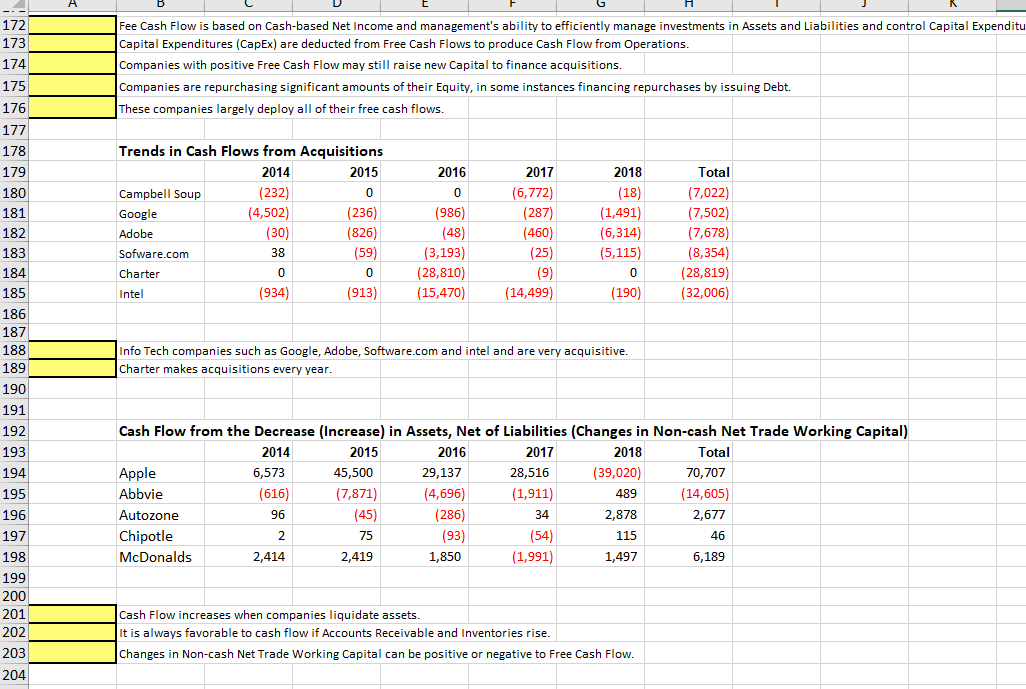

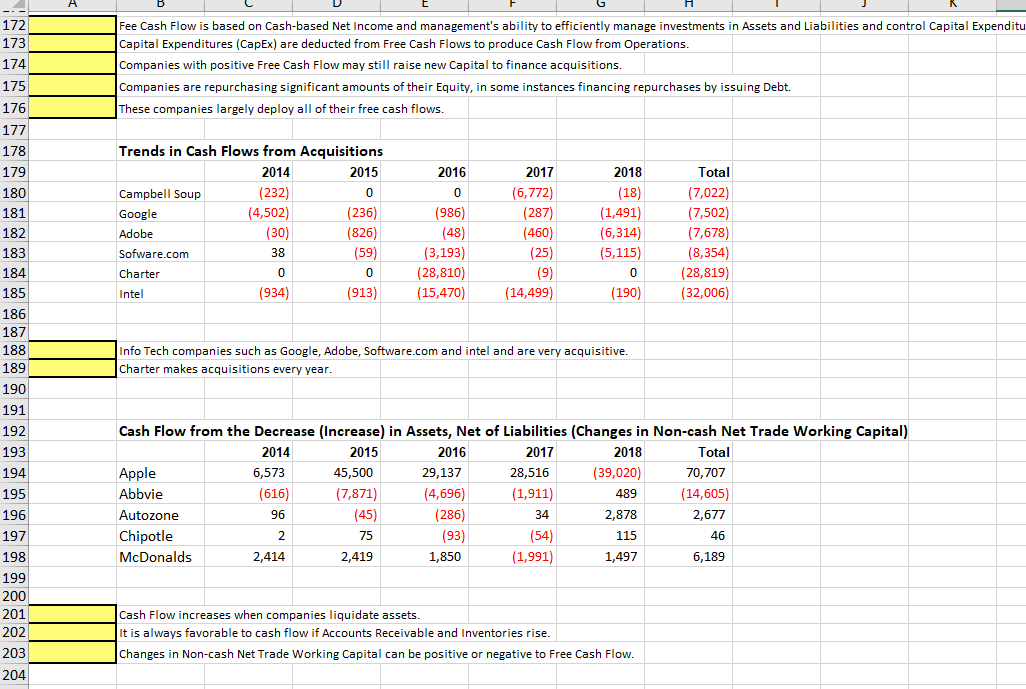

Fee Cash Flow is based on Cash-based Net Income and management's ability to efficiently manage investments in Assets and Liabilities and control Capital Expenditu Capital Expenditures (CapEx) are deducted from Free Cash Flows to produce Cash Flow from Operations. Companies with positive Free Cash Flow may still raise new Capital to finance acquisitions. Companies are repurchasing significant amounts of their Equity, in some instances financing repurchases by issuing Debt. These companies largely deploy all of their free cash flows. Trends in Cash Flows from Acquisitions \begin{tabular}{|l|r|r|r|r|r|r|} \hline & 2014 & 2015 & 2016 & 2017 & 2018 & Total \\ \hline Campbell Soup & (232) & 0 & 0 & (6,772) & (18) & (7,022) \\ \hline Google & (4,502) & (236) & (986) & (287) & (1,491) & (7,502) \\ \hline Adobe & (30) & (826) & (48) & (460) & (6,314) & (7,678) \\ \hline Sofware.com & 38 & (59) & (3,193) & (25) & (5,115) & (8,354) \\ \hline Charter & 0 & 0 & (28,810) & (9) & 0 & (28,819) \\ \hline Intel & (934) & (913) & (15,470) & (14,499) & (190) & (32,006) \\ \hline \end{tabular} Info Tech companies such as Google, Adobe, Software.com and intel and are very acquisitive. Charter makes acquisitions every year. Cash Flow from the Decrease (Increase) in Assets, Net of Liabilities (Changes in Non-cash Net Trade Working Capital) Fee Cash Flow is based on Cash-based Net Income and management's ability to efficiently manage investments in Assets and Liabilities and control Capital Expenditu Capital Expenditures (CapEx) are deducted from Free Cash Flows to produce Cash Flow from Operations. Companies with positive Free Cash Flow may still raise new Capital to finance acquisitions. Companies are repurchasing significant amounts of their Equity, in some instances financing repurchases by issuing Debt. These companies largely deploy all of their free cash flows. Trends in Cash Flows from Acquisitions \begin{tabular}{|l|r|r|r|r|r|r|} \hline & 2014 & 2015 & 2016 & 2017 & 2018 & Total \\ \hline Campbell Soup & (232) & 0 & 0 & (6,772) & (18) & (7,022) \\ \hline Google & (4,502) & (236) & (986) & (287) & (1,491) & (7,502) \\ \hline Adobe & (30) & (826) & (48) & (460) & (6,314) & (7,678) \\ \hline Sofware.com & 38 & (59) & (3,193) & (25) & (5,115) & (8,354) \\ \hline Charter & 0 & 0 & (28,810) & (9) & 0 & (28,819) \\ \hline Intel & (934) & (913) & (15,470) & (14,499) & (190) & (32,006) \\ \hline \end{tabular} Info Tech companies such as Google, Adobe, Software.com and intel and are very acquisitive. Charter makes acquisitions every year. Cash Flow from the Decrease (Increase) in Assets, Net of Liabilities (Changes in Non-cash Net Trade Working Capital)