Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Feller, Inc. received its bank statement for the month ended 12/31/20. The bank statement showed a balance of $10,291.13. The company's general ledger showed

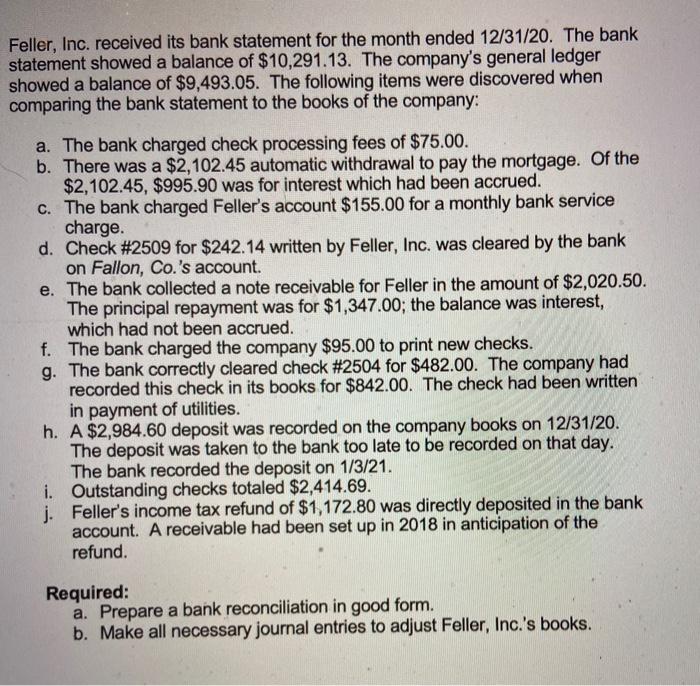

Feller, Inc. received its bank statement for the month ended 12/31/20. The bank statement showed a balance of $10,291.13. The company's general ledger showed a balance of $9,493.05. The following items were discovered when comparing the bank statement to the books of the company: a. The bank charged check processing fees of $75.00. b. There was a $2,102.45 automatic withdrawal to pay the mortgage. Of the $2,102.45, $995.90 was for interest which had been accrued. c. The bank charged Feller's account $155.00 for a monthly bank service charge. d. Check # 2509 for $242.14 written by Feller, Inc. was cleared by the bank on Fallon, Co.'s account. e. The bank collected a note receivable for Feller in the amount of $2,020.50. The principal repayment was for $1,347.00; the balance was interest, which had not been accrued. f. The bank charged the company $95.00 to print new checks. g. The bank correctly cleared check #2504 for $482.00. The company had recorded this check in its books for $842.00. The check had been written in payment of utilities. h. A $2,984.60 deposit was recorded on the company books on 12/31/20. The deposit was taken to the bank too late to be recorded on that day. The bank recorded the deposit on 1/3/21. i. Outstanding checks totaled $2,414.69. j. Feller's income tax refund of $1,172.80 was directly deposited in the bank account. A receivable had been set up in 2018 in anticipation of the refund. Required: a. Prepare a bank reconciliation in good form. b. Make all necessary journal entries to adjust Feller, Inc.'s books.

Step by Step Solution

★★★★★

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

1 Feller Inc Bank Reconciliation For the month ended 123120 Balance as per bank stateme...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started