Answered step by step

Verified Expert Solution

Question

1 Approved Answer

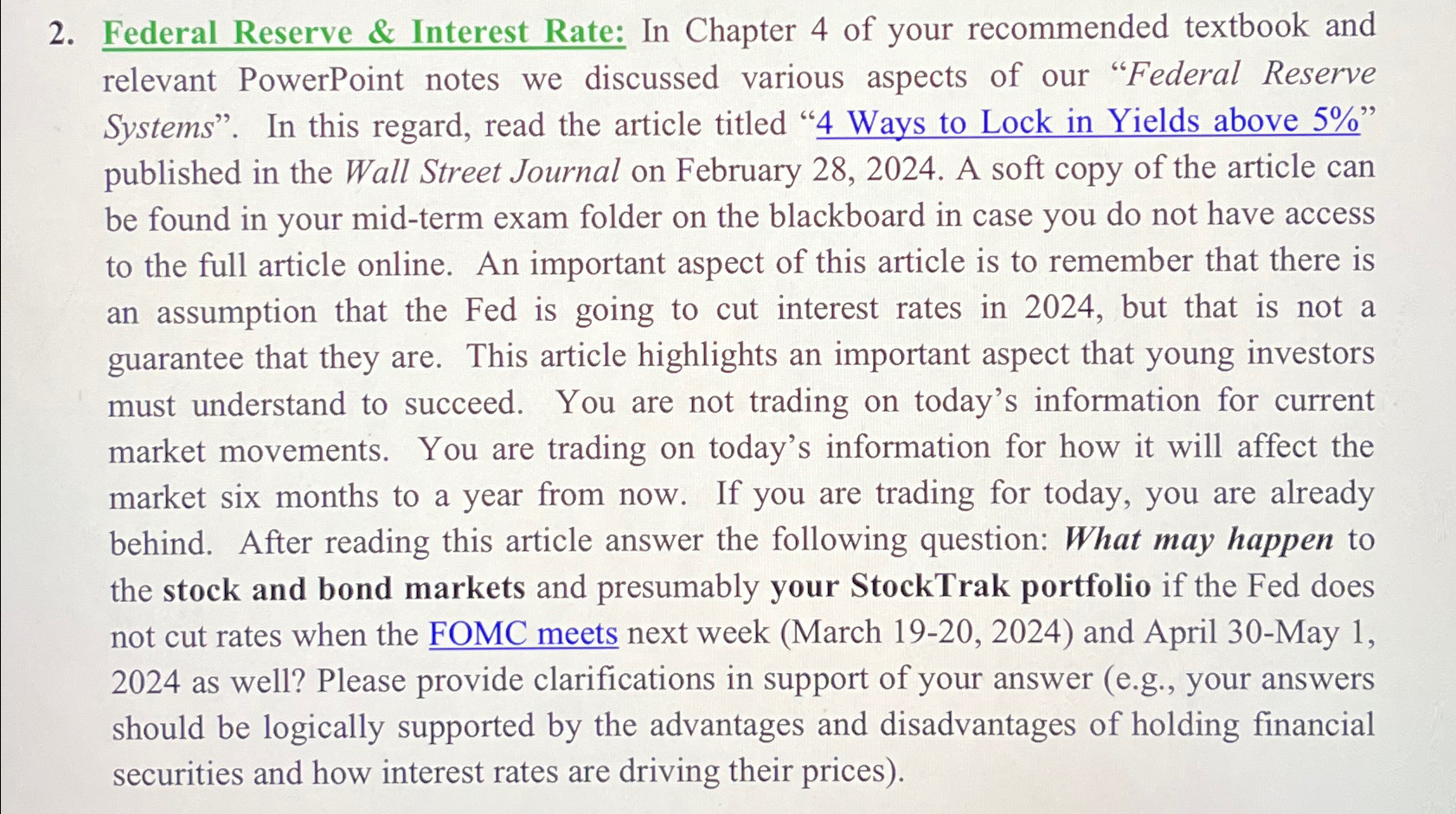

Federal Reserve & Interest Rate: In Chapter 4 of your recommended textbook and relevant PowerPoint notes we discussed various aspects of our Federal Reserve Systems.

Federal Reserve & Interest Rate: In Chapter of your recommended textbook and relevant PowerPoint notes we discussed various aspects of our "Federal Reserve Systems". In this regard, read the article titled Ways to Lock in Yields above published in the Wall Street Journal on February A soft copy of the article can be found in your midterm exam folder on the blackboard in case you do not have access to the full article online. An important aspect of this article is to remember that there is an assumption that the Fed is going to cut interest rates in but that is not a guarantee that they are. This article highlights an important aspect that young investors must understand to succeed. You are not trading on today's information for current market movements. You are trading on today's information for how it will affect the market six months to a year from now. If you are trading for today, you are already behind. After reading this article answer the following question: What may happen to the stock and bond markets and presumably your StockTrak portfolio if the Fed does not cut rates when the FOMC meets next week March and April May as well? Please provide clarifications in support of your answer eg your answers should be logically supported by the advantages and disadvantages of holding financial securities and how interest rates are driving their prices

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started