Answered step by step

Verified Expert Solution

Question

1 Approved Answer

FedEx Corporation (FDX) has a current share price of $150.09 and is expected to have earnings per share (EPS) next year of $12.46 per share.

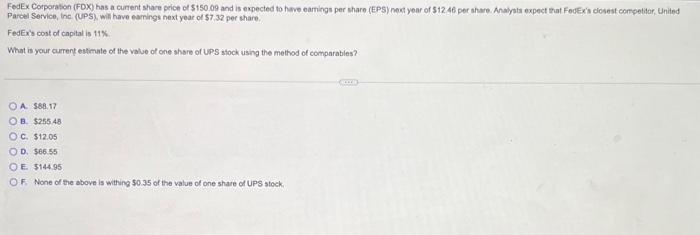

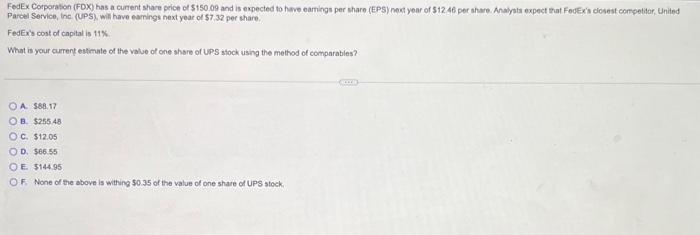

FedEx Corporation (FDX) has a current share price of $150.09 and is expected to have earnings per share (EPS) next year of $12.46 per share. Analysts expect that FedEx's closest competitor, United Parcel Service, Inc. (UPS), will have earnings next year of $7.32 per share. FedEx's cost of capital is 11%. What is your current estimate of the value of one share of UPS stock using the method of comparables? A. $88.17 B. $255.48 OC. $12.05 D. $66.55 OE. $144.95 OF. None of the above is withing $0.35 of the value of one share of UPS stock.

FedEx Corporaton (FDX) has a cunent share price of 5150.09 and is expected to have eamings per share (EPS) neet year of 512.46 per ahare. Analysta expect that FouEx's ciosest competiar, United Parcel Service, the (UPS) will have earings next year of 57.32 per thare. FedEx's cost of capital is 11% What is your curent eatimate of the value of one share of UPS stock using the method of comparables? A. 568.17 B. 5255.48 C. $12.05 D. 566.55 F. $144.95 F. None of the above is withing $0.35 of the value of one share of UPS stock

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started