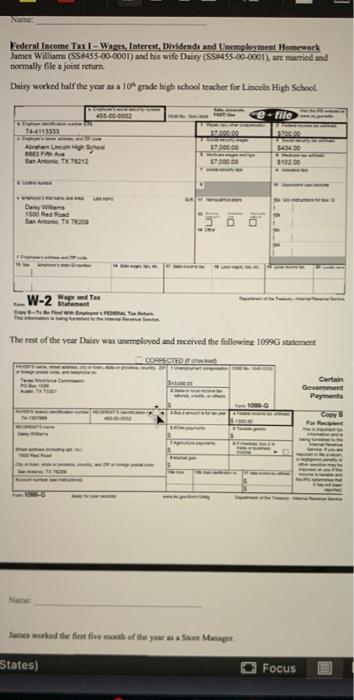

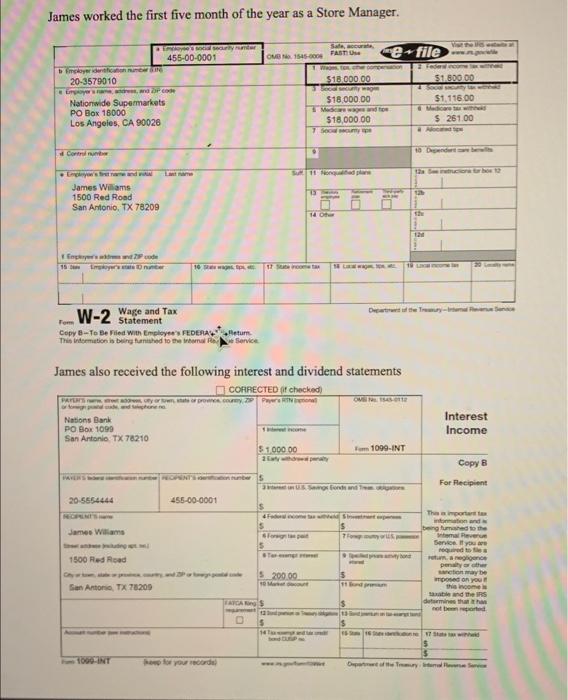

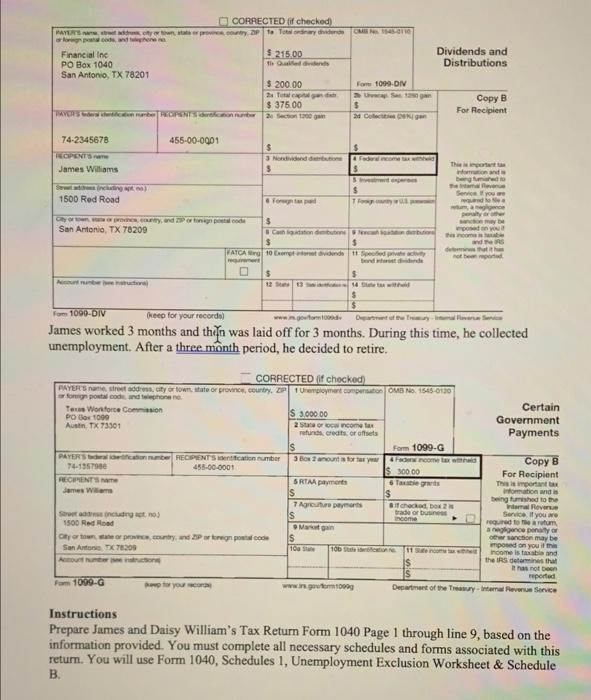

Federal Income Tail - Wages, Interest, Dividends and Unemployment Homework James Williams (SS1455-00-0001) and his wife Daisy (SS1455-00-0001 are married and normally file a joint return. Daisy worked half the year a 10 grade high school teacher for Lincoln High School 40.000002 e-file MARA 24-0112333 Abraham Linco FA San Antonio TX 7212 FRA 1700000 97.500.00 11000 Das Wien 300 Ned Road San Anton TX 78200 W-2 Statement The rest of the vour Daisy was unemployed and received the following 1099 statement CORREGID Certain Government Payments Copy Jures worked the fast five math of the year Store Manager States) Focus James worked the first five month of the year as a Store Manager. V e file 455-00-0001 mythm 20-3579010 $1.800.00 OM 1545-000 FASTU om $18.000.00 SO $18,000.00 Mwandos $18,000.00 Type Nationwide Supermarkets PO Box 18000 Los Angeles, CA 90026 $1,116.00 Mac with $ 261.00 . Control James Williams 1500 Red Rond San Antonio, TX 78209 TO he gerode 15 10 W W-2 Ware and Tax Statement Copy B-To Be Filed with Employees FEDERALS Retum This domation is being tanished to the norm Service James also received the following interest and dividend statements CORRECTED (t checked sorme y Pro PRU Nations Bank PO Box 1090 San Antonio TX 78210 Interest Income $ 1 000 00 Fum 1099-INT Copy B 3. godine For Recipient 20-5654444 455-00-0001 s James Williams Song 7 1500 Red Road Their ion and ngushed to the Save Serye ed to romance penyora action may be posed on you this in and the determines that noted S200.00 San Antonio, TX 78209 ACAS 13 D 14 10-INT for your recorded CORRECTED ff checked) Yaya DP to Towary hende 14.00 logo Financial Inc $ 215.00 PO Box 1040 Thaalaa San Antonio, TX 78201 $ 200.00 For 1090-DIV 2. Tutti US 13 $ 375.00 $ MYCASTROINTS no es Dividends and Distributions Copy B For Recipient 74-2345678 455-00-0001 $ 3 Mondividendo $ James Williams Thino woman gumo Taman See you 1500 Red Road o forte To Goy, and Pood San Antonio, TX 78209 $ Gation de bande ATGA 10 metrov 11 Speed duh not be $ $ Arun 12 13 14 with $ $ From 1000-DIV Qeep for your recorda) www.nowforde James worked 3 months and then was laid off for 3 months. During this time, he collected unemployment. After a three month period, he decided to retire. CORRECTED (if chocked PAYERS are stroos, ty or town, thate or province, Cory ZP TUreno more compensation OMSO. 15480130 s for postcode and phone Tous Workforce Common Certain PO Box 1090 S 3.000.00 Government Austin, TX 73301 2 State or to income tax refunds creditor of Payments S Form 1099-G PAYERS REOPENT Section Sumber 3 Bosna torta Ancome taxe Copy B 74-1959 453-00-0001 $300.00 For Recipient RECIPIENTS SRTAA payments This important to James Wilme IS information is being furnished to the 7 Aguropa BitcheckOX 2 harul Revenue Sretning no) S trade or buses Service. If you come Pored to the autum, 1500 Red Hood Sagan agence pony Cortonate or country. Prognose S sanction may be imposed on your San Antonie 17078209 TORG 111 Income is that ind the IRS de It has not been reported Fm 1099-G to you www.goo1000 Decret of the Treasury Revenue Service TOS Instructions Prepare James and Daisy William's Tax Return Form 1040 Page 1 through line 9, based on the information provided. You must complete all necessary schedules and forms associated with this return. You will use Form 