PV of firm during high Growth Period =6,745,165.558