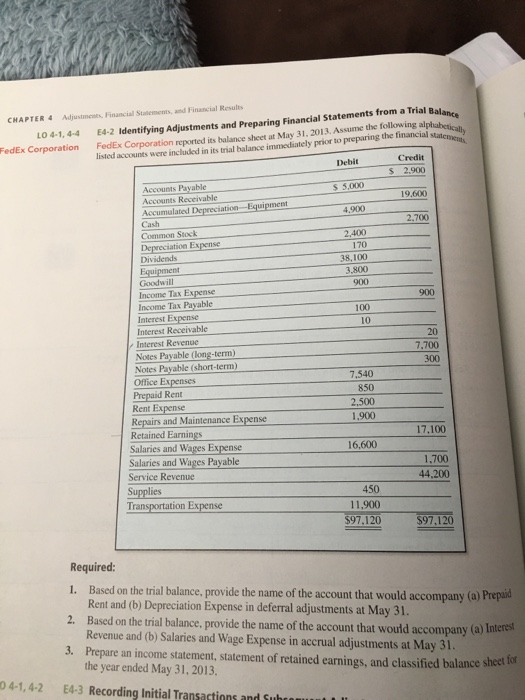

FedEx Corporation E4-2 accounts Adjustments trial balance at May 31. prior to preparing financial statenNat Credit a Trial alphabet Bal the from Preparing 2013 Assume following sheet Financial Results and included and reported Financial in its Corporation balance dentifying statements, FedEx Financial LO 4 4-1, Adjustments 4-4 listed Debit 2,900 Accounts payable S 5.000. 19.600 Accounts R Depreciation-Equipment Accumulated 2.700 Common Stock Depreciation Expense 70 3800 900 Income Tax Expense Tax payable Interest Receivable Interest Revenue 7.700 Notes Payable (long-term) (short-term 7.540 Office Ex 850 2,500 rs and Maintenance Expense 17.100 Retained Earnings Salaries and Wages Expense Salaries and Wages Payable 44.200 Service Revenue 450 Transportation Expense 11,900 $97,120 Required: 1. Based on the trial balance, provide the name of the account that would accompany (a) 2. Rent Depreciation Expense in deferral adjustments at May 31. Interest Based on the trial balance, provide the name of the account that would accompany (a) 3. Revenue and (b) Salaries and Wage Expense in accrual adjustments at 31 Prepare an income statement, statement of retained earnings, and classified balance sheet the year ended May 31, 2013. 0 4-1, 4-2 E4-3 Recording Initial Transaction and illh FedEx Corporation E4-2 accounts Adjustments trial balance at May 31. prior to preparing financial statenNat Credit a Trial alphabet Bal the from Preparing 2013 Assume following sheet Financial Results and included and reported Financial in its Corporation balance dentifying statements, FedEx Financial LO 4 4-1, Adjustments 4-4 listed Debit 2,900 Accounts payable S 5.000. 19.600 Accounts R Depreciation-Equipment Accumulated 2.700 Common Stock Depreciation Expense 70 3800 900 Income Tax Expense Tax payable Interest Receivable Interest Revenue 7.700 Notes Payable (long-term) (short-term 7.540 Office Ex 850 2,500 rs and Maintenance Expense 17.100 Retained Earnings Salaries and Wages Expense Salaries and Wages Payable 44.200 Service Revenue 450 Transportation Expense 11,900 $97,120 Required: 1. Based on the trial balance, provide the name of the account that would accompany (a) 2. Rent Depreciation Expense in deferral adjustments at May 31. Interest Based on the trial balance, provide the name of the account that would accompany (a) 3. Revenue and (b) Salaries and Wage Expense in accrual adjustments at 31 Prepare an income statement, statement of retained earnings, and classified balance sheet the year ended May 31, 2013. 0 4-1, 4-2 E4-3 Recording Initial Transaction and illh