1040, Schedules 1, Unemployment Exclusion Worksheet & Schedule B. Federal Income Tail - Wages, Interest, Dividends and Unemployment Homework James Williams (SS1455-00-0001) and his wife Daisy (SS1455-00-0001 are married and normally file a joint return. Daisy worked half the year a 10 grade high school teacher for Lincoln High School 40.000002 e-file MARA 24-0112333 Abraham Linco FA San Antonio TX 7212 FRA 1700000 97.500.00 11000 Das Wien 300 Ned Road San Anton TX 78200 W-2 Statement The rest of the vour Daisy was unemployed and received the following 1099 statement CORREGID Certain Government Payments Copy Jures worked the fast five math of the year Store Manager States) Focus James worked the first five month of the year as a Store Manager. V e file 455-00-0001 mythm 20-3579010 $1.800.00 OM 1545-000 FASTU om $18.000.00 SO $18,000.00 Mwandos $18,000.00 Type Nationwide Supermarkets PO Box 18000 Los Angeles, CA 90026 $1,116.00 Mac with $ 261.00 . Control James Williams 1500 Red Rond San Antonio, TX 78209 TO he gerode 15 10 W W-2 Ware and Tax Statement Copy B-To Be Filed with Employees FEDERALS Retum This domation is being tanished to the norm Service James also received the following interest and dividend statements CORRECTED (t checked sorme y Pro PRU Nations Bank PO Box 1090 San Antonio TX 78210 Interest Income $ 1 000 00 Fum 1099-INT Copy B 3. godine For Recipient 20-5654444 455-00-0001 s James Williams Song 7 1500 Red Road Their ion and ngushed to the Save Serye ed to romance penyora action may be posed on you this in and the determines that noted S200.00 San Antonio, TX 78209 ACAS 13 D 14 10-INT for your recorded CORRECTED ff checked) Yaya DP to Towary hende 14.00 logo Financial Inc $ 215.00 PO Box 1040 Thaalaa San Antonio, TX 78201 $ 200.00 For 1090-DIV 2. Tutti US 13 $ 375.00 $ MYCASTROINTS no es Dividends and Distributions Copy B For Recipient 74-2345678 455-00-0001 $ 3 Mondividendo $ James Williams Thino woman gumo Taman See you 1500 Red Road o forte To Goy, and Pood San Antonio, TX 78209 $ Gation de bande ATGA 10 metrov 11 Speed duh not be $ $ Arun 12 13 14 with $ $ From 1000-DIV Qeep for your recorda) www.nowforde James worked 3 months and then was laid off for 3 months. During this time, he collected unemployment. After a three month period, he decided to retire. CORRECTED (if chocked PAYERS are stroos, ty or town, thate or province, Cory ZP TUreno more compensation OMSO. 15480130 s for postcode and phone Tous Workforce Common Certain PO Box 1090 S 3.000.00 Government Austin, TX 73301 2 State or to income tax refunds creditor of Payments S Form 1099-G PAYERS REOPENT Section Sumber 3 Bosna torta Ancome taxe Copy B 74-1959 453-00-0001 $300.00 For Recipient RECIPIENTS SRTAA payments This important to James Wilme IS information is being furnished to the 7 Aguropa BitcheckOX 2 harul Revenue Sretning no) S trade or buses Service. If you come Pored to the autum, 1500 Red Hood Sagan agence pony Cortonate or country. Prognose S sanction may be imposed on your San Antonie 17078209 TORG 111 Income is that ind the IRS de It has not been reported Fm 1099-G to you www.goo1000 Decret of the Treasury Revenue Service TOS Instructions Prepare James and Daisy William's Tax Return Form 1040 Page 1 through line 9, based on the information provided. You must complete all necessary schedules and forms associated with this return. You will use Form 1040, Schedules 1, Unemployment Exclusion Worksheet & Schedule B